Table of Contents

What Are Leading Indicators

Leading indicators are indicators able to precede the price movements of a currency/stock due to their predictive qualities. While, lagging indicators (RSI, Stochastic Oscillator, moving averages, Bollinger Bands etc.) follow price movements and don’t have reliable predictive qualities, leading indicators are able to anticipate when major moves in the markets would occur.

I’ve read a lot of false information regarding RSI, Stochastic, Momentum oscillators, which were associated with the leading indicators category. Although those indicators will generate a lot of good signals if traded correctly, they will become almost useless during non-trending periods. Just because they tell you how overbought or oversold a market is, this not means that they are leading the price.

Leading Indicators vs Lagging Indicators In Technical Analysis

• offer an early warning about the current market price

• predetermine which direction to trade

• offer accurate target prices and optimal entries on the market

Here are the most useful leading technical indicators, to help you trade the stock market.

Best Leading Indicators For Forex And Stock Market

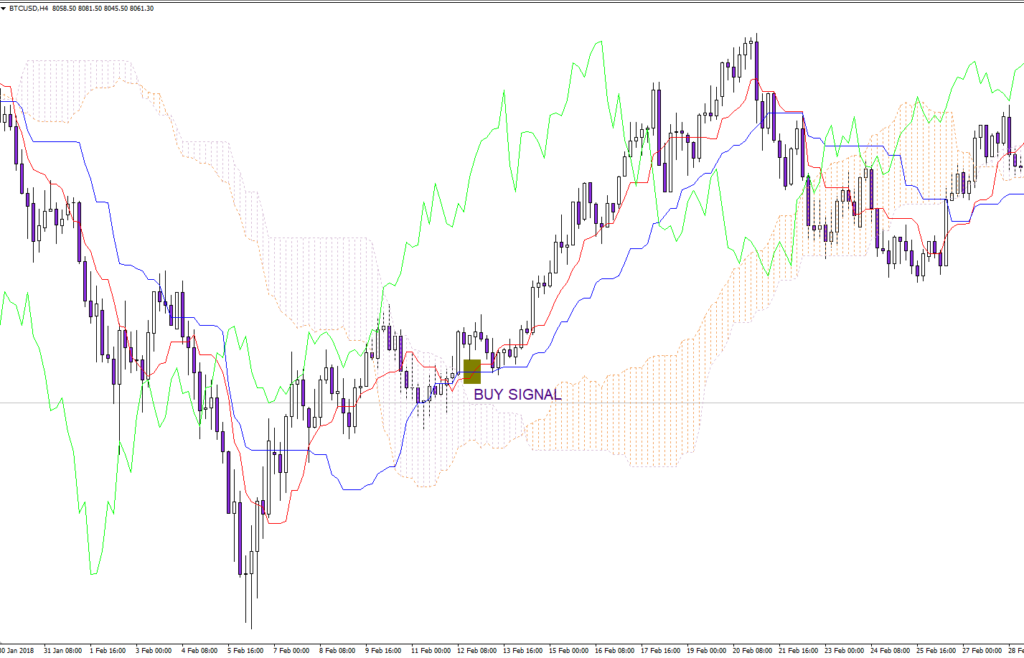

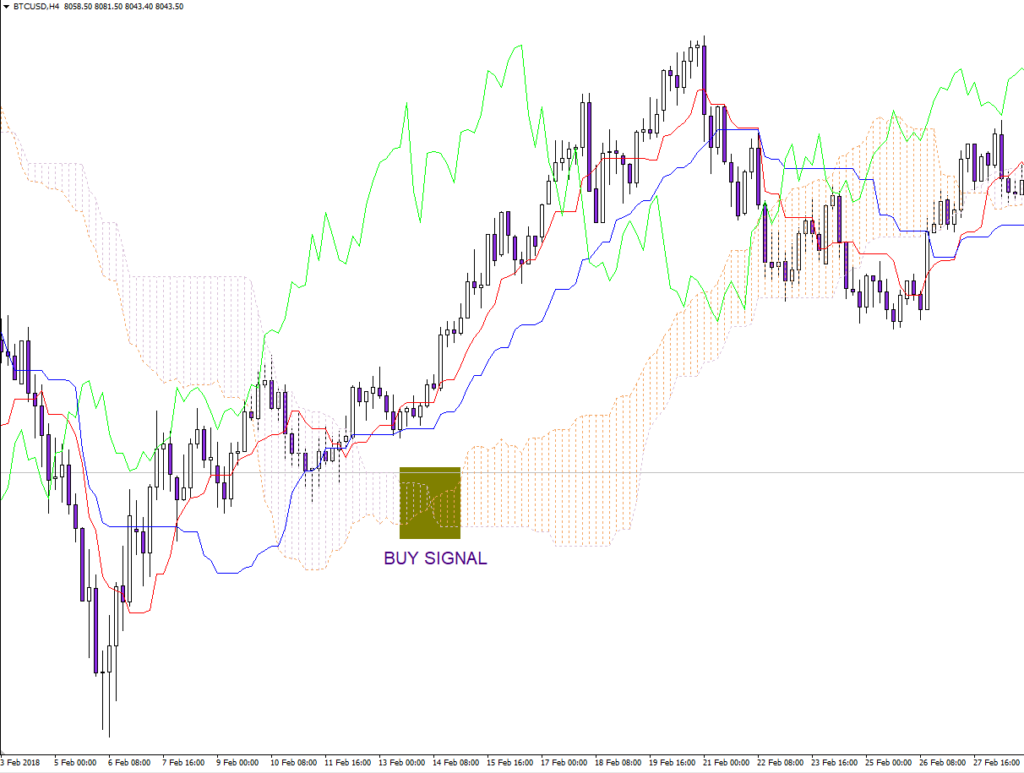

5. Ichimoku Indicator

An Ichimoku chart, developed by Goichi Hosoda, represents a trend-following system with an indicator similar to moving averages. Ichimoku is one of the trading indicators that predicts price movement and not only measures it. The advantage of the indicator is the fact that offers a unique perspective of support and resistance, representing these levels based on price action.

Ichimoku – Pros

• Leading indicator that predicts price movements

• Excellent at offering dynamic support and resistance levels

• Good at measuring the direction and intensity of the current market trend

Ichimoku – Cons

• During non-trending markets will offer a lot of false signals

You can learn more about Ichimoku indicator here.

4. Awesome Oscillator

The Awesome Oscillator (AO), developed by Bill Williams is a momentum indicator, representing a 34-bar simple moving average that is subtracted from a 5-bar simple moving average. Basically, the Awesome Oscillator measures the immediate momentum of the last 5 bars and compares it to the momentum in the last 34 bars. The Awesome Oscillator indicates if bulls or bears are in control of the market.

AO is a leading indicator because it tracks the momentum of the market.

Awesome Oscillator – Pros

• leading indicator because it tracks the momentum of the market.

• good at identifying divergences on the chart

• good during a trending market condition

Awesome Oscillator – Cons

• can produce numerous whipsaws if not used correctly

• does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other indicators

You can learn more about the Awesome indicator here.

3. On Balance Volume (OBV)

On Balance Volume (OBV), developed by Joe Granville, is a momentum indicator that relates volume to price change. On Balance Volume indicator shows if market’s volume is flowing into or out of a security/stock.

- When the security/stock closes above the previous close, all of the day’s volume is considered up-volume.

- When the security/stock closes below than the previous close, all of the day’s volume is considered down-volume.

So, the OBV increases or decreases during each day in correlation on whether the price closes higher or lower compared to the close during the previous day.

The main assumption is that On Balance Volume movements precede price changes. As the volume is the main fuel behind the market, OBV is designed to anticipate when major moves in the markets would occur. It is believed that “smart money” can be seen accumulating into the security/stock by a rising OBV and when the public comes along into the security/stock, both the security and the OBV will increase. The numerical value of OBV is statistically irrelevant.

On Balance Volume (OBV) – Pros

• leading indicator, able to anticipate when major moves in the markets would occur

• good during a trending market condition

• good at spotting divergences on the chart

On Balance Volume (OBV) – Cons

• offers many false signals when used on shorter time frames

• does not contain all of the data necessary for proper analysis of price action, so it must be used in combination with other tools

You can learn more about the On Balance Volume here.

2. Fibonacci Retracements

I’m sure that you already know the basics about Fibonacci retracements, so I will be brief. Fibonacci retracements represent a technical analysis method based on the idea that markets will retrace to a predictable area of a move, and they will continue their move in the original direction.

Fibonacci Retracements – Pros

• help traders to identify strategic entries, stop losses or target prices

• offer accurate support and resistance levels

Fibonacci Retracements – Cons

• very subjective, depending on the vision and skill of each market participant

• it can experience a high degree of inconsistency

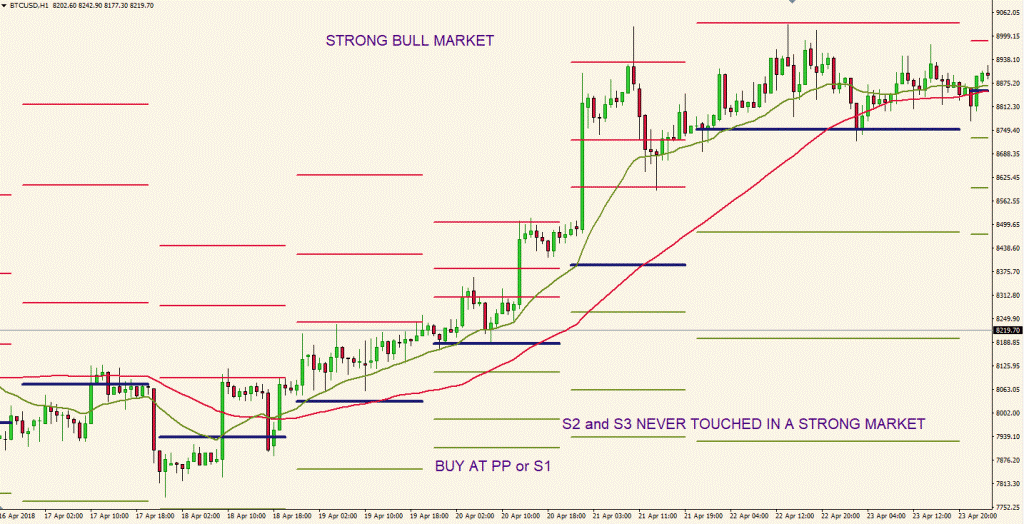

1. Pivot Points

Pivot Points represent levels that are used by floor traders to determine directional movement and potential support/resistance levels. They became popular once traders on the floor exchanges began to use them. A pivot point is a price at which the direction of price movement changes. It is calculated using data from the previous trading day.

By analyzing the high, low, and close of the day, floor traders were able to calculate the next day’s pivot point, as well as potential support and resistance levels. Pivots Points are an accurate leading indicator, as the most market participants are watching and trading these key levels. Part of what makes the Pivots Points so reliable is the fact that they are based purely on price.

The central Pivot Point represents the intraday point of balance between the buyers and sellers and is usually where the largest amount of trading volume takes place. The reason is that the floor-traders are using the central Pivot Point as the main level of the day and most market orders are usually placed between the Pivot Point (PP) and the first levels of support (S1) and resistance (R1).

When the price exceeds a level of support or resistance, this will affect the rest of the trading day, as floor traders will adjust their intraday valuations of the price. A break of a support or resistance level will have a pronounced effect on when and where a rally or a pullback would occur.

Pivot Points – Pros

• one of the most accurate leading indicators

• offers excellent support/resistance levels

• most market participants are watching and trading with pivots

Pivot Points – Cons

• should be complemented by other technical indicators for better entries

• during non-trading days will offer false signals

You can learn more about Pivot Points here.