Table of Contents

What Is Average Directional Index ADX

The Average Directional Movement (ADX), developed by Welles Wilder, is an indicator that measures trend strength and shows trend direction.

ADX tells traders whether the bulls or the bears are in control on the market. The ADX is derived from two indicators known as the Positive Directional Movement Indicator (+DMI) and the Negative Directional Movement Indicator (-DMI).

How Average Directional Index ADX Works – Calculation

The calculation of the Average Directional is rather complex. Let’s take a 20-period ADX as an example. Below is a simplified calculation of the ADX:

- We determine the positive directional movement (+DMI) and the negative directional movement (- DMI) for each bar in the last 20 periods.

- Bars making higher highs and higher lows compared to the previous bar are allocated a positive DM.

- Bars making lower highs and lower lows compared to the previous bar are allocated a negative DM.

- An inside bar (a bar formed within the range of the previous bar) has no directional movement.

- If a bar has a positive DM, the absolute value of the distance between current high and previous high is added to the +DM running total calculated over the last 20-period. If a bar has a negative DM, the absolute value of the distance between current low and previous low is added to the -DM running total over the last 20-period.

- We determine the sum of the true ranges for all bars in the last 20-period. True range is the greatest (absolute) distance between the following:

- current high and current low.

- current high and previous close.

- current low and previous close.

- We determine the +DI and -DI by dividing the running totals of +DM and -DM by the sum of the true ranges.

- We determine the directional index (DX) by measuring the absolute value of the difference between the +DI value and the -DI value, dividing that by the sum of the +DI and -DI values, multiplied by 100.

- We determine a moving average of the DX over 20- period.

Most charting platforms include the average directional index, so we won’t have to deal with such complex calculations.

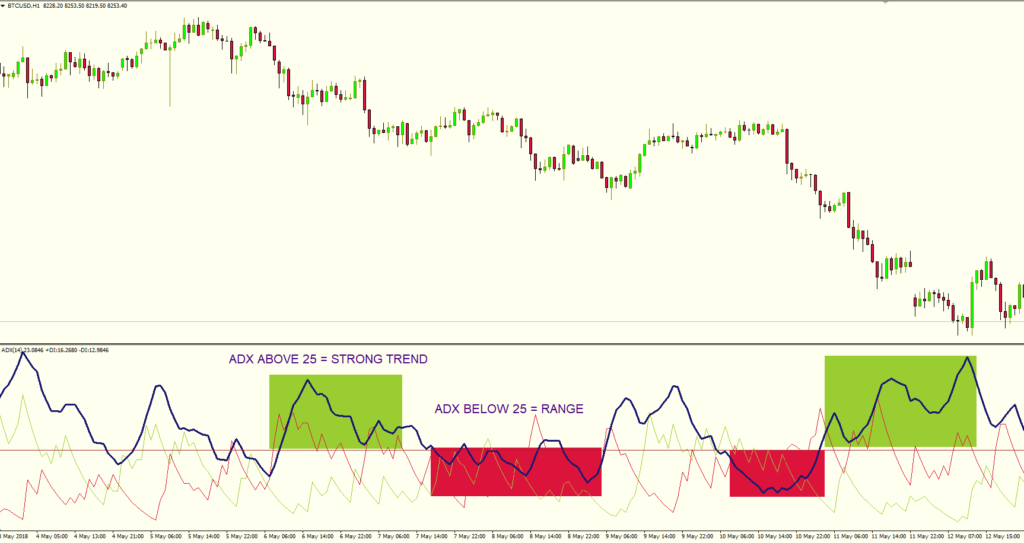

How To Read The ADX Indicator

The ADX is an oscillating indicator, displayed as a single line, ranging from 0 to 100. The ADX only indicates the strength of the trend and does not indicate its direction. In other words, the ADX is non-directional, meaning that it measures the strength of a trend, but doesn’t distinguish between uptrends and downtrends. So, during a strong uptrend, the ADX rises and during a strong downtrend, the ADX also rises.

ADX measuring the trend strength reads as follows:

- When ADX is above 25, trend strength is strong enough for strategies involving trend following

- When ADX is below 25, traders must avoid trend trading strategies as the market is in accumulation or distribution phase

- When ADX is above 25 and +DMI (positive directional movement index) is above the –DMI (negative directional movement index), ADX measures the strength of an uptrend.

- When ADX is above 25 and +DMI is below the –DMI, ADX measures the strength of a downtrend.

- Values over 50 of the ADX indicate a very strong trend

How To Trade With ADX DMI Indicator – Signals and Trading Strategies

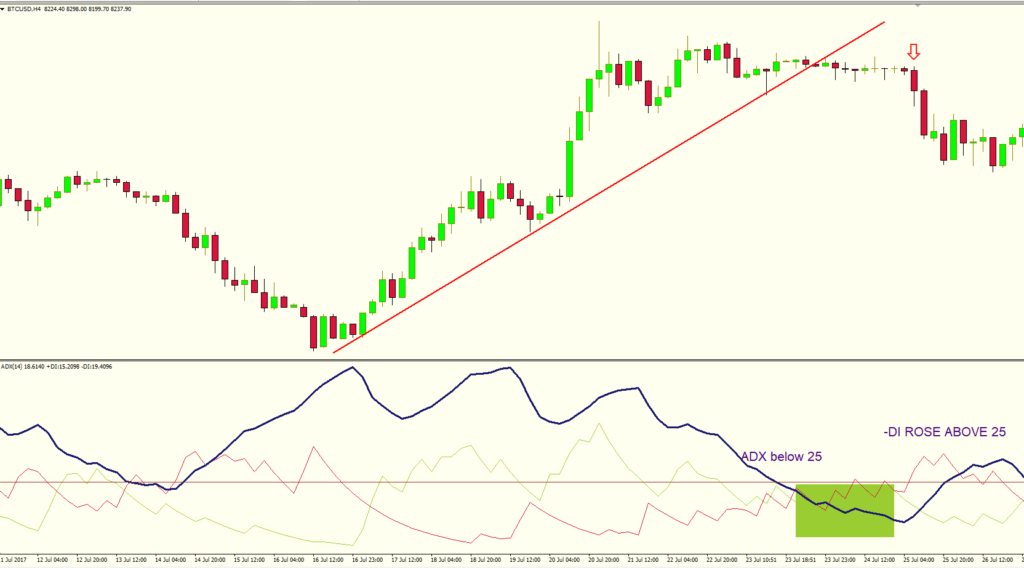

Directional Movement Index Strategy: ADX Below 25 Level + Trend Line Breakout

A reliable way to trade ADX is to anticipate the beginning of a new trend or a continuation of the current one. This strategy requires traders to identify the zones of accumulation and trading ranges and wait for a breakout of a trendline.

- A valid breakout on the upside requires a new high in price and +DMI must increase over 25 level

- A valid breakout on the downside requires a new low in price and -DMI must increase over 25 level

Let’s analyze the Bitcoin chart above. After a strong rally on the upside, the price entered a range, with the ADX decreasing to below 25 level. After the lower trendline of the upwards channel was broken on the downside, we confirmed the short signal with the –DI, when it increased above 25 level.

Of course, other indicators could be added for this setup, in order to filter out the market noise. Indicators like StochRSI, RSI, CCI , Parabolic SAR, Momentum indicator or Chaikin Money Flow are also useful tools for filtering bad trades.

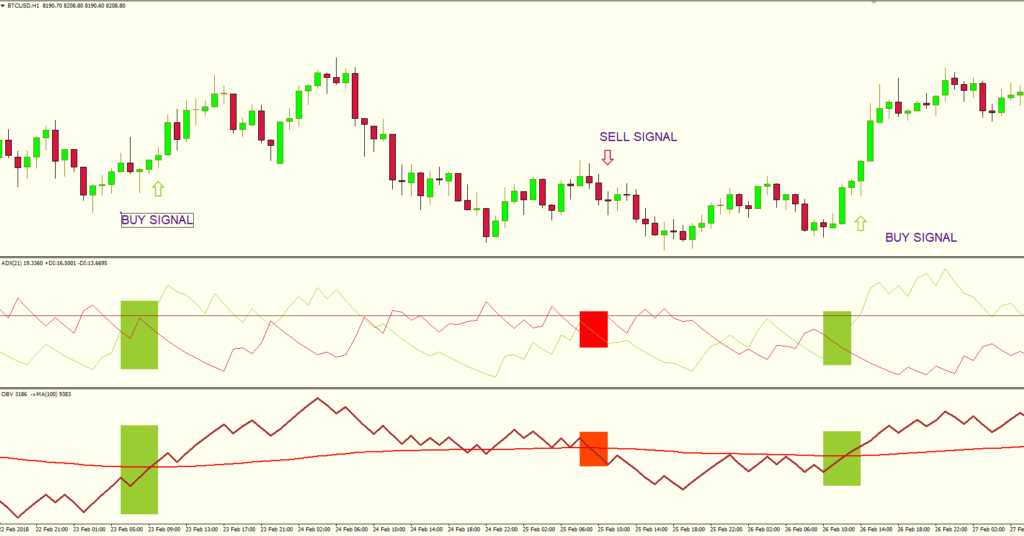

ADX DMI Indicator Crossover + On Balance Volume Trading Strategy

A common way to take entries with the ADX indicator is by spotting the DI crossovers:

- the +DMI green line crossing above the –DMI red line, suggest an uptrend.

- the +DMI green line crossing below the –DMI red line, suggest a downtrend.

This strategy is not enough to be profitable, as it will offer a lot of false signals. It’s better to be used in conjunction with other indicators. I personally prefer to filter the entries with the on balance volume.

On Balance Volume (OBV) is a momentum indicator that relates volume to price change. On Balance Volume indicator shows if market’s volume is flowing into or out of a security/stock.

We thus combine the strength of a trend (ADX) with momentum (OBV).

Let’s consider the Bitcoin ADX DMI chart below:

We used for this setup a setting of 21 for the ADX, in order to filter the noise. We added the OBV indicator and the chart became clearer.

We took the long positions when the +DI green line crossed above the –DI red line and the OBV crossed the MA100 on the upside.

During this period, we also had a valid sell signal, with the +DI green line crossing below the –DI red line and OBV falling below MA100.

This is a powerful setup, and it works on higher timeframes.

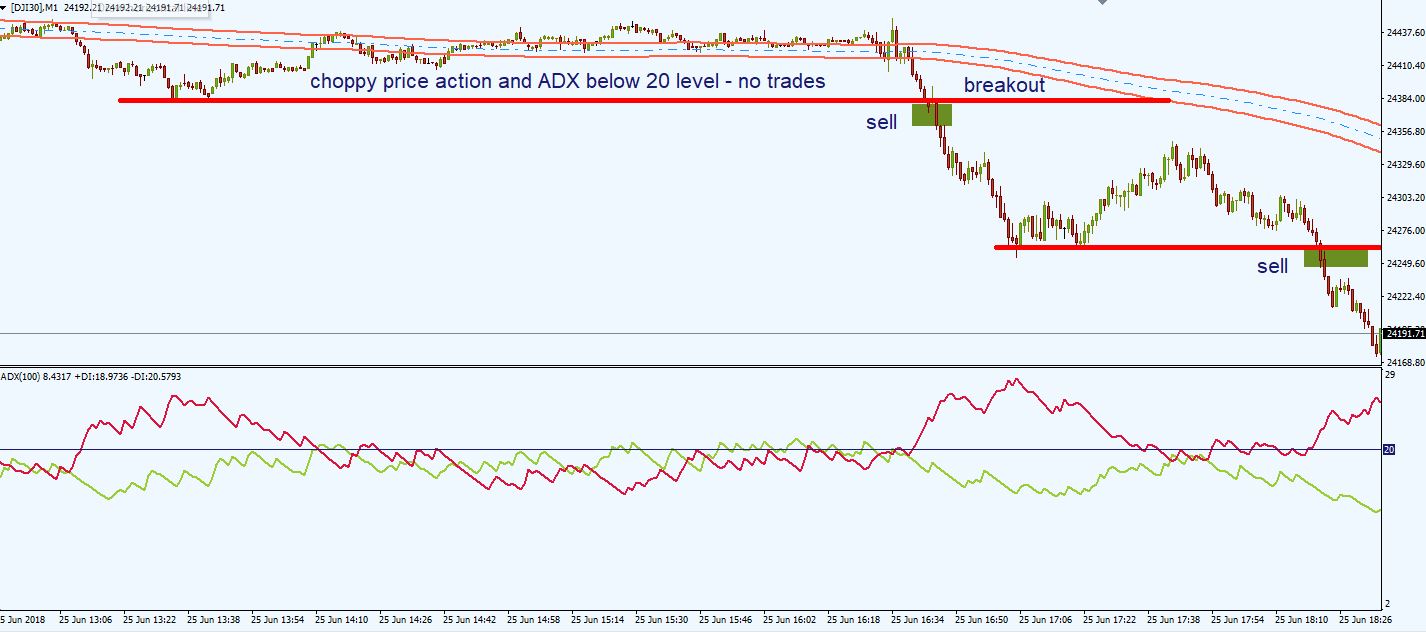

Forex Trading Strategy: How to Use ADX for Scalping and Day Trading

Scalping with the ADX indicator could be a good choice for the traders that enjoy lower timeframes.

In order to be profitable with scalping and day trading, you need in the first place to determine the main trend, or at least the main trend on the smaller timeframes. Without that, you are practically gambling.

You also need to recognize relevant support and resistance levels and to trade accordingly.

Fortunately for us, there are a bunch of indicators that help us to check all of our requirements.

So, in order to trade with the ADX, we’ll also need the Kelner Channel indicator.

Keltner Channel is practically a hybrid between an exponential moving average and the Average True Range indicator. The Keltner Channel is an underrated indicator, not used by many traders.

With the help of the Keltner Channel indicator, we can determine the trend, we can estimate the volatility of the market and we can also spot some dynamic areas of support and resistance.

Here are the main rules of this scalping strategy:

- As we are engaging in scalping and day trading activities, we will use lower timeframes, like 1-min or 5-min charts.

- Add the ADX indicator, calculated for the last 100 period. We will use a higher period for calculating the ADX because we want to eliminate market noise as much as possible.

- Add the Keltner Channel, calculated based on the 200-period exponential moving average and 1 multiple of the ATR. By using a longer-term moving average, we will reduce the risk of getting whipsawed

- Closely examine the slope of the Keltner Channel. This will determine the current trend. If the Keltner Channel’s is positive, pointing upward, we start looking for buy signals only. If the Keltner Channel’s is negative, pointing downward, we start looking for sell signals only.

- Once we know the direction we intend to trade, we need to spot a breakout of a support or resistance, to be confirmed by the ADX.

- For a long entry, we need a positive slope of the Keltner Channel, a breakout of resistance and +DI above the – DI

- For a short entry, we need a negative slope of the Keltner Channel, a breakout of support and +DI below the – DI

- We don’t trade when the slope of the Keltner Channel is flat, or when the price is inside the Keltner Channel

- We ignore the signals if the crossover between the +DI and –DI are below 20 level

- Use tight stop losses, below or above the recent support/resistance breakout

If it sounds complicated, it isn’t. Let’s see some charts to spot some entries.

Let’s analyze the DAX 1-min ADX DMI chart. By looking at the example, I hope that the theory is much simple now.

This setup generated 3 main signals, as the market price recorded an uptrend, traded sideways and also recorded a downtrend.

The first signal occurred after a resistance breakout. We didn’t enter at the breakout, as the price was inside the Keltner Channel and its slope was negative. We waited for the +DI to close above 20 level and the price to stabilize above the Keltner Channel and we entered long.

Several candles later, the market offered the chance to add long positions, or to re-enter with new positions, as the +DI closed again above 20 level.

The next 2 long signals were ignored. Despite the fact the trades were successful, we didn’t enter because the market didn’t record an evident breakout.

By waiting for a breakout, you will save a lot of money in the long run. There will be a ton of false signals on the 1-min and 5-min charts, so it’s advisable to be patient and follow the rules.

After we spotted a breakout, an ascending triangle, we had a valid buy signal.

The last signal was a sell entry, after a breakout below the Keltner Channel. The –DI was way above the 20 line, suggesting a strong trend.

Here is when you should not trade. When you see the ADX below 20 level, you must ignore all the signals. This is just noise, and we are not interested in trading false signals.

Also, look at the price at the time the ADX was below 20 level. The market price closed below and above the Keltner Channel, also indicating market indecision.

Only after we spotted the breakout and the ADX finally closed above 20 level, we were safe to short the market.

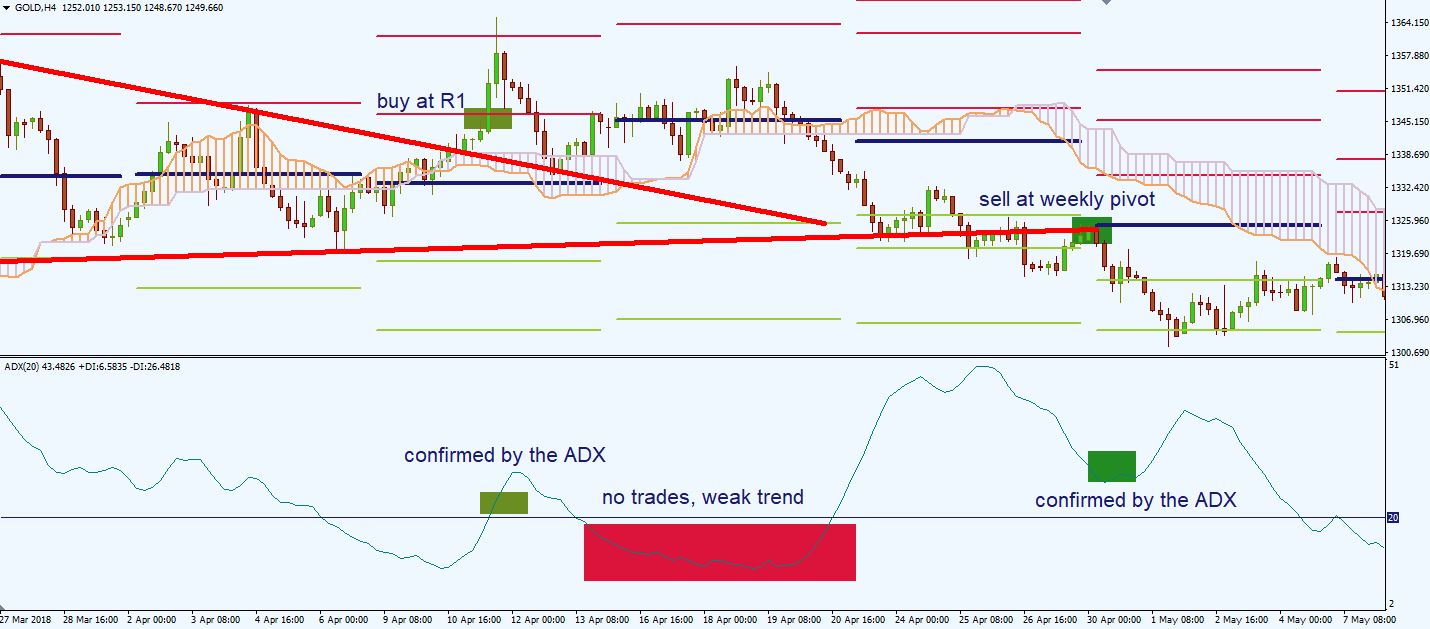

How to Use Directional Movement Index for Swing Trading/Position Trading

If you have a full time job or don’t like spending all day in front of charts, the ADX can also assist you if you prefer swing trading or position trading.

In order to profit from the market, it’s necessary to have a disciplined approach to trading. It is also important to keep things simple and don’t over-complicate your trading.

So, for this strategy, we’ll keep our price charts clean, without plotting a lot of indicators. We will focus on reading price in order to increase our chances to swing trade the right way.

For this setup we’ll plot 2 indicators besides the ADX: pivots points and Ichimoku indicator.

Pivot Points indicator is one of the most accurate leading indicators which offer excellent support/resistance levels.

Most market participants are watching and trading with pivots, so it’s important for use to know where those important levels are. Part of what makes the Pivots Points so reliable is the fact that they are based purely on price.

Also, the Ichimoku indicator will be used to determine the current market trend. The advantage of the Ichimoku is the fact that offers a unique perspective of support and resistance, representing these levels based on price action.

We will only need the Kumo cloud for this setup.

Let’s see the main rules of this strategy:

- We’ll use this setup on higher timeframes, H4 and D1 timeframes

- Plot the weekly pivot points, in order to spot relevant levels on the chart. This way, we’ll know in advance were the bulls and bears are likely to intervene in the market

- Plot the Kumo cloud of the Ichimoku indicator. We are interested in taking long positions above the cloud and short entries below the cloud

- Add the ADX indicator, without the +DI and – DI. We want to determine the strength of a trend and trade accordingly

- We aim to enter long on the market, around the weekly pivot points, if the price is trading above the Kumo cloud and the ADX indicates a strong trend

- We aim to enter short on the market, around the weekly pivot points, if the price is trading below the Kumo cloud and the ADX indicates a strong trend

- Look for breakouts and trading patterns in the direction of the main trend, to confirm our entries

- Stop-loss orders are placed below the Kumo cloud or below a relevant weekly pivot point

- Aim for at least 2:1 risk/reward ratio. Also, look to move your stop to break-even one the price goes in your favor and stabilizes at a safe level.

Let’s see this setup in action.

Above we have a Gold H4 ADX DMI chart, with the indicators added on it.

When we start analyzing the chart, we mainly look at the Kumo cloud. We want to see where the price trades in relation to the cloud.

Then, we look the pivot points around the price action, to establish potential entry points.

We look for a breakout, a confirmation that we enter in the right position and with momentum on our side.

If the ADX confirms the setup, with a value over 20, we can safely enter the trade.

In the Gold chart above this setup offered 2 decent entries.

The first signal was a buy position around the R1 weekly level, above the Kumo cloud, after a trendline breakout. As the ADX was traded above 20, we were safe to enter long on the market.

Once the ADX fell below 20 level, we ignored all the price action.

The second signal was a great short position, right around the central weekly pivot point.

The trade was fueled by a long term trend line breakout. This move came when the ADX was above 20, so we were safe to enter short on the market.

This system requires patience and discipline. The signals occur rarely, but they are high probability trades.

Average Directional Movement (ADX) Pros And Cons

- ↑ excellent at quantifying trend strength

- ↑ allows traders to see the strength of bulls and bears at the same time

- ↑ good at filtering out trades, during accumulation periods

- ↑ good at identifying trending conditions, on Forex and stocks

- ↑ the indicator is useful for day trading but also for swing trading.

- ↓ lagging indicator, that follows the price

- ↓ offers many false signals when used on shorter timeframes

- ↓ does not contain all of the data necessary for proper analysis of price action, so it must be used in combination with other indicators