Table of Contents

What Is Stochastic RSI (StochRSI)

StochRSI, developed by Tushar S. Chande and Stanley Kroll, represents an indicator that combines the features of the Stochastic oscillator and the Relative Strength Index. The indicator increases the sensitivity and reliability of the regular RSI indicator as it applies the Stochastic formula to RSI values, instead of price value.

The Relative Strength Index (RSI) is an internal strength index which is adjusted on a daily basis by the amount by which the market increased or fell. The Stochastic Oscillator compares where the price closed relative to the price range over a given time period. The StochRSI measures the RSI relative to its own high/low range over a period of time.

Stochastic RSI (StochRSI) Calculation

Let’s consider a 21-period StochRSI. The Stochastic RSI is calculated using the following formula:

StochRSI = (RSI – Lowest Low RSI) / (Highest High RSI – Lowest Low RSI)

21-period Stoch RSI = 1 -> RSI is at its highest level in 21 Days.

21-period Stoch RSI = 0 -> RSI is at its lowest level in 21 Days.

21-period Stoch RSI = .8 -> RSI is near the High of its 21 Day High/Low range.

21-period Stoch RSI = .2 -> RSI is near the Low of its 21 Day High/Low range.

21-period Stoch RSI = .5 -> RSI is in the middle of its 21 Day High/ Low range.

How To Read Stochastic RSI Indicator (StochRSI)

Considering that the Stoch RSI is basically an indicator of an indicator, you must be aware that this is a lagging indicator and can display different from actual price movement. Being a range bound indicator, the Stoch RSI’s main goal is to identify crossovers and overbought and oversold conditions.

So, If Stochastic oscillator measures the momentum of price, then StochRSI measures the momentum of the RSI. StochasticRSI indicator reads as follows:

- When the RSI records a new low for the period, StochRSI will be at 0.

- When the RSI reaches a new high for the period, StochRSI will be at 100.

- values above 80 level indicate overbought conditions.

- values below 20 level indicate oversold conditions.

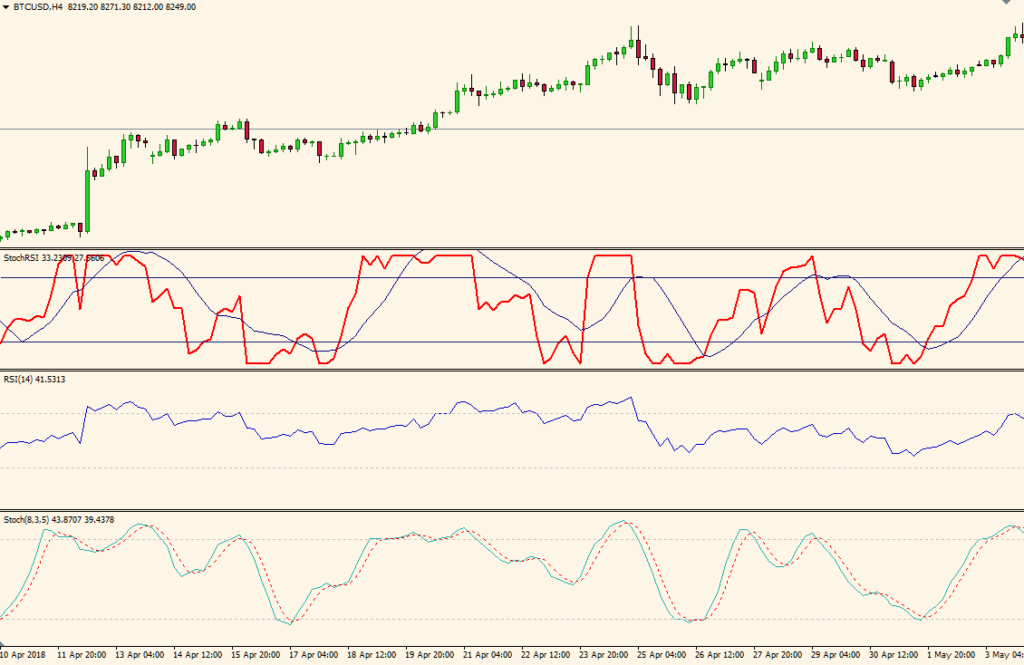

Stochastic vs RSI vs StochRSI

In the Bitcoin chart above we can spot the visual differences between the simple RSI, the Stochastic Oscillator and the Stochastic RSI indicator.

- We can observe that the StochRSI indicator is more volatile compared with the other 2 oscillators, due to its increased sensitivity.

- Also, the Stochastic RSI generates more overbought/oversold signals than the simple Stochastic oscillator.

- However, if we look closely at the chart, there are more false signals offered by the StochRSI compared to the other 2 indicators. We can safely say that during trending conditions, the StochRSI is not a reliable indicator for spotting overbought or oversold entry points on the market.

- In what concerns trading divergences, StochRSI also lacks. I don’t know about you, but I can spot the divergences more clearly on the simple Stochastic Oscillator and the RSI. There is a smarter way to trade divergences with the StochRSI, detailed below.

How To Trade With Stochastic RSI (StochRSI) – Signals and Trading Strategies

StochRSI Overbought/Oversold Signals

The general belief is that if a market reaches overbought levels (too many buyers on the market), then prices should go lower. Also, if a market reaches oversold levels (too many sellers on the market), prices should increase.

It is important to remember that simply because a market reaches overbought or oversold levels, does not mean that market prices will immediately reverse in the opposite direction. During periods of strong upward trends of downward trends, markets can remain in the overbought or oversold areas for days, weeks or even months.

As many traders use the RSI in a wrong way, there is a high probability that they will also use the StochRSI in a similar manner. Entering countertrend positions whenever the StochasticRSI indicates overbought or oversold conditions will only lead to losing positions. The RSIStoch is indeed useful for gaining an overview of the overbought/oversold conditions of the market but it should not be used as a trading signal without a confirmation.

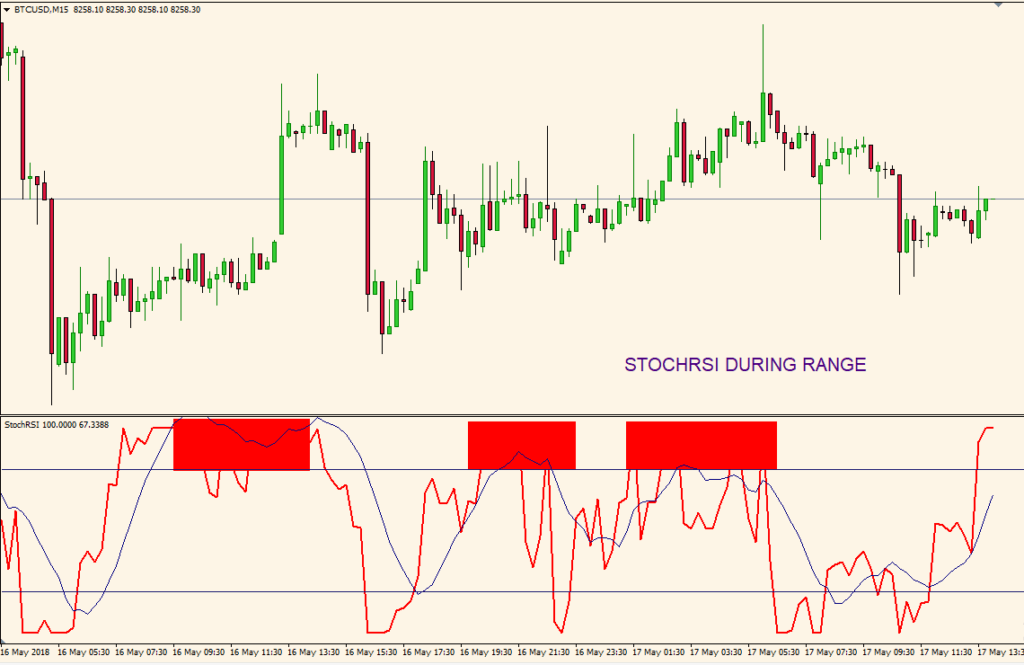

Being a lagging indicator, my advice is to forget using StochRSI for trading overbought and oversold conditions, there are better indicators to spot those areas. In a non-trending market, this indicator will generate a lot of false signals. Tell me, do you see any clear entries on the Bitcoin StochrRSI chart below? I don’t!

By the time you’ll hit a good signal chasing overbought and oversold signals, your account will be down 20%. It’s not profitable in the long term, so let’s move to the second way of trading with StochRSI.

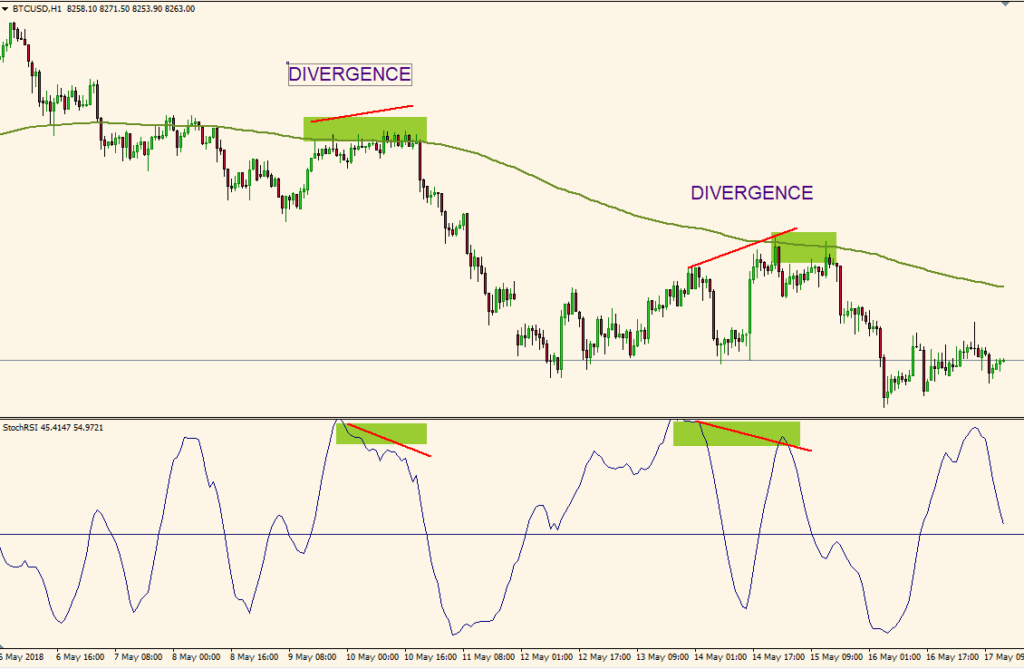

StochRSI %D Divergence Trading Strategy

A smarter use of the StochRSI is to watch for divergences between the indicator and the price of the security/stock. For example, when prices rallied to a new high but the StochasticRSI cannot increase to a new high, then we have a divergence. Keep in mind that Price/StochasticRSI divergence is not an exceptional signal. It occurs frequently, as it is inevitable and is useful only when used in conjunction with other indicators.

For this strategy, we only need to display the %D on the graph.

% D = Percent of Deviation between price and the average of previous prices (aka momentum).

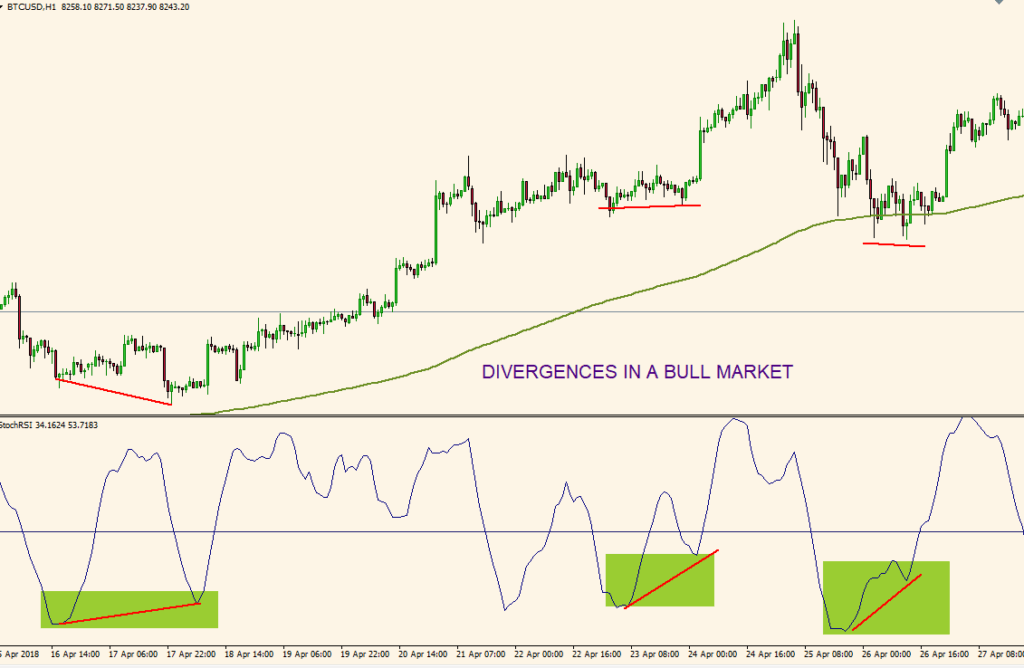

Let’s analyze the Bitcoin StochRSI chart above, by plotting the 200 EMA (Exponential moving average) and the %D of the StochRSI. We can clearly see the divergences, and we only take signals in direction of the main trend.

TIP: You should never take countertrend entries trading StochRSI divergences, just stick with the main trend on the market.

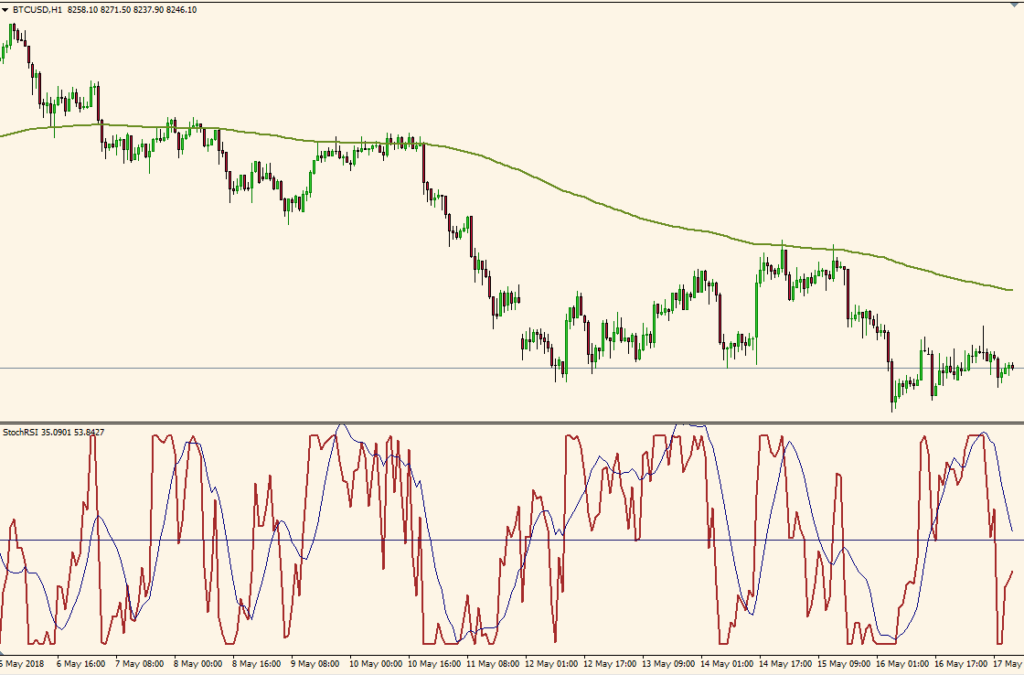

The reason I only display the %D is simple. I like clean and clear charts, and StochasticRSI formula could be quite confusing. Look at the same chart, with the full indicator displayed, it’s messy and I can barely see any signals.

Below is another Bitcoin chart, this time in an upward trend. As you can see, the signals are quite accurate. You could also add other filters, to eliminate the noise, like ADX or Pivot Points to pinpoint the entries on the market.

Forex Trading Strategy: How to use StochRSI for Scalping/Day Trading

By itself, the StochRSI is not a reliable indicator. If you want to scalp or to day trade only with this indicator, it will be a very hard task to find valid signals.

Scalping may seem easy, but the reality is that it’s an advanced trading style. It requires very quick decision making, quick reflexes to react when setups are spotted, and the trader must be skilled at quickly executing a trade.

If you want to make money from scalping, it’s imperative to have a disciplined approach to trading and a solid trading system.

So, in order to profit from the market, we’ll use the StochRSI indicator in a totally different way. We won’t trade the oversold/overbought areas and we won’t look for divergences.

What we have to do in order to make the indicator more reliable is to smooth it by using longer periods.

For this setup, I used a 100-period for the RSI and a 100-period for the K percent. We will ignore the D percent, as we are not interested in any crosses or divergences.

The trick here is to add a 50 level and watch for the bullish and bearish periods.

But that isn’t enough. Even with this setup, the StochRSI will also offer a lot of noise.

That’s why we have to adjust our entry points.

Thus, we will add daily pivot points. Pivot Points represent levels that are used by floor traders to determine directional movement and potential support/resistance levels.

Pivots Points are an accurate indicator, as the most market participants are watching and trading these key levels. They are especially useful to short-term traders who are looking to speculate small price movements.

We will also add the MACD indicator with 10.100.1 settings. Basically, these MACD settings are tracking the crossover between 10 MA and 100 MA.

Here are the main rules of this setup:

- As we are scalping and day trading, we will use this system on the 5-min chart

- Plot the StochRSI with 100-period for the RSI and a 100-period for the K percent and 1-period for the D percent

- Add the 50 level on the StochRSI. When the indicator is above 50, this signals bullish pressure. When the indicator is below 50, this signals bearish pressure

- Plot the MACD indicator with 10.100.1 settings. MACD above 0-level suggest a bullish outlook. MACD below 0-level suggest a bearish outlook

- Add the daily pivot points. We are interested only in the central pivot point. The rest of the levels are ignored.

- We will trade only at the central pivot point of the trading day

- We will look to buy when the price is above the central pivot point, above the 0-level of the MACD and above the 50-level of the StochRSI

- We will look to sell when the price is below the central pivot point, below the 0-level of the MACD and below the 50-level of the StochRSI

- Stop-loss orders are placed below the central pivot points

- Aim for at least 2:1 risk/reward ratio

Let’s look at some examples to see this system in action.

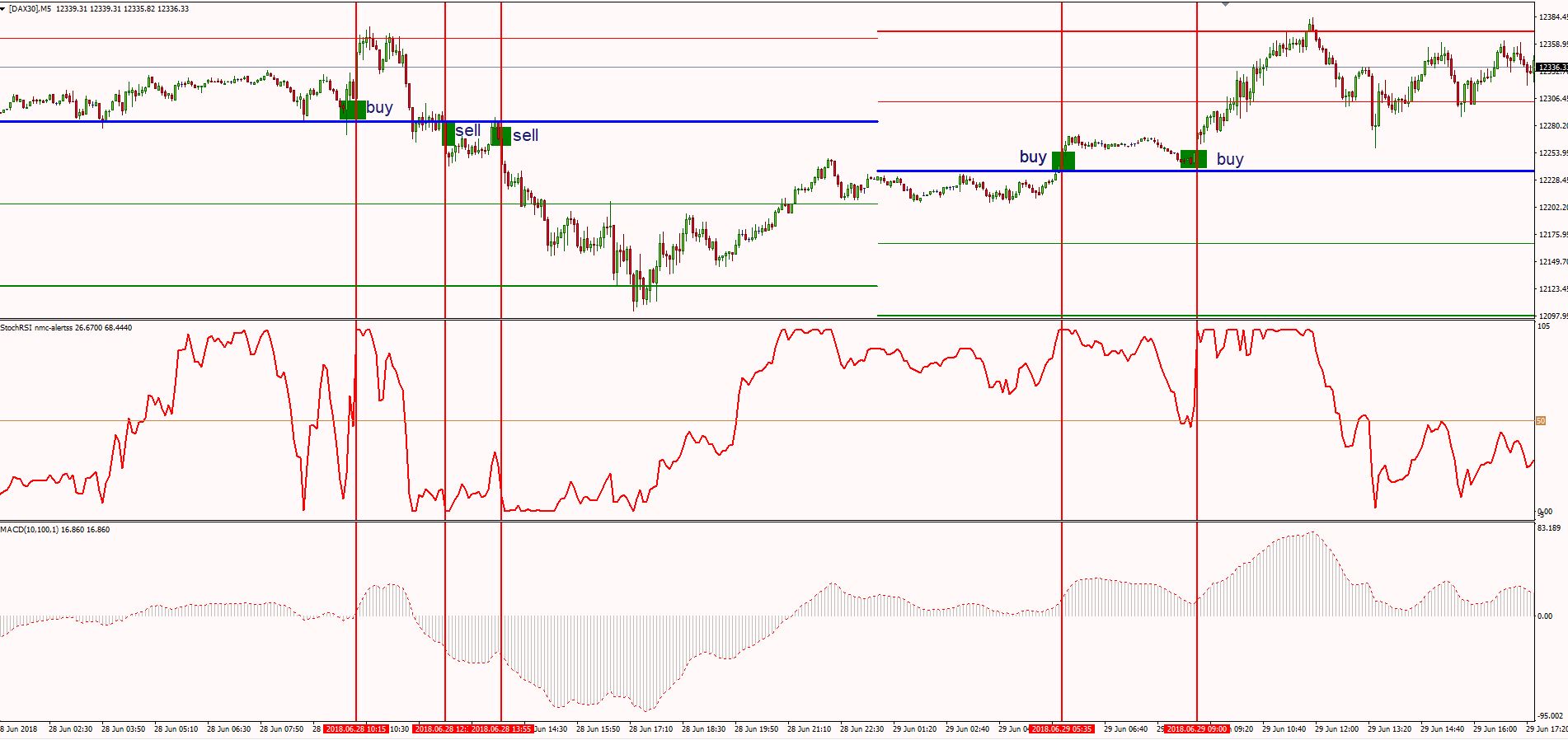

Here is a DAX30 Index chart, on the 5-min chart.

When we start analyzing the chart, the first thing we should do is to look at the central pivot point and price. We are looking for signals above or below the pivot point.

Once we determined a direction to trade, we need the StochRSI and the MACD to confirm the trade.

As you can see, this setup generated during 2 trading days 5 excellent signals. All of the trades were successful.

The first signal was a buy entry, above the central pivot point, when the StochRSI crossed its 50-level and MACD crossed the 0-line.

We then had 2 short signals, below the pivot. Look at the StochRSI at the time we took our short trades. It was clearly indicating oversold conditions. That’s why many traders fail when using this indicator. They were taught to trade the StochRSI the wrong way.

To me, the StochRSI at those levels suggests a strong bearish pressure. As the MACD confirmed our trades, we were safe to short the market.

The second day, this system generated 2 buying opportunities.

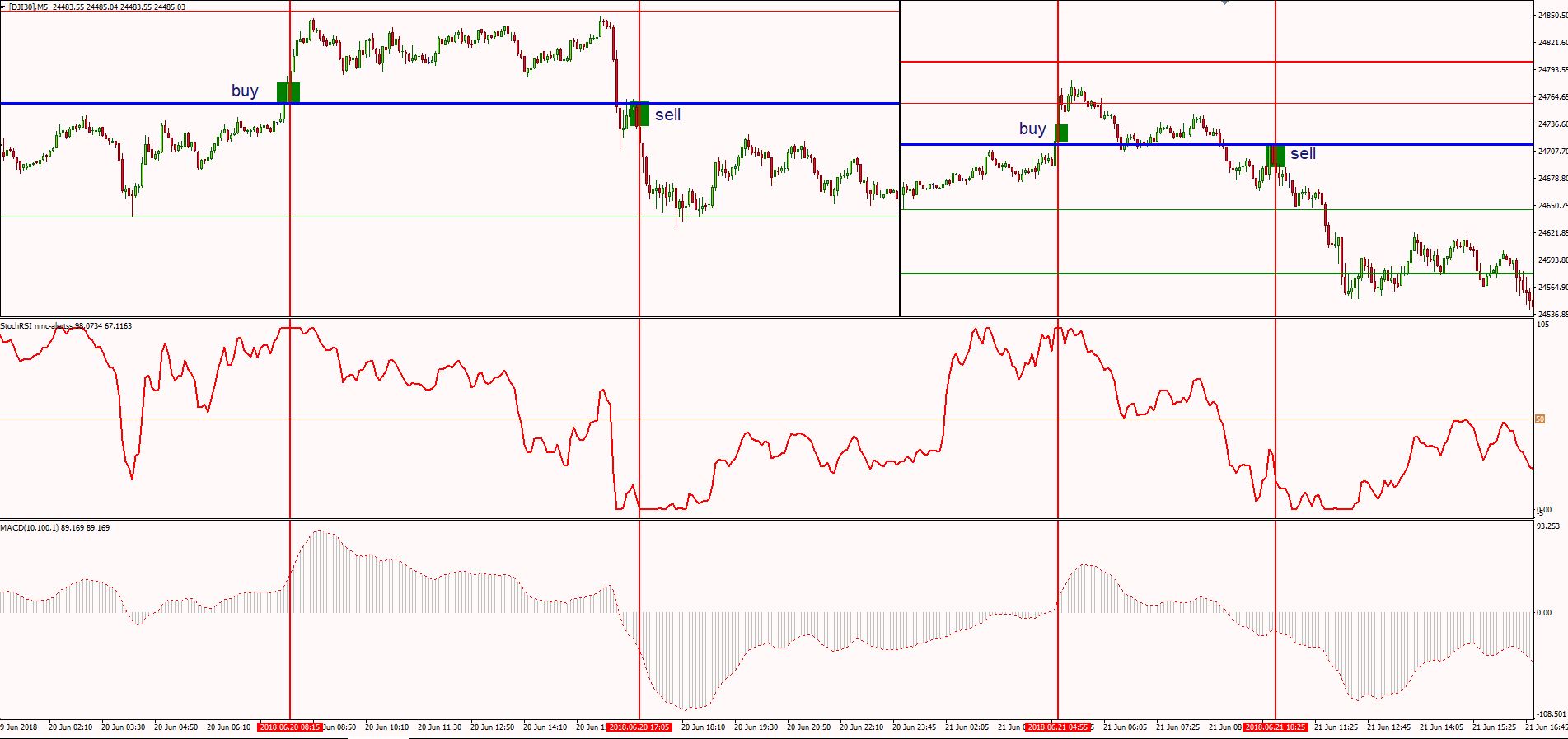

Let’s add another chart. This time we plotted the Dow Jones Index Chart.

We also have 2 consecutive trading days during which this setup offered 4 valid signals.

The key to this system is taking the trades around the main pivot. We also have the advantage of looking differently at the StochRSI. We don’t trade oversold/overbought levels and we don’t chase tops and bottoms. We are searching for market strength.

As you can see, all signals were successful. The power of this system is the fact that we use tight stop losses. Entering around the pivot point, we don’t leave much room for the market to go against us.

If it does, we check our MACD and StochRSI and reverse the trade.

Once you bank a couple of winners, use a trailing stop and leave the trades to run to their full potential.

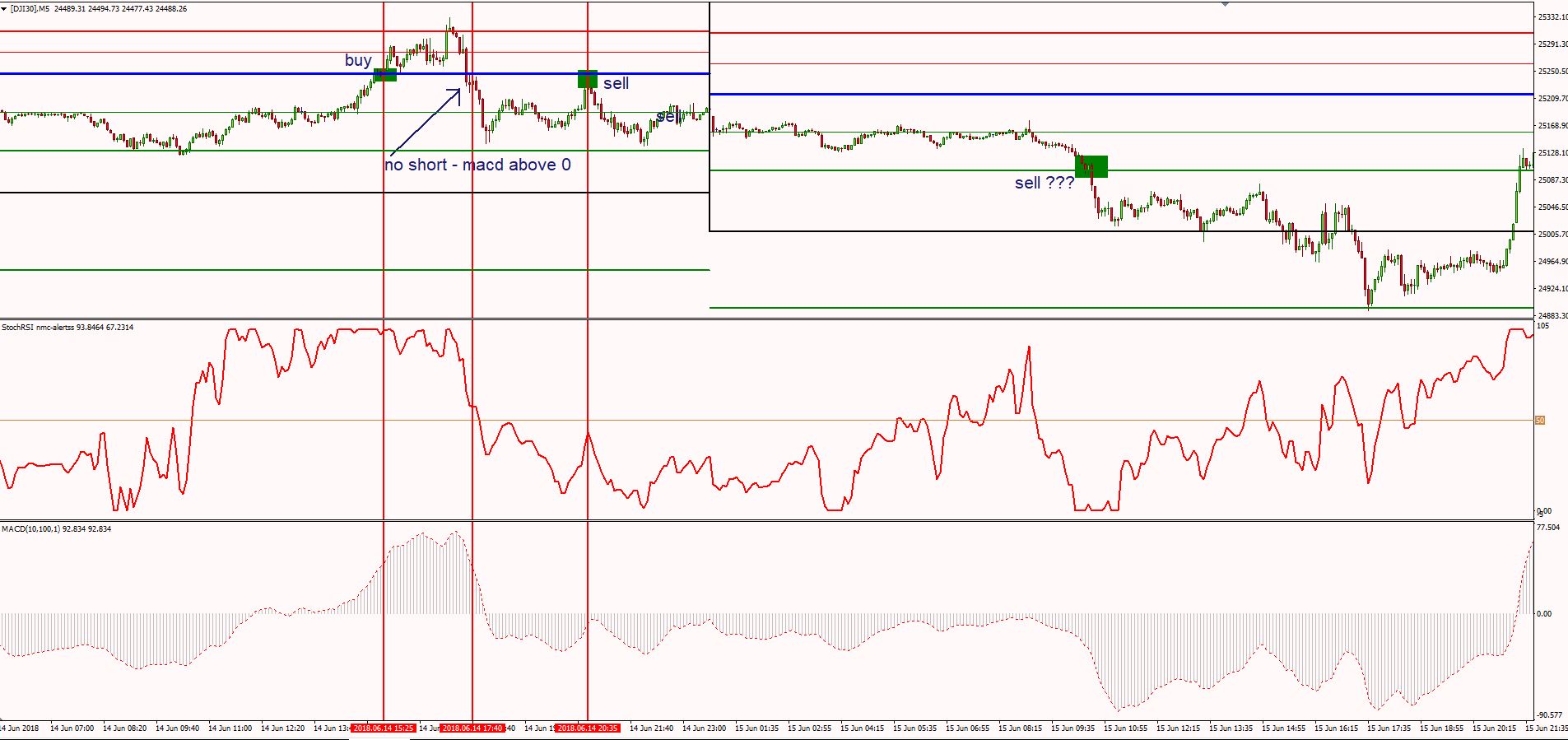

Here’s another example. By now, I think the charts are clear and easy to follow. During the first day, we had 2 valid signals. The middle one was not valid because the MACD was above the 0-level when the price closed below the central pivot point.

It’s important to stick to the rules and be disciplined. It will benefit you in the long run. Even though the trade would have been successful, we ignored it. The market gave us the opportunity to re-enter during a pullback to the pivot.

The second day was a no-signal day. Yes, there will be days when the price never comes to the central pivot point.

When this happens, you could try to trade around the S1 or R1 levels, but it will be riskier. As you can see, the short trade below S1 level turned out to be successful. I personally ignore all the signals and focus mainly on the main pivot point.

Stochastic RSI (StochRSI) – Pros And Cons

- ↑ excellent at identifying divergences on the chart, on Forex and stocks

- ↑ good during trending market conditions

- ↓ lagging indicator and can produce numerous whipsaws if not used correctly

- ↓ does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other indicators

- ↓ confusing at identifying overbought and oversold areas on the chart

2 thoughts on “Day Trading With StochRSI [Stochastic RSI Trading Strategy]”

Great and knowledgeable content! Especially the scalping and day trading strategy. Thanks a lot!

I have a question about using StochasticRSI for scalping or day trading. You mentioned that “Plot the StochRSI with 100-period for the RSI and a 100-period for the K percent and 1-period for the D percent”. Then what period should I use for Stochastic? I use the chart provided by TradingView. Is it appropriate to use the default setting of 14-period for Stochastic? (The default setting of StochasticRSI in TradingView is 3-K%, 3-D%, 14-RSI, 14-Stochastic.)

Thanks in advance.

So useful and interesting .Thank you very much