Table of Contents

If you want to be successful in the markets, you better focus your efforts on support and resistance lines. Support and resistance is practically the foundation of technical analysis. The better traders understand that support and resistance levels serve as a starting point for developing an idea of what may happen next in what concerns the price movement.

Traders are generally interested in support and resistance trading taking into account a number of other factors:

- current trading range

- recent trading patterns that took place within the trading range

- whether the range itself is in an uptrend or downtrend

- points of exhaustion near support/resistance levels

- profit-taking levels or possible stop-losses areas

How To Find Support and Resistance Main Lines In Day Trading

A support level is an area at which demand (buying power) is strong enough to stop the price of an instrument from decreasing any further.

A resistance level is an area at which supply (selling power) is strong enough to stop the price of an instrument from increasing any higher.

- a new support level often will be found above a previous trading range’s resistance level (when a resistance level is broken, it becomes an area of support)

- a new resistance level often will be found below a previous trading range’s support level (when a support level is broken, it becomes an area of resistance)

Static Support and Resistance Lines

Most common static support and resistance trading levels are:

Recent Market Swings

Horizontal lines near recent market swings can be very subjective. In most cases, we can usually only approximate those areas.

The technique of drawing support and resistance line is simple, you just have to identify recent and relevant market highs and lows and connect the swings with a line.

If the line includes 3 or more swing points, it means that the support/resistance level is more relevant.

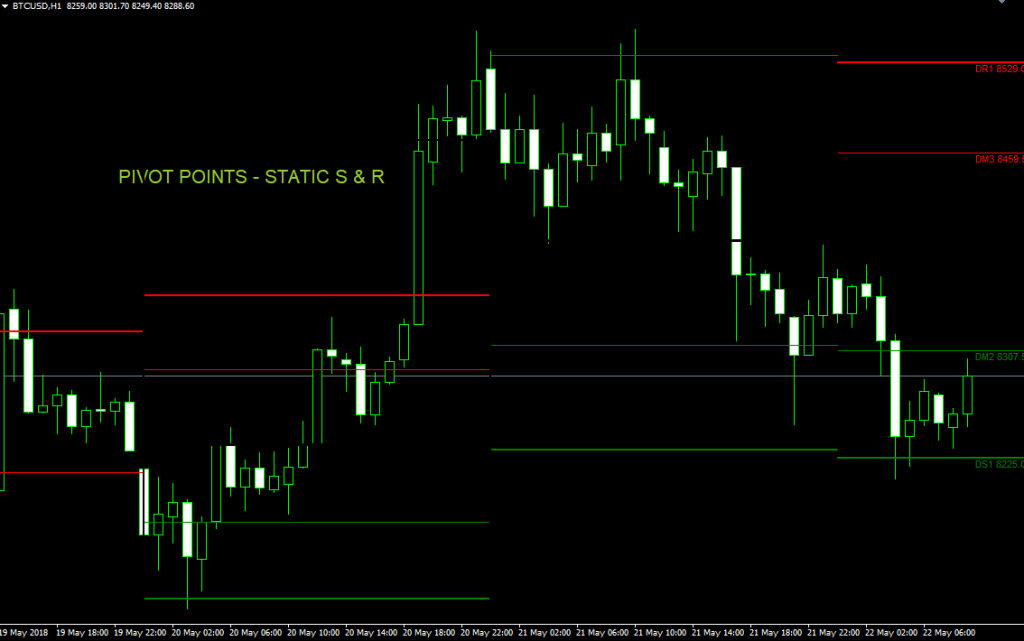

Pivot Points

Pivot Points represent levels that are used by floor traders to determine directional movement and potential supply/demand levels. They became popular once traders on the floor exchanges began to use them. A pivot point is calculated using data from the previous trading day. By analyzing the high, low, and close of the day, floor traders were able to calculate the next day’s pivot point and determine the potential support and resistance levels.

Fibonacci Retracement Levels

Fibonacci retracements represent a technical analysis method based on the idea that markets will retrace to a predictable area of a move, and they will continue their move in the original direction. This is a popular technique of technical analysis used by traders to predict future price support and resistance levels.

Let’s take as an example the Bitcoin chart below. The price decreased for a long period of time and started to increase back up. Traders look at Fibonacci retracements to try and figure out where the increase may stop and the market will resume its previous decrease. The first resistance was at 61.8 level, at the next one at 50 retracement level, tested twice.

Trend Lines & Channels

Trend lines are straight lines drawn on a graph connecting support points for an uptrend or resistance points for a downtrend. A trend line may rise, fall or move sideways. Trend lines connect two or more support/resistance points that define the trend.

The same principles apply here like in the case of horizontal lines near market swings. In order to draw support and resistance trend lines you just have to identify recent and relevant market highs and lows and connect the swings with a line.

If the line includes 3 or more swing points, it means that the support/resistance level is more relevant.

When a support trend line is broken, it becomes a resistance trend line and vice versa.

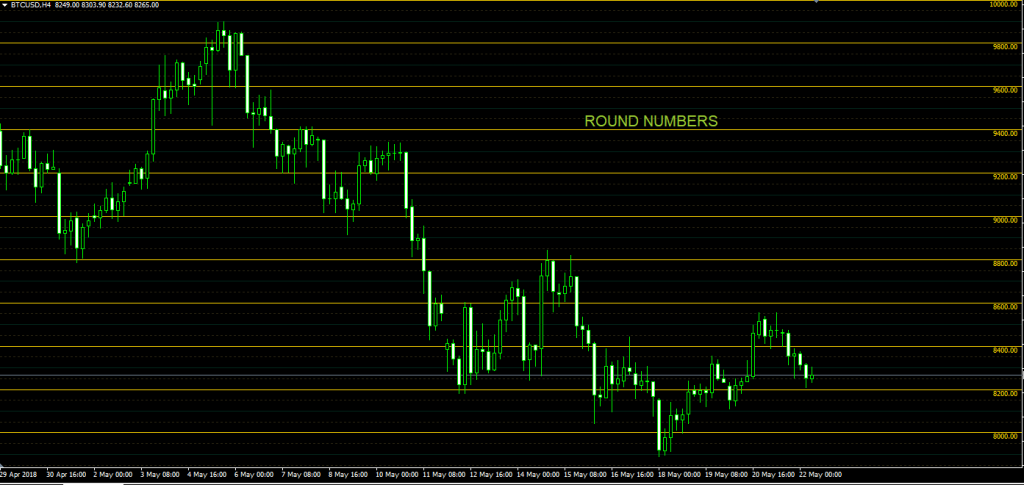

Round Numbers

The market tends to push prices towards areas where prices are rounded, at which prices tend to stall. As humans, we tend to use round numbers rather than uneven numbers. This also applies to technical analysis, where traders tend to round the numbers up or down in order to simplify things.

Look closely at the Bitcoin chart above and you might notice how the price behaves to such round levels. You can see how well the price responds to such levels. That’s because round number levels take both retail traders and major banks into consideration. When price approaches these levels, the number of transactions and trading volume both increase.

These levels of support and resistance can help traders to more accurately predict the movement of prices.

Dynamic Support and Resistance Lines

Dynamic areas of support and resistance are constantly changing depending on recent price action.

In the case of static support and resistance, you already know at the beginning of the trading day where those levels are. You know in advance where the possible areas of interest are located on the chart.

With dynamic support and resistance, you don’t know an exact number, as these levels are changing depending on market fluctuation. This is a good thing for a trader because he can use both static and dynamic levels in its advantage.

The dynamic support and resistance levels work significantly well in a trending scenario. During choppy price action, the static levels offer more depth and less false signals.

Another advantage of the dynamic support and resistance is that traders don’t have to plot and adjust them manually. In most cases, traders simply add a technical indicator in order to determine these areas.

There are several indicators that serve as dynamic support or resistance.

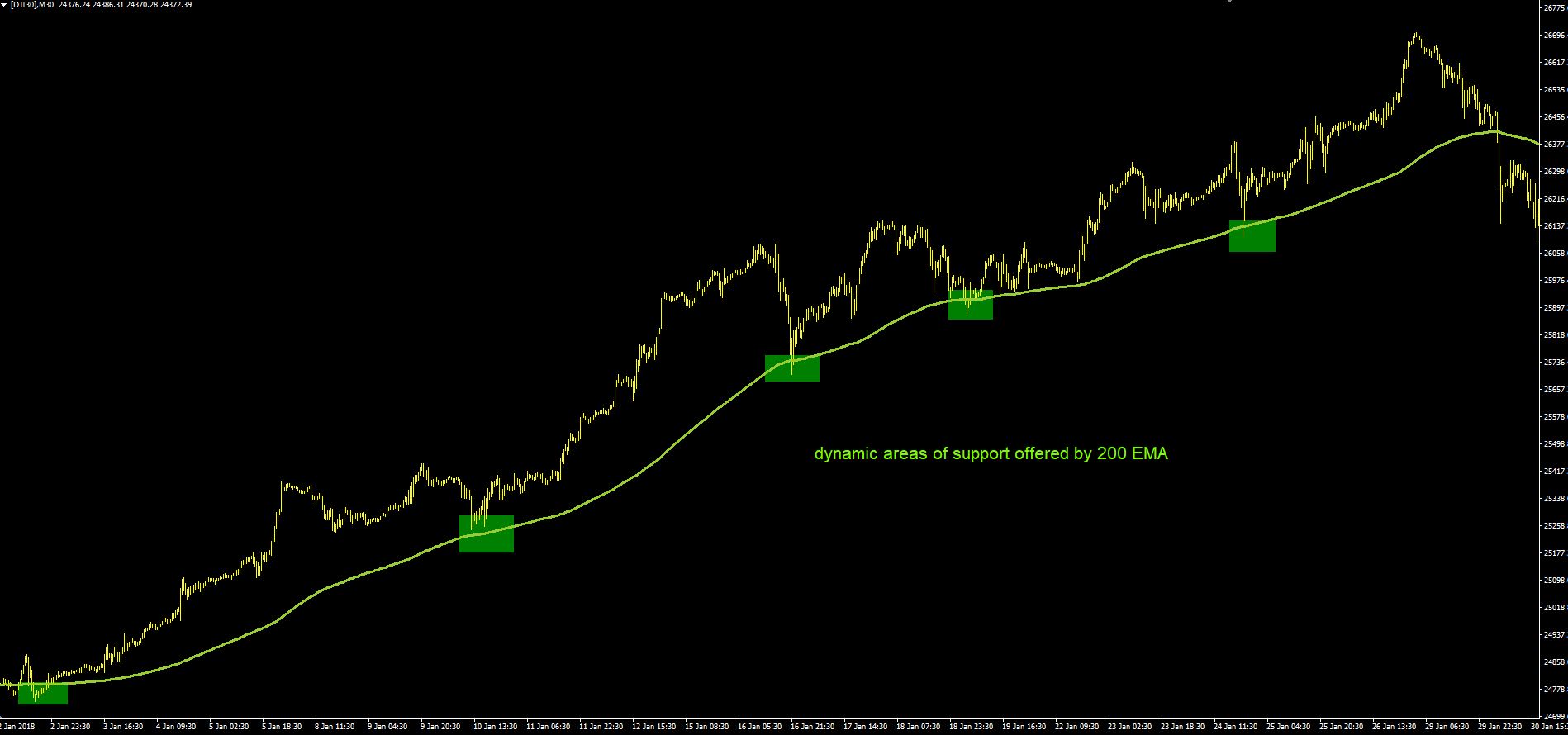

Moving Averages

Traders use the moving averages in many ways, mostly for estimating the market trends by smoothing out the price fluctuations.

One of the most important roles of a moving average is the identification and confirmation of the market trend.

Traders also use the moving averages for identifying and confirming support and resistance levels.

Being so common and followed by so many traders, we can often see on charts that the popular moving averages (200 EMA, 50 SMA 50, 20 EMA) work very well as dynamic support and resistance levels.

In some cases, just one moving average will serve as a dynamic support or resistance. Other times, the area between two relevant moving averages could act as a dynamic support or resistance.

You just have to plot some moving averages and backtest in the chart history, to see which moving averages work best in the analyzed market.

Bollinger Bands

Bollinger Bands are a popular technical indicator used by traders to analyze the dynamics of the price on the market. Bollinger Bands consists of 3 lines:

- The middle band, representing a simple moving average (most common value is 20)

- The upper band, which is the period + N standard deviations (usually 20 + 2 STD)

- The lower band, which is the period – N standard deviations (usually 20 – 2 STD).

Being calculated based on a moving average, the Bollinger Bands will also offer traders dynamic levels areas of support and resistance.

More exactly, the upper and lower Bollinger bands can act as dynamic S/R levels, as traders generally avoid buying when the instrument’s price hits the upper Bollinger band, respectively avoid selling whenever the price reaches the lower Bollinger band.

In a ranging market, when there isn’t a clear trend on the chart, Bollinger Bands provide excellent support and resistance.

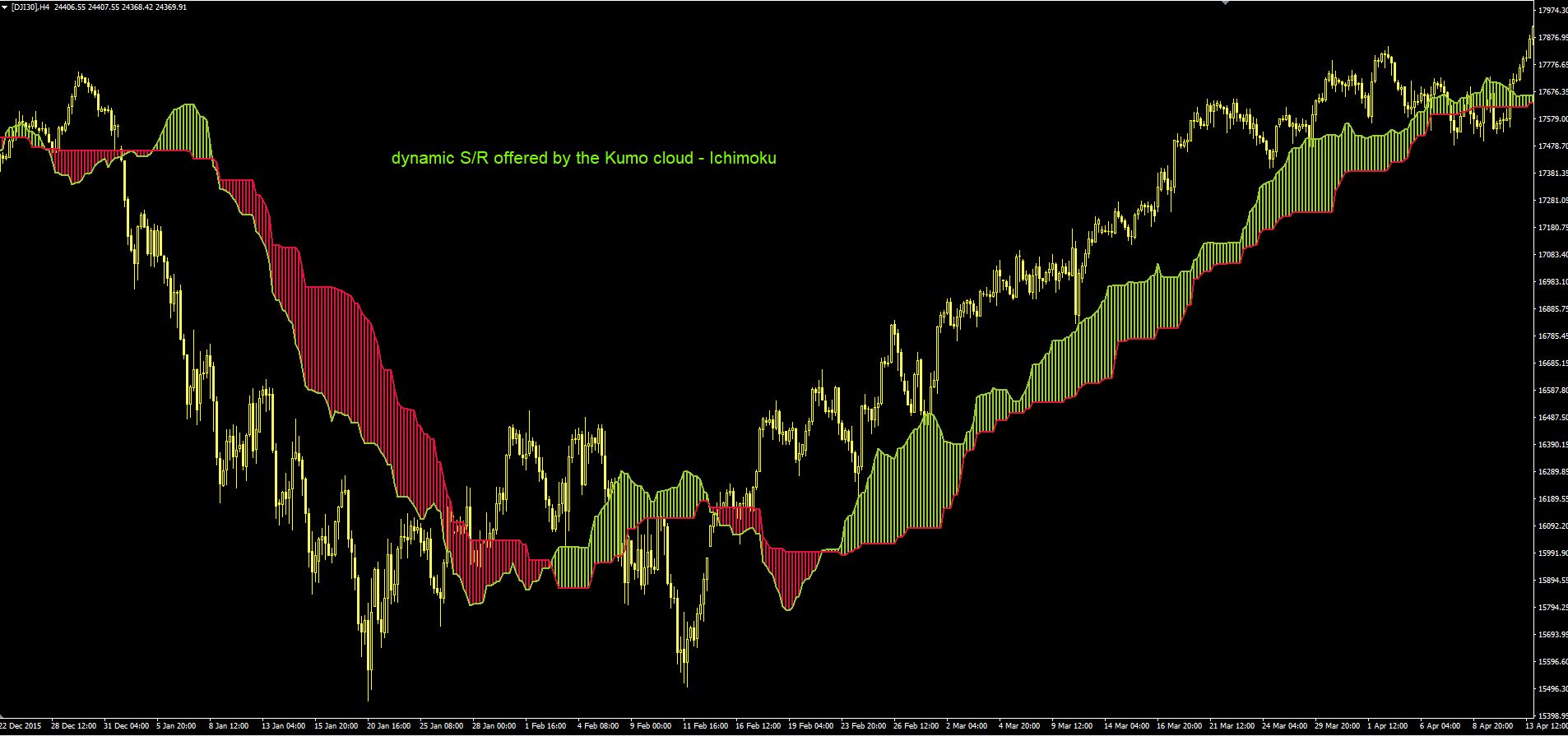

Ichimoku Cloud Indicator

Ichimoku indicator offers a unique perspective of support and resistance, representing these levels based on price action.

For most traders, Ichimoku might seem complicated. However, once you get familiar with how to interpret the charts you’ll spot great areas of support and resistance.

The Ichimoku indicator includes 6 components which are calculated based on moving averages.

The innovative style of this indicator is that it projects the moving averages into the future, offering excellent dynamic areas of support and resistance.

For spotting those levels you don’t need all 6 components of the Ichimoku. You just need the Kumo cloud and it will be enough to determine the dynamic S/R levels.

Keltner Channel

Keltner Channel is a technical indicator calculated based on an exponential moving average and the Average True Range.

This indicator is similar to the Bollinger Bands. Thus, the upper and lower bands of the Keltner Channel can act as a dynamic resistance and support areas.

Keltner Channel works best as support and resistance in a sideways market, when there isn’t a clear trend on the chart.

Donchian Channel

The Donchian Channel is another great indicator to identify dynamic support and resistance levels.

This indicator is similar to the Bollinger Bands and analyzes the evolution of the price by plotting the highest high and lowest low over a specific time interval.

As in the case of the Bollinger Bands and the Keltner Channel, the upper and lower bands of the Donchian Channels provide traders important areas of dynamic support and resistance.

How To Find The BEST Support and Resistance Levels On Forex And Stock Market

The relevance of a level of support or resistance depends mainly on its length and its number of retests.

Support and Resistance Length

The length of a support or resistance level is an important factor. A support or resistance level formed in the last 5 trading days, for example, has a minor importance.

A level which acted as a support or resistance in the last 30 days has a bigger relevance. A breakout from that level could represent an important signal for market participants.

That’s why it’s better to focus on support and resistance levels on the higher timeframes.

The support and resistance levels on lower timeframes offer a lot of noise. The risk of getting whipsawed is much higher when you are trading based on minor support and resistance areas.

The seasoned traders start analyzing the S/R levels by plotting them from higher timeframes to lower ones. They start plotting monthly levels, then weekly areas of S/R, daily levels, H4 and so on.

So, try to focus on the bigger picture of the market when you are analyzing support and resistance levels.

Number of Support and Resistance Retests

A support or resistance level is more important if it has been retested many times in the past. Each retest contributes to the importance of support or resistance.

A support or resistance level which includes only one recent market swing, for example, is an easy target for bulls/bears. A level which has been retested at least 3 times is considered a strong level and will be harder to be broken.

If we combine the length factor of a support or resistance level with the number of re-tests, we can now truly establish if an S/R level is relevant or not.

A 2-months support and resistance level retested many times in the past will represent an important level on every trader’s chart.

So, try to focus your attention on relevant levels. Draw the most important areas on your charts and leave the minor levels for the beginners.

The goal is to eliminate market noise as much as possible. Trading based on relevant support and resistance levels will make your job as trader much easier.

Confluence of Support and Resistance Lines

A confluence is an area with multiple support or resistance levels, both static and dynamic.

A confluence of support or resistance is more relevant to traders as it includes 2 or more important focus points on the chart.

Although it might seem complicated, finding confluence on the chart is not so difficult. You just have to train your eye to spot chart areas where multiple levels meet.

Finding confluence on your charts is very important because these areas offer high probability trading opportunities. After all, if 2 or more relevant levels are coming together at the same point in the market, that must mean something.

Finding confluence is quite subjective and it’s dependent on the trader’s skill, experience and tools used on the chart.

My personal rule is to find areas with at least 3 support and resistance levels, and at least one of them must be dynamic. Here are some examples:

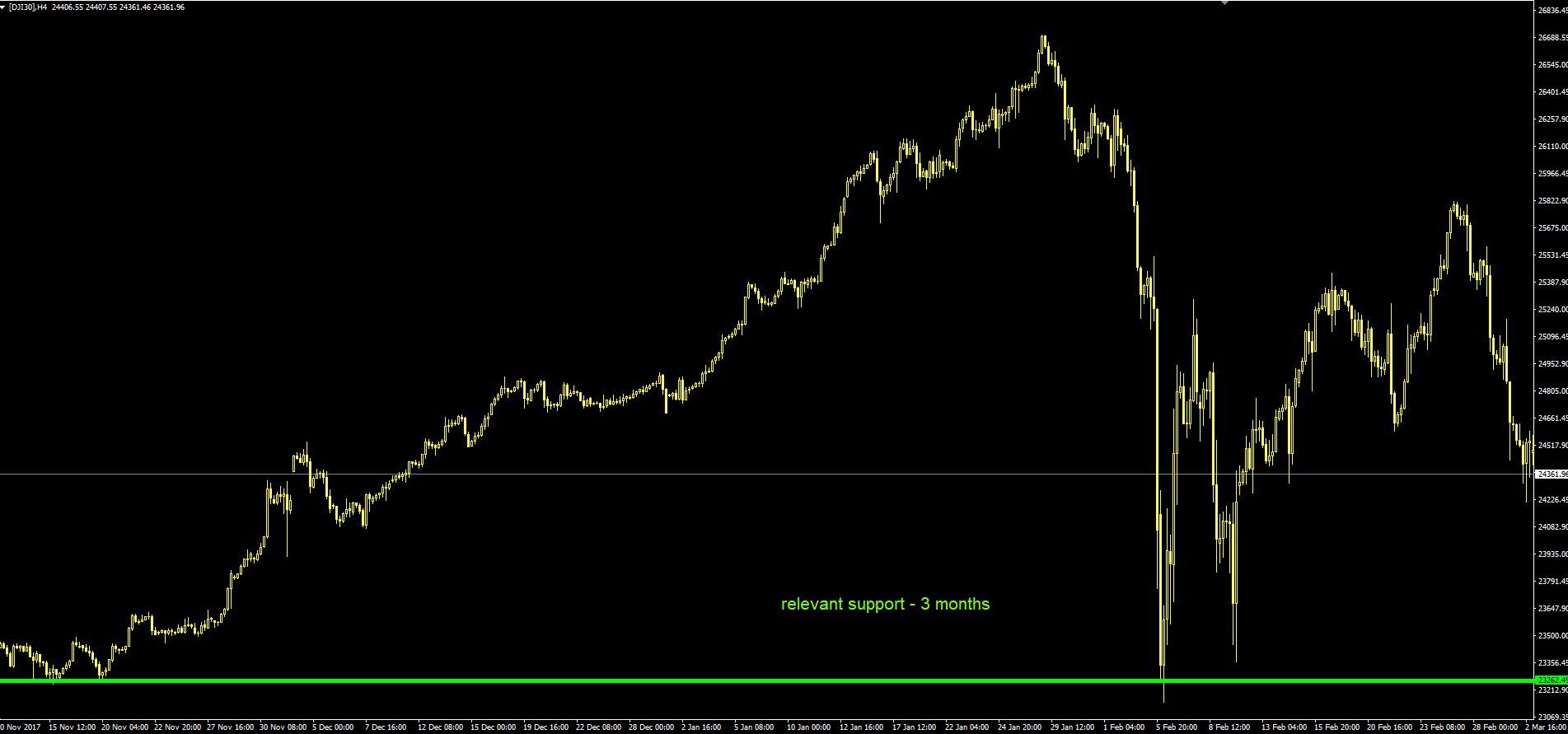

In this Dow Jones Index chart, we found a high probability trade around the 50.0 Fibonacci level, which coincided with the recent market swing, tested 2 times in the past. Also, the 200-period exponential moving average offered dynamic support.

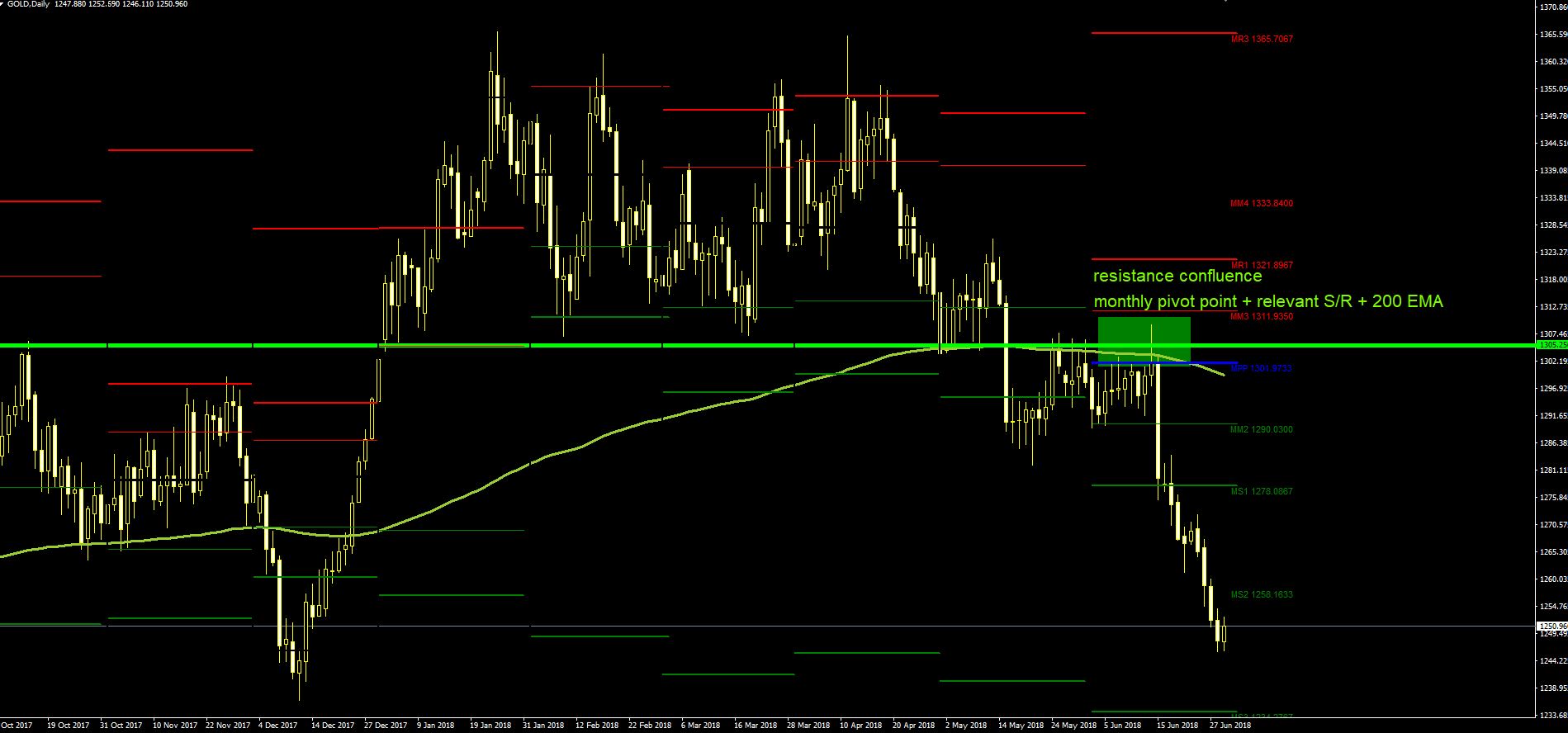

In the Gold Daily chart, we have a high probability short trade at a confluence area between the monthly central pivot point, the 200-period exponential moving average and the previous support level broken to the downside.

Final Thoughts

A proper support and resistance analysis is critical in order to be successful trading on that market. If you learn to spot the relevant areas of support and resistance on your chart you’ll gain a substantial competitive advantage over other market participants.

The reality is that no one knows how high or how low a market will go. No one knows if one support or resistance will hold or will be broken. But we can increase our chances to profit from the markets when we find those chart areas that group several key levels.

After all, support and resistance trading is one of the most consistent trading styles that could benefit you in the long run.