Table of Contents

What Is Momentum Indicator

Momentum indicator is an oscillator which identifies the strength or speed of a price movement. The momentum indicator compares the most recent price to a previously determined price and measures the velocity with which price changes.

How To Calculate Momentum Indicator

Momentum indicator is calculated as the difference between the most recent price and the closing price of a previously determined period. The oscillator is plotted as a single line on a separate chart.

Momentum Indicator= CLOSE (n)/CLOSE (n-X)

CLOSE (n) —represents the closing price of the most recent bar.

CLOSE (n-X) — represents the closing price X periods ago.

Basically, the momentum indicator represents the difference between two prices. Let’s take an example.

The S&P 500 Index closes today’s trading session at the price of 2750.

- If the S&P 500 Index had closed 10 sessions ago at the price of 2700, the difference would have been positive: +50 (2750 – 2700).

- If the S&P 500 Index had closed 10 sessions ago at the price of 2800, the difference would have been negative: –50 (2750 – 2800).

How To Read Momentum Indicator

The main assumption of the oscillator is that it leads price direction. Think about momentum indicator in terms of acceleration and deceleration.

Let’s consider that the market suddenly makes a large movement in one direction. Perhaps this movement is in response to new information coming into the market. Or it can simply be a result of a random price spike. No matter the reason behind the price fluctuation, this type of sharp movement is called a momentum move.

This means that the market accelerated. As the price movement starts to slow down, the momentum will also slow down, or decelerate.

Momentum indicator can be interpreted as the rate of change of the instrument’s price over that specified period.

- The faster the price increases, the bigger the increase in momentum indicator

- The faster the price decreases, the bigger the decrease in momentum indicator

Here is how you should read the momentum indicator when you analyze the trend:

- If the momentum indicator is above 100 level, this signals that the market bias is on the upside

- If the momentum indicator is above 100 level and the market price is increasing, this signals that the trend is accelerating. This suggests that the current upward trend is strong and likely to continue.

- If the momentum indicator starts declining but is still above the 100 level, this means that the trend is still on the upside, but at a much-reduced rate. This signals that the market is losing momentum. This does not automatically mean that a reversal or trend change will happen

- If the momentum indicator is below 100 level, this signals that the market bias is on the downside

- If the momentum indicator is below 100 level and the market price is decreasing, this signals that the downtrend is accelerating. This suggests that the current downtrend trend is strong and likely to continue.

- If the momentum indicator starts increasing but is still below the 100 level, this means that the trend is still on the downside, but at a much-reduced rate. This signals that the market is losing momentum. This does not automatically mean that a reversal or trend change will happen

Momentum Indicator Best Settings

The most used settings for the momentum indicator are 7, 14, or 21.

- Momentum settings with values over 21 make the indicator less sensitive. This will result in fewer, but better quality signals

- Momentum settings with values below 10 make the indicator oversensitive. This will result in more market noise. Lower settings on the momentum indicator should be carefully traded, as it can lead to many false signals.

How To Trade Momentum Indicator – Signals and Trading Strategies

100-Level Crossover Momentum Indicator Trading Strategy

One of the most common ways in which traders use the momentum indicator is to take signals when the oscillator crosses the 100 level.

- when Momentum indicator crosses above zero, a buy signal is generated

- when Momentum indicator crosses below zero, a sell signal is generated

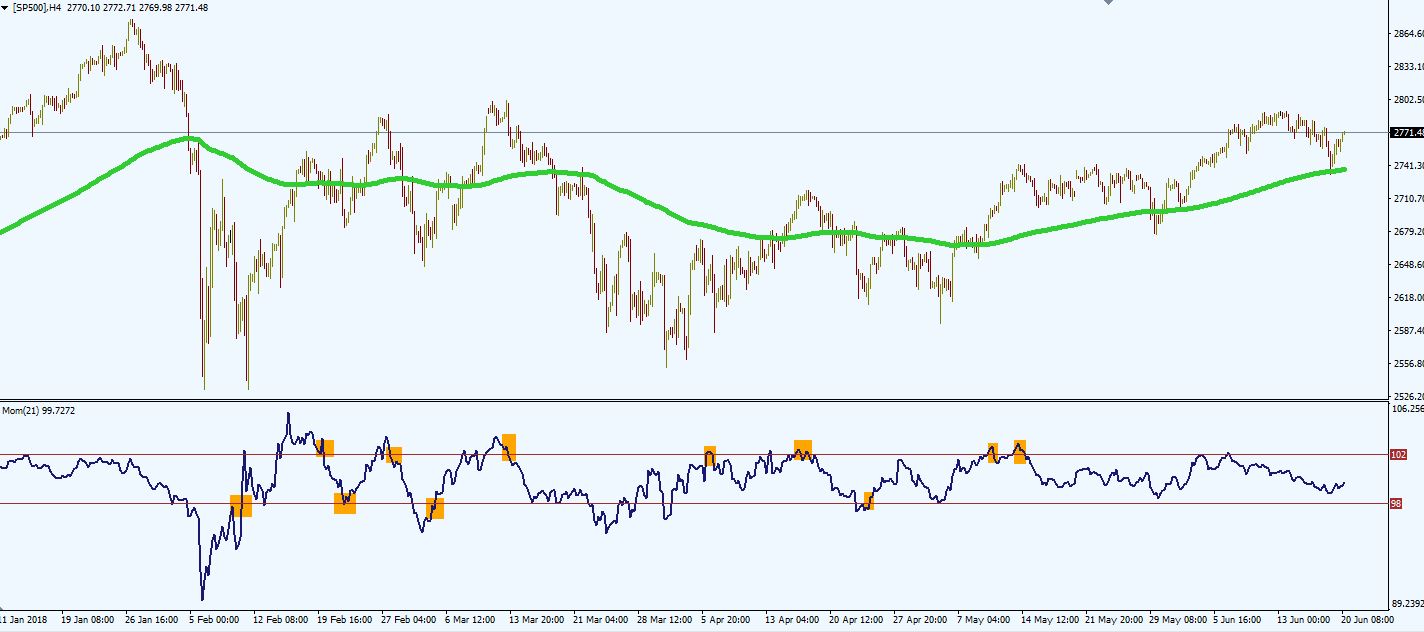

If we analyze the SP500 Index momentum chart above, we might get fooled by the last 2 valid signals generated by the momentum indicator.

Despite the fact the momentum signaled a very good buy signal and a decent short entry, if we took all the signals during this period, we would be down in our accounts.

During trending conditions, the indicator will offer good signals. But what about when markets are not trending?

Look at the orange period on the chart. You can see at least 6 false signals which would have damaged your account.

Despite the fact we are analyzing the H4 chart and we used a 21-period momentum, we can clearly see that the indicator is not reliable for generating good signals. In the long term, you will lose money by adopting this technique.

Overbought/Oversold Levels Forex Momentum Trading Strategy

Momentum oscillator is also used as an overbought/oversold indicator, in order to identify potential overbought and oversold levels.

Traders look at the previous highs or lows of the momentum indicator in order to spot the overbought and oversold levels.

- A buy signal occurs when the momentum indicator moves below a level, into the oversold area, and then crosses back above that level.

- A sell signal occurs when the momentum indicator moves above a level, into the overbought area, and then crosses below that level.

This strategy also offers a higher proportion of false signals, as shown in the momentum chart below.

However, this approach to look for overbought and oversold areas has some potential. If we look at the chart, we can see that despite the fact we had many false signals, there were some good trades to be taken.

This means, we just have to filter the signals with other indicators or patterns.

Momentum Divergence Trading Strategy

The momentum oscillator can also detect divergences. A divergence occurs when price action differs from the evolution of momentum oscillator. This basically means that the momentum isn’t reflected in the price, which could be an early indicator of a reversal.

As in the case of Stochastic or RSI oscillators, when a divergence occurs, a potential change in price direction could be on the cards.

This is how you should spot divergences with the momentum indicator:

- We determine the main trend by adding a 200-period exponential moving average.

- When the price trades above the 200-period exponential moving average, we consider taking only long entries. When the price trades below the 200-period exponential moving average we consider taking only short entries.

- We add the momentum indicator, with an input of 14 periods or 10 periods – depending on the market traded

- We search for divergences between the momentum and the price only in the direction of the main trend indicated by the 200-period exponential moving average

- If the price trades above the 200 EMA, we search for divergences on the lower side of the momentum indicator and if the price trades below the 200 EMA, we search for divergences on the upper side of the momentum indicator

Look at the SP500 Index momentum chart above. We can spot 3 hidden divergences and one classic divergence on the momentum oscillator, all in direction of the main upward trend.

Hidden divergences signal a continuation move in the direction of the prevailing trend. That’s why, if you prefer to take positions in the direction of the main trend, momentum hidden divergences can generate some pretty accurate signals.

The main advantage of this system is the fact that we have 2 market forces on our side when trading: the long-term trend indicated by the 200 EMA and the momentum offered by the divergence on the indicator.

By using this approach, we’ll reduce the market noise and eliminate false signals.

Momentum Indicator – Moving Average Crossover Trading Strategy

In order to smooth the signals offered by the momentum indicator, many traders prefer to add a moving average on the indicator.

By adding a moving average on the momentum chart window, traders take crossover signals, for better quality signals.

Now, when you want to trade a crossover between the momentum oscillator and a moving average, you should be aware of an important thing. A crossover will catch good movements when markets are trending. When markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades.

A longer-term moving average added on momentum will work better than short-term moving average. A longer-term moving average will produce fewer whipsaws.

Also, this is not enough. This system will generate many false signals if the trader doesn’t confirm the trend with other indicators. We cannot take a crossover signal without knowing the market trend.

That’s why I prefer to determine the prevailing trend in the market with Ichimoku indicator. For this setup, I plot only the Kumo cloud.

Let’s look at some charts.

On the Dow Jones H1 chart, we plotted the Kumo cloud and we added a 200-period moving average on the momentum indicator.

To me, this is a great setup. We have the Kumo cloud, indicating a downtrend. We have the longer term moving average, so we will have fewer but quality signals. We just have to take crossovers in the direction of the main trend. We ignore the crossovers indicating long signals.

This setup generated 5 valid short entries. As you can see, all 5 trades were stress-free. Because we traded with the momentum on our side, in the direction of the main trend.

Here’s another chart. This time, we have a long setup.

Once the price closes above the Kumo cloud, we start looking at momentum for a long market entry.

As you can observe on the chart, this setup generated 5 long signals. 3 of them were good price movements, with big profits. One trade was lost and another one closed on break-even.

We exit the market once the momentum signals a sell entry or hits our take-profit level. You don’t have to worry about your stop-loss orders, they are tight and if the market goes against you, you minimize your losses.

I prefer to set my stop-losses below recent swings and ride the trend with a trailing stop. On the long term, you will profit from this method.

Momentum Trend Line Breakouts Trading Strategy

Momentum oscillator can also be useful for drawing trend lines. The technique of drawing trend lines is subjective, is not a precise science.

This method is simple: you draw straight lines on the momentum indicator connecting support points for an uptrend or resistance points for a downtrend.

A valid trend line should connect two or more support points that define the trend.

Now, here’s what you should consider. If you will start drawing trend lines on lower time frames, it will not work. There is too much noise and you will record lots of false signals.

I never use this method on a time frame lower than H1.

And you also need to determine the main trend. I prefer to take trend lines breakouts in the direction of the main trend.

So, we will use the Kumo cloud to spot the main trend and wait for momentum trendline breakouts.

Look at this setup above. We have a relevant trend line on the momentum indicator tested 3 times in the past. Once the breakout above the trend line occurred, we looked at the price in relation to the Kumo cloud.

As the price was traded above the Kumo cloud, this trend line breakout on the momentum indicator represented a valid signal. As you can see, the price took off after the breakout.

Let’s also look at a DAX30 chart.

We spot 2 valid signals, one long position above the Kumo cloud and one short position. Both positions were stress-free, as the market went in our favor as soon as the breakout occurred.

Momentum Indicator Pros And Cons

- ↑ a great indicator for spotting divergences on the chart

- ↑ works well during trending market conditions

- ↑ useful at identifying overbought and oversold areas on the chart

- ↑ good at identifying strong market impulse moves, in conjunction with other trending indicators

- ↑ leading indicator, which offers an early warning about the current market price

- ↓ bad at identifying cycle turns, generating a lot of false signals

- ↓ does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other tools

- ↓ used with lower settings can produce numerous whipsaws if not used correctly

1 thought on “Momentum Indicator Trading Strategy | Day Trading Tips”

I’m convinced the strategy sounds rewarding.

I’ve just put together a combination and I trust it will bear fruit shortly. I revert to you after actual testing