Table of Contents

What Is Chaikin Money Flow

Chaikin Money Flow, developed by Marc Chaikin, is a technical indicator which determines if an instrument is under accumulation or distribution. The Chaikin Money Flow indicator compares the closing price to the high-low range of the trading session.

- if the instrument’ price closes near the high of the session with increased volume, the Chaikin Money Flow increases in value

- if the instrument’ price closes near the low of the session with increased volume, the Chaikin Money Flow decreases in value.

Chaikin Money Flow measures buying and selling pressure over a set period of time.

The CMF is a popular indicator among the traders who use volume technical analysis. Along with the On Balance Volume, the Chaikin Money Flow is tracking the Money Flow.

The Chaikin Money Flow indicator does not calculate a cumulative total money flow volume. Instead, the CMF sums the money flow volume for a specific trading period.

How To Calculate Chaikin Money Flow

The Chaikin Money Flow indicator is calculated by adding the accumulation/distribution line for a specific trading period.

The formula for calculating the CMF is quite complex. Let’s try to simplify the formula and divide it into three easy steps:

- We calculate the Money Flow Multiplier for each period

Money Flow Multiplier = ((Close – Low) – (High – Close)) / (High – Low)

- We calculate the Money Flow Volume by multiplying the Money Flow Multiplier with the period’s volume

Money Flow Volume = (Money Flow Multiplier) x Volume

- We calculate the Chaikin Money Flow by dividing the specified period sum of Money Flow Volume by the specified period sum of the volume

Chaikin Money Flow = (Specified Period Sum of Money Flow Volume) / (Specified Period Sum of Volume)

Chaikin Money Flow Best Settings

Traders generally use 20-periods or 21-periods for calculating the Chaikin Money Flow indicator.

Some traders also use the 50-period Chaikin Money Flow to determine the accumulation /distribution on the longer term.

- Chaikin Money Flow settings with values over 30 make the indicator less sensitive. This will result in fewer, but better quality signals

- Chaikin Money Flow settings with values below 20 make the indicator over-sensitive. This will result in more market noise. Lower settings on the Chaikin Money Flow indicator should be carefully traded, as it can lead to many false signals

How To Read Chaikin Money Flow

Chaikin Money Flow confirms the market trend

Chaikin Money Flow is used by traders to confirm the market trend. CMF values above zero indicate an uptrend while the CMF values below zero suggest a downtrend.

- when the Chaikin Money Flow indicator is above 0-level this is a bullish signal

- when the Chaikin Money Flow indicator is below 0-level this is a bearish signal

The Chaikin Money Flow usually stays between -0.5 and 0.5 levels.

The Chaikin Money Flow indicator rarely reaches its maximum/minimum values of -1 and 1.

Let’s say we are trading with a 21-period Chaikin Money Flow oscillator. In order to reach the extreme levels of the Chaikin Money Flow, it would take 21 consecutive periods on the high for a 21-period Chaikin Money Flow to reach +1 and the opposite to reach -1.

A movement of the Chaikin Money Flow oscillator from negative to positive or vice versa does not suggest a change in trend.

In choppy markets the CMF generates many false signals.

For this reason, the CMF should be traded in combination with other indicators.

Chaikin Money Flow confirms the strength of a trend

The Chaikin Money Flow is also used by traders to confirm the strength behind an uptrend or a downtrend.

In this regard, the indicator resembles the Average Directional Movement (ADX), which also measures trend strength.

Chaikin Money Flow confirms the breakouts of support and resistance levels

The Chaikin Money Flow is used by traders to confirm a breakout of a support or resistance.

- During an uptrend, if a breakout of a resistance occurs while the CMF reaches new highs, this suggests that the bulls are taking control of the market. This is a signal of an uptrend continuation

- During a downtrend, if a breakout of a support occurs while the CMF reaches new lows, this suggests that the bears are taking control of the market. This is a signal of a downtrend continuation

However, the Chaikin Money Flow has a flaw. The CMF is not handling gaps very well. For example, if a gap occurs on the upside and closes at a lower price, the money flow would give you a negative figure, despite the bullish price increase.

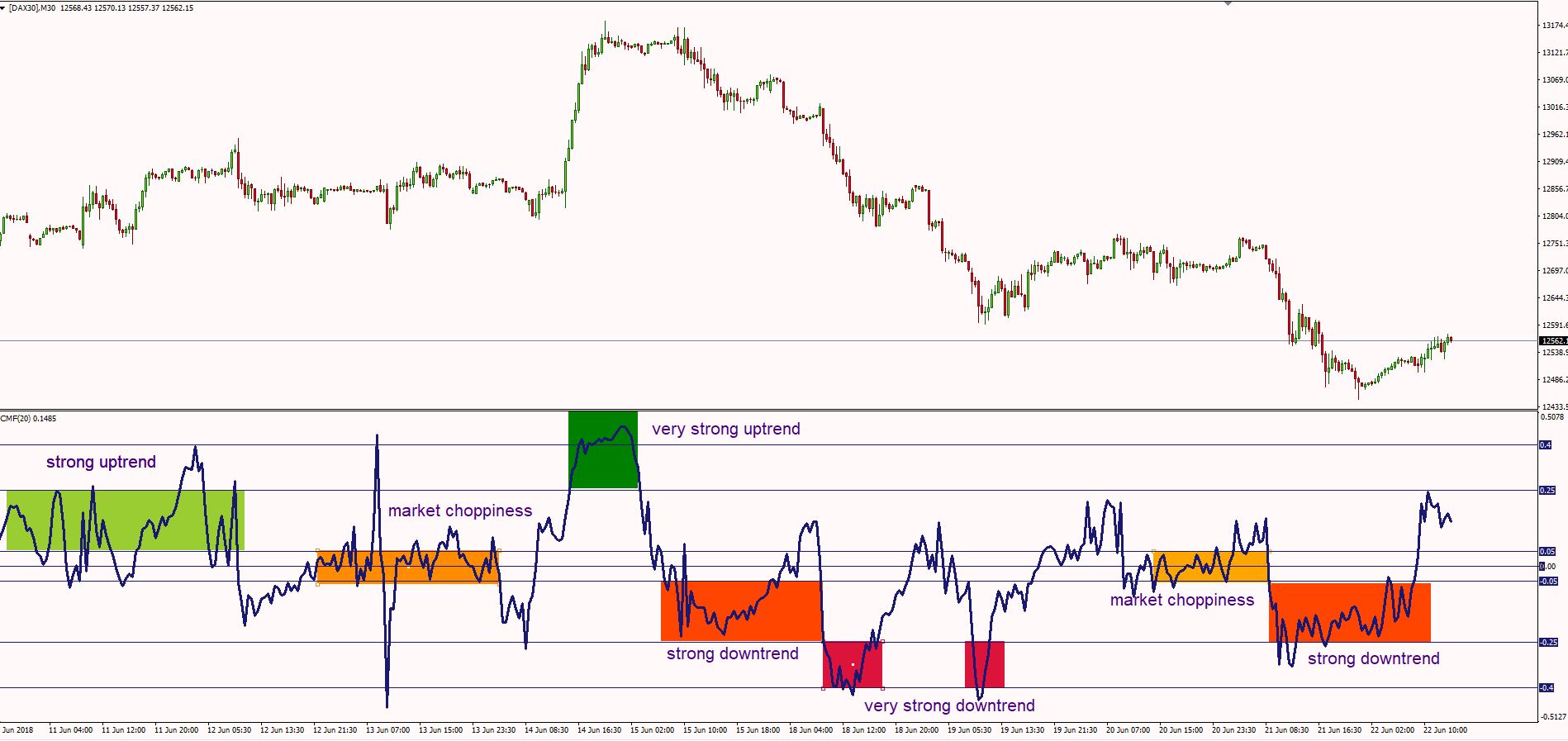

How to Read Market Conditions with Chaikin Money Flow

- Chaikin Money Flow values between 0.05 – 0.25 indicate buying pressures from the bulls. This is a sign of accumulation and that the market trades in an uptrend.

- Chaikin Money Flow values between 0.25 – 0.4 indicate that the bulls are in control of the market. This indicates that the market is in a strong uptrend

- Chaikin Money Flow values between 0.4 – 1 indicate that the bulls are in full control of the market. This suggests that the market is in a very strong uptrend

- Chaikin Money Flow values between -0.05 – -0.25 indicate selling pressures from the bears. This is a sign of distribution and that the market trades in a downtrend.

- Chaikin Money Flow values between -0.25 – -0.4 indicate that the bears are in control of the market. This indicates that the market is in a strong downtrend

- Chaikin Money Flow values between -0.4 – -1 indicate that the bears are in full control of the market. This indicates that the market is in a very strong downtrend

- Chaikin Money Flow values between -0.05 – 0.05 signals a decision-making period. When the CMF trades between these levels, the bulls and bears are putting pressure to take control of the market. This area is often marked by choppiness and is better to be avoided.

How To Trade With Chaikin Money Flow – Trading Strategies

Chaikin Money Flow Zero Line Crossover Trading Strategy

One of the most common ways in which traders use the Chaikin Money Flow indicator is to take signals when the oscillator crosses the zero level.

- when Chaikin Money Flow indicator crosses above zero, a buy signal is generated

- when Chaikin Money Flow indicator crosses below zero, a sell signal is generated

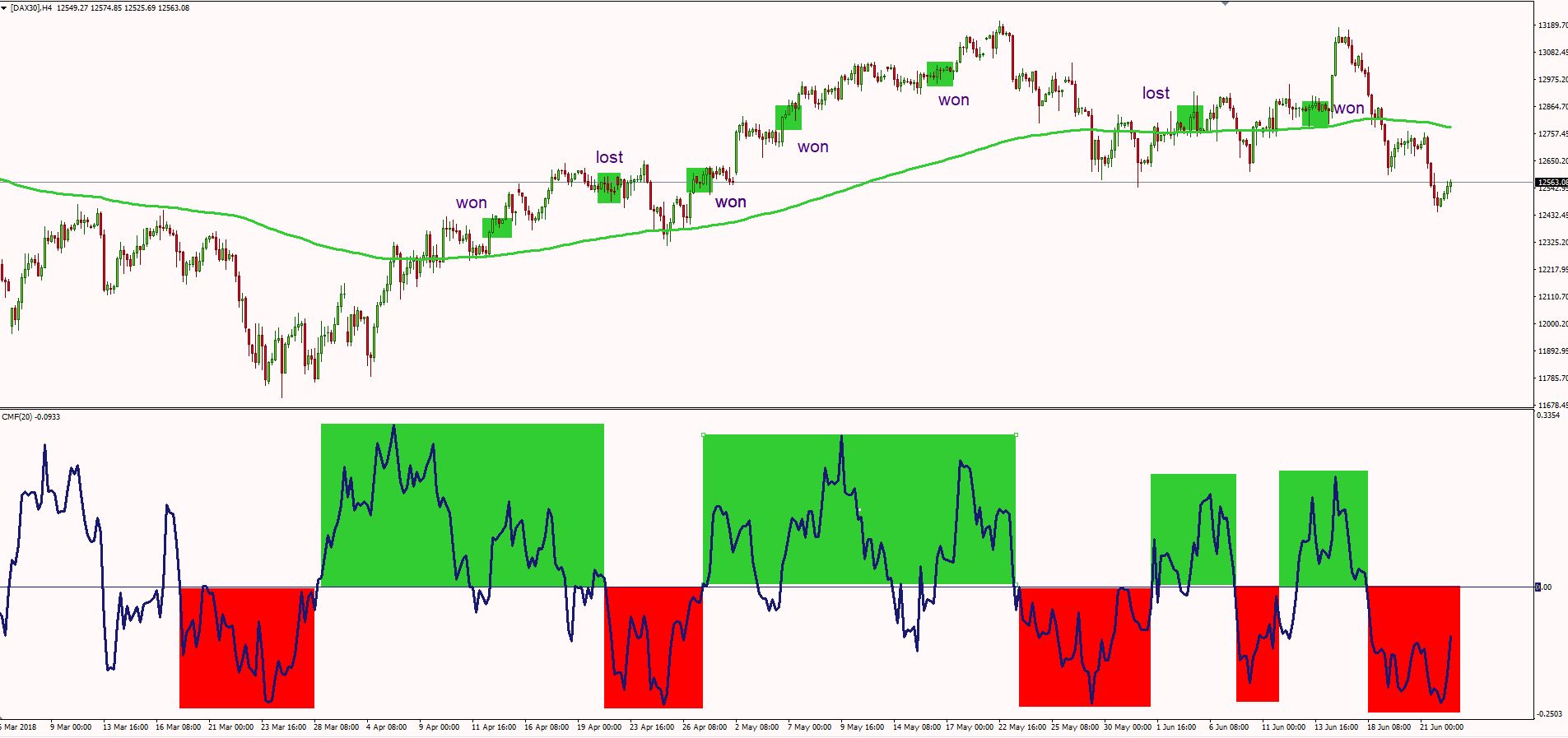

If we analyze the DAX30 Index cmf chart above, we can observe some decent signals generated by the Chaikin Money Flow indicator.

By itself, the indicator is not so reliable and it will offer many false signals. It’s better to confirm the trend with another indicator.

In this case, we used a 200-period moving average in order to determine the prevailing trend.

- When the price trades above the 200-period exponential moving average, we consider taking only long entries.

- When the price trades below the 200-period exponential moving average we consider taking only short entries.

As you can see, this setup generated 7 signals on the long side. 5 of the signals were successful trades, while 2 of them were lost.

The method of entering the market was simple. We waited for the Chaikin Money Flow indicator to cross the 0-level, above 200-EMA for a long entry.

PRO TIP: A smarter way to trade the Chaikin Money Flow would be to plot the 0.05 and -0.05 levels. In this way, you filter the choppiness around the 0 level.

- Take short entries below -0.05 level

- Take long positions above the 0.05 level

Chaikin Money Flow Divergence Trading Strategy

The Chaikin Money Flow oscillator can also detect divergences. A divergence occurs when price action differs from the evolution of the Chaikin Money Flow oscillator.

This basically means that the market momentum isn’t reflected in the price. This could be an early indicator of a reversal.

Unfortunately, many traders prefer to trade divergences the wrong way. Most of them look for regular divergences and enter the market blindly.

How NOT to use Chaikin Money Flow

Here is how you should NOT trade divergences with the Chaikin Money Flow oscillator.

If we analyze the SP500 cmf chart above, you can see that we had 5 divergences between the price and the Chaikin Money Flow indicator. Guess what: 4 of them were unsuccessful trades.

During a strong trend, the classic divergences don’t work. That’s why many traders, use this technique the wrong way. And not just with the CMF. This is also valid for Stochastic Oscillator, Momentum indicator, Relative Strength Index, CCI, ROC or MFI.

So, stop chasing divergences in the “old” way. There’s a smarter solution to trade divergences and I will show you how.

Chaikin Money Flow Forex Divergence System

There’s an elegant way to trade divergences with the CMF. This is what you should do it:

- We establish the main trend by adding the 200-period exponential moving average – 200 EMA.

- When the price trades above the 200-period exponential moving average, we consider taking only long entries. When the price trades below the 200-period exponential moving average we consider taking only short entries.

- We add the Chaikin Money Flow indicator, with an input of 20 periods

- We search for divergences between the Chaikin Money Flow and the price only in the direction of the main trend indicated by the 200-period exponential moving average

- If the price trades above the 200 EMA, we search for divergences on the lower side of the Chaikin Money Flow indicator and if the price trades below the 200 EMA, we search for divergences on the upper side of the Chaikin Money Flow indicator

Let’s look at the same chart, with the new setup.

Here it is, the same cmf chart, but no more false signals.

By choosing to take only long divergences, we improved our style massively. This setup generated 4 signals, and all of the trades were successful.

The secret lies in the hidden divergence. For some reason, hidden divergences are harder to spot by many traders, despite the fact that represent a high probability pattern.

Once we spot a hidden divergence on the Chaikin Money Flow indicator, we wait for the oscillator to move above the 0.05 level. Not the 0-level, we want to avoid choppiness.

Once the indicator crosses the 0.05 level, we have confirmation that the bulls are in control of the market. Plus, don’t forget we are trading in the right direction, with the main trend. That’s pretty powerful.

Let’s analyze another chart, this time the Dow Jones Index. This time we establish that we have a downtrend, as the price trades below the 200-exponential moving average.

By using the same principles, the system generated 2 valid signals. Both of them were successful trades.

The first signal was a great short signal, after a hidden divergence. We entered the market as the Chaikin Money Flow indicator crossed below the -0.05 level.

The second one was a classic divergence. This was a high probability setup because occurred near the 200-exponential moving average. The price rejected that area, and we entered a short position after the Chaikin Money Flow oscillator closed below -0.05 level.

The main advantage of this system is the fact that we have 3 market forces on our side when trading:

- the long-term trend indicated by the 200 EMA

- the momentum offered by the divergence

- the strength of the trend, indicated by the Chaikin Money Flow

By using this approach, we’ll reduce the market noise and eliminate false signals. We’ll have fewer, but quality signals.

Chaikin Money Flow – Moving Average Crossover Trading Strategy

In order to smooth the signals offered by the Chaikin Money Flow indicator, I prefer to add a moving average on the oscillator.

By adding a moving average on the Chaikin Money Flow’s chart window, I take crossover signals, for better quality signals.

Now, when you want to trade a crossover between the Chaikin Money Flow oscillator and a moving average, you should be aware of an important thing. A crossover will catch good movements when markets are trending. When markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades.

A longer-term moving average added on Chaikin Money Flow will work better than short-term moving average. A longer-term moving average will produce fewer whipsaws.

Also, this is not enough. This system will generate many false signals if we don’t confirm the trend with other indicators. We cannot take a crossover signal without knowing the market trend.

That’s why I prefer to determine the prevailing trend in the market with Ichimoku indicator. For this setup, I plot only the Kumo cloud.

Let’s look at some charts.

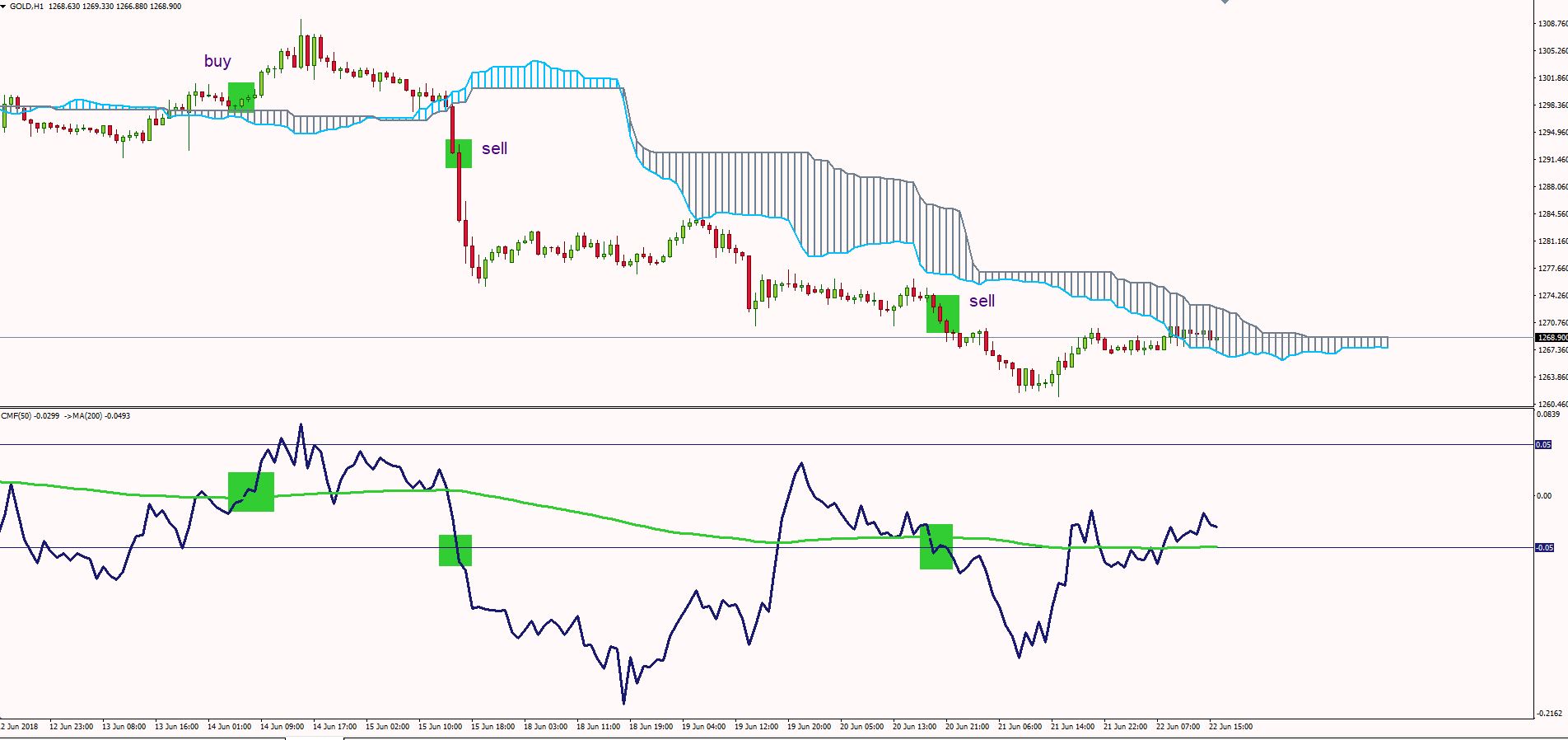

Let’s take a look at the commodities market, at the Gold chart.

We plotted the Kumo cloud and we added a 200-period moving average on the Chaikin Money Flow indicator with a 50-period input. We want to smooth the indicator. With this period we will avoid getting whipsawed.

The setup is simple:

- Buy only signals above the Kumo cloud, when the Chaikin Money Flow crosses above the 200-period moving average

- Sell only signals below the Kumo cloud, when the Chaikin Money Flow crosses below 200-period moving average

The gold chart above generated 3 signals. First, a long entry, above the Kumo cloud, and 2 short signals below the cloud. As you can see, all of the trades were successful.

Final note:

- We don’t take entries when the price is inside the Kumo cloud. If a crossover between Chaikin Money Flow and the 200 EMA occurs when the market price is inside the Kumo cloud, we ignore the setup.

- We could enter a trade once the price closes above or below the cloud, in the direction indicated by the crossover. But never when the price is inside

Chaikin Money Flow Pros

- A great indicator for spotting divergences on the chart

- Works well during trending market conditions

- Good at confirming the direction of the main trend

- Excellent at confirming the strength of the main trend

Chaikin Money Flow Cons

- In a choppy market, many false signals are generated around the zero level

- CMF value is not accurate when big gaps occur on the market

- Chaikin Money Flow does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other tools

- Used with lower settings, CMF can produce numerous whipsaws if not used correctly

- Unreliable on smaller time frames like M1, M5 or M15

- Lagging indicator, as it follows the price

1 thought on “Chaikin Money Flow Trading Strategy: Day Trading Tips”

All unparalleled info not easily found online, most of which are mingled with unclear strategies and marketing.

Only thing i wanted to clarify is, when I am using the cross over between Cmf and the 200 ema, it seems to constantly be repainting past signals. The actual value of the indicators are not changing, but mabey due to auto scaling the cross over points are continuously adjusting and changing as i scroll through historical data on chart. This is a huge issue, because hard to tell if the signals produced are genuinely valid or not.

Thanks