Table of Contents

Position trading is a technique which focuses on the bigger picture of the market. 95% of all traders lose money and only 5% of them make any real money. This is due to the fact that the majority of traders enter the markets with a “get rich quick” mentality. Short-term trading can be profitable, yes, but on the long run you’ll be safer when adopting a position trading attitude.

What is Position Trading

The goal of any trader/ investor who wants to be active in the financial markets is simple. How does one make effective decisions in an uncertain and dynamic market? The solution is finding an approach that will work effectively in the long term. That’s why position trading could be the solution to this problem.

Position trading style eliminates the market noise, in order to obtain a clearer signal. In other words, position trading does not rely on the excess information that may be associated with short-term trades that are not driving the trend.

Position trading usually involves a combination of technical analysis and fundamental analysis to make right trading decisions. When evaluating the markets, position traders usually make their research on weekly and monthly price charts.

The Long-Term Trading Perspective – Why Is Important

The market usually gets it right in the long-term. This means that if a market is efficient, prices will eventually incorporate all information and will move to their true value.

Of course, markets aren’t always right immediately. Markets, while accumulating all information from investors, are only a reflection of their actions. Each of the market participants has its own concept of where the market is going. Each market participant is motivated by basic human emotions. Price momentum oscillates strongly in both directions, stimulated by greed and fear.

When a market is uncertain, prices will adjust slowly as a reaction to the ambiguity. When there is no information, prices will not trend. When there is clarity, markets will react accordingly.

That’s the main advantage of position trading. You trade with the “house”, and the house is always winning.

Positional Trading vs Day Trading

When executed correctly, position trading comes with several advantages over day trading or scalping:

Eliminates market noise

Sometimes when trading on shorter time frames you get caught up in the market price fluctuations, rumors or the constant monitoring of the market. That’s market noise.

The market noise is the volatility around the price, a movement in price that is not associated with the direction or true value of the market.

Trading on higher time frames requires discipline to remove the market noise and to extract the correct information from the price.

Flexibility

While day traders monitor the price action very closely and their “screen time” is considerably higher, position traders don’t have to deal with such problems.

Position trading is more flexible, as it offers time away from charts. Once you’ve made your research and pulled the trigger, that’s it.

Also, position traders execute fewer trades and they don’t have to monitor the trades all the time.

No Over-Trading

Day trading involves entering and exiting trades relatively quickly. The trades are typically opened and closed within one or two trading sessions. Position trading keeps you away from these daily “temptations”. Position traders do not trade actively and execute fewer trades.

Position traders don’t have to deal with the daily stress arising from trading. Position traders stress less because their positions have plenty of room to survive the market volatility.

Signals are more relevant on higher time frames

Position traders often use the daily, weekly and monthly charts. They are not interested in analyzing lower time frames. This adds weight to their trading systems.

A divergence is much stronger on the weekly chart than on a 15-minute chart. A moving average crossover has more relevance on the daily chart than on the 5-minute chart.

By using higher time frames position traders improve the quality of their trades. Trading on the higher time frames requires discipline and patience, as waiting for a signal can take weeks or even months.

Safety net for early exits from the market

Have you ever entered a trade thinking that the price will go up for sure, just to see the price hitting your stop loss order and then continuing in the upward direction? It happens all the time, and it affects you emotionally.

With position trading, this problem is gone. By using higher stop losses by default, position traders remain on the market even when the price movement is not in their favor. There is no early exit from the market. Of course, the patience comes again into play, position traders being required to be disciplined even if the position didn’t develop as initially planned.

Requirements of Position Traders

- A Position Trader must recognize the weekly and monthly support and resistance.

- Position traders must recognize chart patterns, in both trending and range-bound markets.

- A Position trader must understand fundamental analysis and should implement it in his trading analysis, along with technical tools

- Position traders should gain profits from the market by diminishing risk as much as possible. The risk is reflected in his exposure. A Position Trader must be aware of the balance between risk and reward.

- A Position trader must be patient and disciplined. Patience and discipline will help the trader entering the market at the wrong times and turning small losses into bigger losses.

- Position traders must control their own emotions while entering and exiting trades.

Position Trading Trading Strategies

Positional Trading Strategy A: Forex Carry Trade

A viable strategy for a position trader is the carry trade.

Carry trade is an interesting long-term strategy that is based on the difference in interest rates around the world. It’s a strategy through which a position trader sells a certain currency at a relatively low-interest rate and uses the funds to buy another currency that generates a higher interest rate.

By executing a carry trade, the position trader intends to generate profit from the difference in interest rates between two countries.

Also, with an appropriate approach, the position trader aims to benefit not only from the difference in interest rates but also from the changes in the exchange rate.

Let’s consider a carry trade example.

- Firstly, we need to find 2 currencies with a big difference between interest rates, so we could make a profit in the long term from the swap.

- The exchange rate we will focus must be in an upward trend.

- We determine the weekly and monthly relevant support and resistance and potential price patterns

- If all conditions are met, we must wait for the right signal in the direction of the main trend

In the AUD/JPY monthly chart above, we identified a channel breakout in the direction of the prevailing upward trend.

A long entry on the market would be a safe entry, considering the long term. The long position on the instrument is related to a positive swap, and thus the profit of such a transaction would be even greater.

Position Trading Strategy B: Hidden Divergence On Weekly Charts

The hidden divergence is a trend continuation pattern. Hidden divergences signal momentum coming into the main trend, suggesting a possible continuation in the main direction of the trend.

A hidden divergence

- higher lows of the price accompanied by lower indicator values during an uptrend

- lower highs of the price accompanied by higher indicator values during a downtrend

A hidden divergence is more reliable on higher time frames because the market does not move as fast and it is easier to define trends. By trading hidden divergences, the position traders see the patterns developing and have time to make the correct decisions.

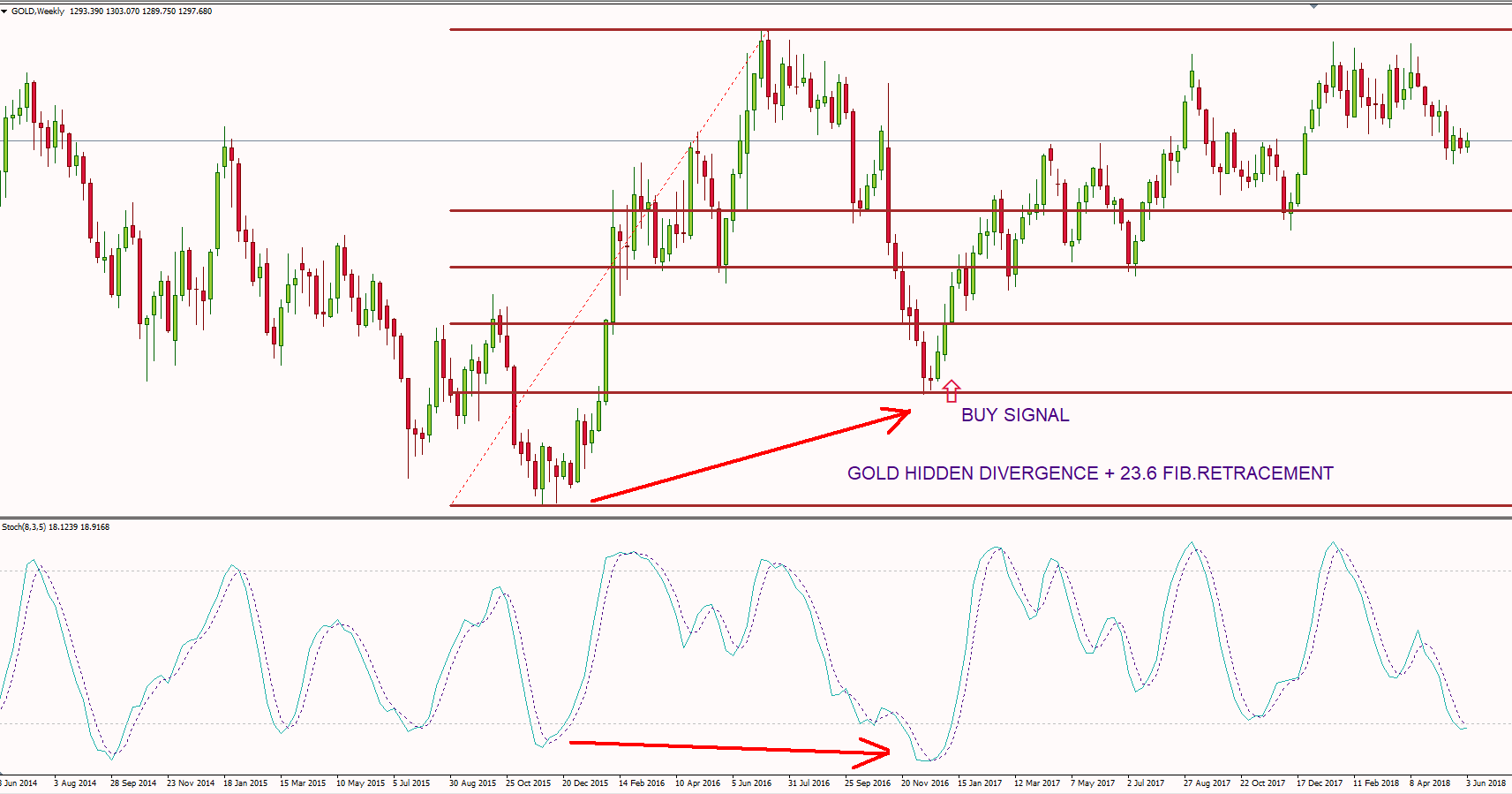

Let’s analyze the weekly Gold chart above. The Gold price recorded a strong upward trend and retraced at the 23.6 Fibonacci retracement level. During this time, a hidden divergence pattern developed on the Stochastic Oscillator.

As you can observe, the Gold price failed to record new lows and closed higher than the previous downward swing. However, if we look at the Stochastic oscillator, it recorded a lower low, thus forming a hidden divergence and signaling that a possible upward movement was on the cards.

This represented a perfect buy for a position trader, the Gold price continuing indeed its upward trend.

Let’s take another example, this time Apple stock. The AAPL stock was in a strong upward trend on the weekly chart. The price was trading above the 50 simple moving average (50SMA), recording higher highs and higher lows.

However, if we look closely at the Stochastic Oscillator, we can clearly observe a hidden divergence and a solid buy signal for a position trader.

As you can see, hidden divergences represent a reliable tool for position traders on the higher time frames, generating high probability signals.

Position Trading Strategy C: Short Selling Stocks

The technique of short selling became very popular in the last decade, many position traders taking trades on the downside of a market.

Short selling represents a technique through which a trader/investor sells an instrument that he does not own. A short selling occurs when the investor believes the price of the instrument is going to decrease in the future.

Let’s analyze an Exxon Mobil Corp example. XOM shares recorded an important increase in the past months. The XOM increase was accompanied by increased volume – reflected the On Balance Volume. The price reached a consolidation phase, a trading range. The price formed a triple top, which was broken to the downside.

As the XOM price closed below the triple top and below the lower trend line of the upward channel, short-selling looked like a viable position trading strategy.

Positional Trading Strategy D: Moving Averages Crossover

The moving averages are probably the most well-known and heavily used indicators in technical analysis. The moving average effectively captures the trend of a financial market in an easily identifiable manner.

Position traders often use moving averages for identifying and confirming support and resistance levels. Most S/R levels, like market highs and lows, pivot points, round numbers etc. are static levels. Well, moving averages offer traders dynamic areas of support and resistance because are constantly changing depending on price action.

A crossover between 2 moving average is probably one of the most well-known technical analysis signal used by traders. The strategy is simple, we take moving averages, one with a shorter period and the other with a longer period and we track the signals when a crossover occurs. This is the simplest position trading system.

Longer-term moving average crossovers work better than short-term crossovers. This is likely because they produce fewer whipsaws. A system involving two short-term moving averages will generate many false signals even for position trading systems.

If we analyze the daily GBP/USD chart above, we can spot 2 position trading signals. We plotted the 200 exponential moving average and the 50 exponential moving average and we traded the “golden cross” (when the 50-period EMA crosses above the 200-period EMA) and the “death cross” (when 50-period EMA crosses below the 200-period EMA).

We filtered the crossover signal with the on-balance volume indicator. We also plotted a 200 exponential moving average on the volume indicator.

As you can see, 2 valid signals occurred, the OBV indicator confirming the long-term trend indicated by the moving averages crossover.

Position Trading Pros And Cons

Position trading isn’t for everyone. This trading style requires a lot of research and an adequate money management.

Position traders know that as important as it is to have an effective method to determine when to trade, it is equally important to develop a system to determine how much to risk. A position trader that risks too much will increase the probability that they will not survive long enough to realize the long run profits of a position trading strategy.

Also, position trading involves patience and discipline. Patience and discipline will help the position trader entering the market at the wrong times and turning small losses into bigger losses.

Despite the fact that position trading is a long-term strategy and takes some time to profit from markets, it’s a safer alternative compared to the other strategies in the market. Used it in conjunction with the long-term trend and with a proper money management system, the position trading might bring back the enjoyment of trading, without having to spend all day in front of the computer.