Table of Contents

What is Stochastic Oscillator

Stochastic oscillator, first introduced by George Lane in the 1970s, is part of the momentum indicator family. The indicator is mainly used for determining whether the price has moved into an overbought or oversold area. The Stochastic Oscillator compares where the price closed relative to the price range over a given time period. The Stochastic Oscillator is displayed as two lines, the main line called “%K” and the second line, called “%D,” representing a moving average of %K.

How to Read Stochastic Oscillator

Stochastic is designed to oscillate between 0 and 100.

- Low levels indicate oversold conditions while high levels indicate overbought conditions.

- A Stochastic value of 20 or below indicates an oversold condition. A value of 80 or above indicates an overbought condition.

Keep in mind that the price can often remain in extended periods of oversold and overbought levels. Although reversals from oversold and overbought levels are conventionally considered buy/sell signals, we must take into account that these are just conventional assumptions, and this cannot be considered as a signal for an entry.

How Stochastic Indicator Works | Stochastic Calculation

Traders use two types of Stochastic Oscillators: Fast Stochastic and Slow Stochastic.

The Fast Stochastic Oscillator consists of two lines:

- %K (Stochastic main line) = is displayed as a solid line, its value ranges from 0 to 100 and is calculated based on the high of the recent closing price in respect to the highest and the lowest price registered during a specified period.

%K = 100 x (C – L)/ (H – L)

C = closing price

H = the highest closing price over the last n periods

L = the lowest closing price over the last n periods

- %D (Stochastic signal line) = is displayed as a dotted line and represents a moving average of the %K

The Fast Stochastic Oscillator is very volatile, its reaction to market price will generate many signals. In a strong trending market, the fast stochastic isn’t able to filter noise and will offer a lot of false signals, which will lead to bad trades.

In order to manage the signal in a more efficient way, the Slow Stochastic Oscillator was developed. The Slow Stochastic Oscillator helps to smooth the noise and replaces the %K line with the %D Line and replaces the %D line with a 3 day moving average of %D.

The difference between the Slow and Fast Stochastic Oscillator is the fact that %K of Slow Stochastic incorporates a %K slowing period of 3 which controls the smoothing of %K. If we set the smoothing period to 1, the Slow Stochastic becomes a Fast Stochastic.

Slow Stochastic Oscillator was designed to reduce volatility but in a strong trending market offers many false signals, as in the case of Fast Stochastic.

What Are Stochastic Indicator’s Best Settings And Values

Stochastic Oscillator comes with the standard 5.3.3 settings. Other common settings are 8.3.3 and even 14.3.3.

Now, depending on your trading style, you have to decide how much noise you’re willing to accept with the Stochastic.

- Low values for the Stochastic oscillator will make the indicator over-sensitive. A stochastic with lower settings will offer a lot of signals, but also comes with a lot of market noise.

- Higher values for the Stochastic indicator will make it less sensitive to market noise. This will lead to fewer signals, as the indicator is smoothed.

I prefer to use the Stochastic oscillator with 8.3.5 for spotting divergences on the chart and also for market entries during a strong trend.

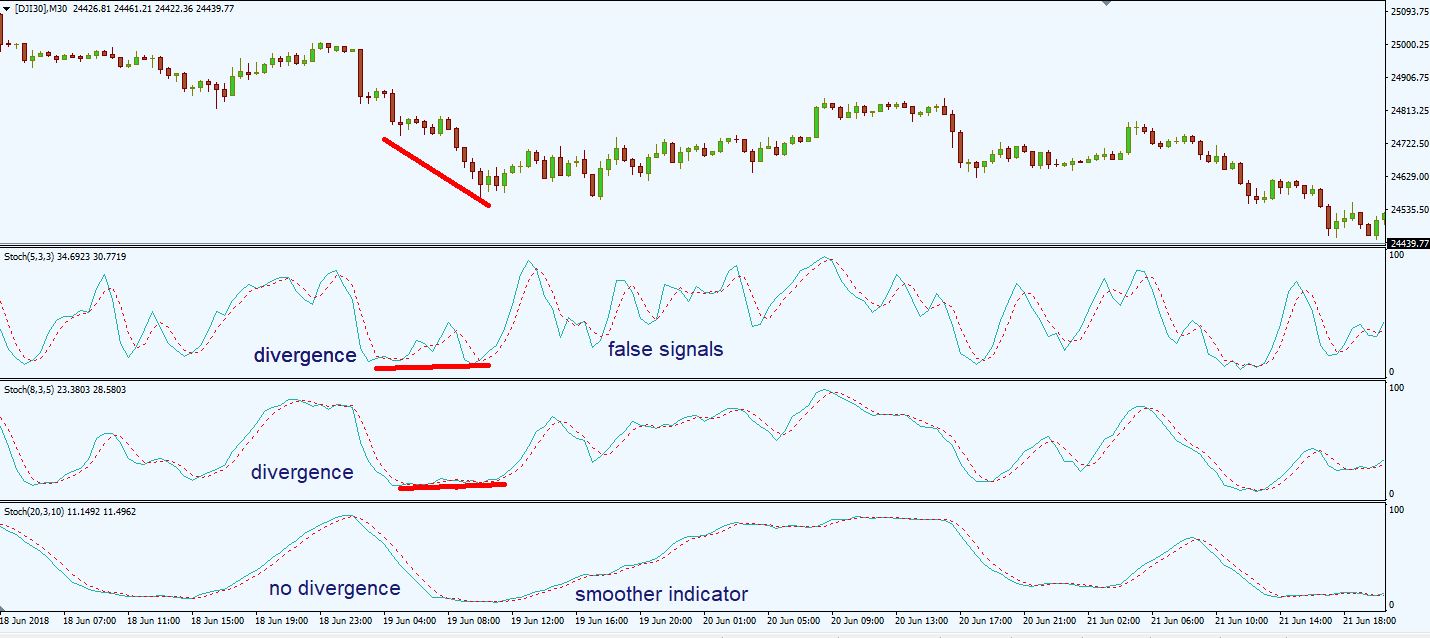

Let’s take a look at the Dow Jones Index chart above, in order to see 3 types of Stochastic indicators in action:

- The first 2 Stochastic oscillators were able to spot a classic divergence, while the smoother Stochastic was unable to find it.

- However, if we were trend-trading, the first Stochastic would have taken out of the market a few times. The second one performed better during choppy price action.

- The third one was the less responsive to market noise, and possibly the better one to use during this movement.

If you prefer to trade divergences and you want a higher number of signals when you trend-trade, then lower settings on the Stochastic will suit you.

If you are a swing trader or a position trader and want to eliminate market noise, then higher settings on the Stochastic will help you do that.

A lot of traders look for the “perfect settings” on the Stochastic indicator when they trade the Forex market or the stock market. The reality is that there isn’t one. You just have to know your trading style. You then have to backtest different settings, depending on the market you are trading and the timeframe you are analyzing.

How To Use Stochastic Indicator | Signals and Trading Strategies

Stochastic Indicator Guide To Trade Overbought & Oversold Areas

The most popular method of generating entry signals (but not the smart one) is to consider the Stochastics indicator as an overbought/oversold indicator. Many traders use a Stochastic threshold of 80 or higher as overbought. Once the stochastic increases above 80 threshold, it serves as a warning that the price increased too fast and that a short-term correction could be on the cards. The sell signal would be generated once the stochastic decreases below 80 level.

- A buy signal occurs when the Stochastic moves below 20 level, into oversold area, and then crosses back above that threshold.

- A sell signal occurs when the oscillator moves above 80 level, into overbought area, and then crosses below that threshold.

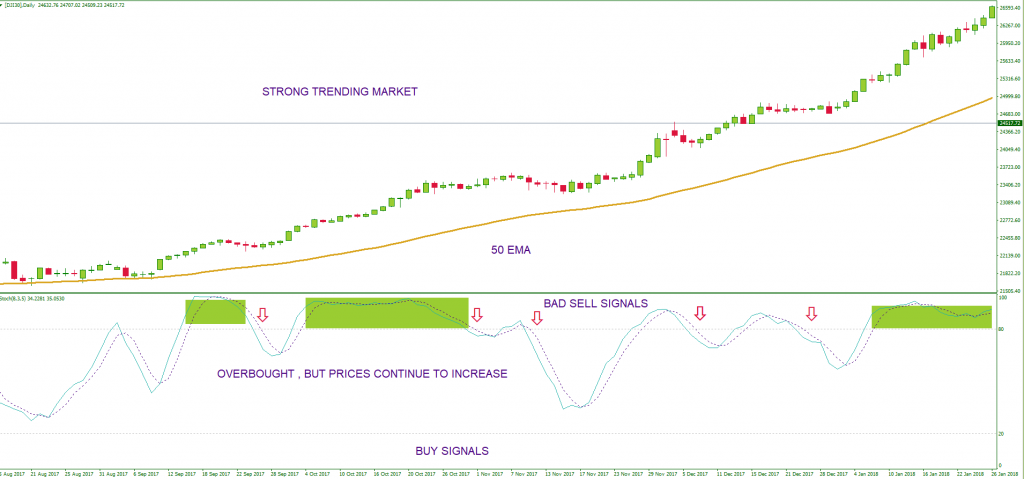

This strategy works only during non-trending conditions and will fail during strong trending phases.

We can observe in the chart above that during a non-trending market – indicated by the slope of the 50-period exponential moving average, the Stochastic generates some pretty good signals.

Stochastic’s settings used in the previous chart were 8(%K period) – 3 (%D period) -5 (Slowing).

In a trending market – confirmed by the positive slope of the 50-period exponential moving average, the Stochastic oscillator generated a lot of false sell signals. And the price never came back to an oversold area during that period, so buying opportunities based on this strategy were non-existent.

That’s why Jake Bernstein offered an alternative method to the interpretation of the stochastic indicator. He observed that when the price enters an overbought area during a strong trend, it can stay overbought for a long period, as we observe in the chart above. So, a smarter entry would be on the long side, against traders that consider the price to be overbought and incapable of going higher.

Stochastic Indicator Tips to Trade Crossovers

Another strategy used to generate signals is with the signal line, which is usually a moving average of the oscillator (crossover).

A long or short position occurs when the Stochastic crosses above or below (respectively) the signal line. This strategy should be used in combination with other indicators, because by itself will give a lot of false signals.

Keep in mind that Stochastic indicator crossovers are lagging and can produce numerous whipsaws.

My method for trading Stochastic’s crossover involves determining the trend with 2 exponential moving averages – 200 EMA and 50 EMA, and taking positions only in the direction of the prevailing trend on the market.

- if EMA 200 and EMA 50 slopes are positive, I take only long Stochastic crossovers

- if EMA 200 and EMA 50 slopes are negative, I take only short Stochastic crossovers

Stochastic Oscillator Guide To Divergences

A. How To Trade Classic Divergences With Stochastic Indicator

Maybe the most elegant approach is to look for price/oscillator divergences. A divergence occurs when price action differs from the action of the Stochastics indicator.

This means that the momentum isn’t reflected in the price, which could be an early indicator of a reversal.

A classic divergence occurs when prices form a lower low while the Stochastic forms a higher low (indicating a possible buy), or when prices form a higher high while the oscillator forms a lower high (indicating a possible sell).

When a divergence occurs, a potential change in price direction could be on the cards.

This is my favorite method to trade with Stochastics oscillator. I determine the main trend with a 200-period exponential moving average, and I only trade classic divergences in the direction of the main trend. I ignore the divergences that occur on the pullbacks or corrections of the main trend.

Also, I only trade on H1, H4 and D1 timeframes, in order to reduce market noise and filter the bad signals occurring on shorter time frames. This strategy is helpful for swing traders.

B. How To Trade Hidden Divergences With Stochastic Indicator

The Stochastic oscillator is an excellent tool for spotting hidden divergences. If you are a trend trader, hidden divergences should be one of your most important tools.

Hidden divergences signal momentum coming into the main trend, suggesting a possible continuation in the main direction of the trend.

For some reason, hidden divergences are harder to spot by many traders, despite the fact that represent a high probability pattern.

When trading hidden divergences with the Stochastics oscillator, we have to look for:

- higher lows of the price accompanied by lower Stochastic values during an uptrend

- lower highs of the price accompanied by higher Stochastic values during a downtrend

Let’s look at the Dow Jones index chart above. The price action indicated a downward momentum, with the price making lower highs.

However, despite the fact the price was making lower highs, the Stochastic oscillator recorded higher highs, thus forming a hidden divergence.

As you can see, 3 bearish hidden divergences occurred during this period, signaling that bears were in strong positions to enter the market.

The trick is to determine the main trend and only take positions in the direction of the trend.

So, don’t chase all the divergences that occur on the chart. Go for the ones with a higher probability: the ones in the direction of the main trend.

Trading Strategy | How to Use Stochastic Indicator for Trading Divergences

- Establish the main trend by adding a 200-period exponential moving average.

- When the price trades above the 200-period exponential moving average, you should take only long entries. When the price trades below the 200-period exponential moving average you should take only short entries.

- Plot the Stochastic indicator for spotting divergences, with the settings you feel most comfortable trading with

- Search for divergences between the indicator and the price ONLY in the direction of the main trend indicated by the 200-period exponential moving average

- If the price trades above the 200 EMA, search for divergences on the lower side of the Stochastic indicator and if the price trades below the 200 EMA, search for divergences on the upper side of the oscillator

Stochastic Oscillator Forex Trading Strategy | The 50-Line Crossover

Another way in which traders use the Stoch oscillator is to take signals when the indicator crosses the 50-level, especially on the Forex market.

- when Stochastic indicator crosses above the 50-level, this signals buying pressure

- when Stochastic indicator crosses below 50-level, this signals selling pressure

This method is not used often by traders. I say that this is an underrated method of trading with the Stochastic indicator.

The problem is that many traders see the Stoch indicator mainly as an overbought/oversold indicator. Instead of thinking in terms of buying pressure and selling pressure, their first thought is to seek for overbought and oversold areas.

A smarter way is to look for trend strength and continuation movements.

A 50-level crossover of the Stochastic indicator could be a solution, but only in combination with another indicator. By combining it with other tools, we will avoid getting whipsawed by the market. After all, Stochastic is a lagging oscillator.

If we are planning to use the Stochastic oscillator for crossovers above and below the 50-level, the standard settings won’t work in the long term. We will receive a lot of false signals.

That’s why we have to smooth the Stoch indicator by using other settings.

Please keep in mind that there aren’t universal settings that will work in every market. You have to backtest and analyze which Stochastic settings work better in the long term.

Let’s take a look at some charts.

We have the DAX30 Index on the H4 timeframe. We plotted the Stoch oscillator with 20.1.20 settings.

In order to determine the prevailing trend on the market, I’ve added a 200-period exponential moving average.

When the price trades above the 200 EMA, we take only long signals. When the price trades below the 200 EMA, we take only short signals.

If we analyze the signals received by using the 50-level crossover, we see that we would be in profit for the whole period.

This technique is perfect for swing trading, as it allows you to capture some big price movements.

When trading the Stochastic oscillator 50-level crossover we should always watch the slope of the moving average. Here is why you should pay attention to the 200-EMA.

Look at the chart above. When you see that the 200 EMA’s slope is flat, that’s a clear signal of market indecision.

Also, you should avoid taking signals when the price closes above and below the moving average during short periods of time. This also suggests that there isn’t a clear market direction.

We want to see the price stabilizing above or below the 200 EMA before taking trades with the Stochastic.

So, pay attention to 200 EMA slope and the price action in relation to it.

Stochastic Oscillator Pros And Cons

↑ works ideally in a sideways or trading range market condition

↑ identifies cycle turns

↑ good at identifying overbought and oversold areas on the chart

↑ good at identifying strong momentum, in conjunction with support and resistance levels

↓ fails during a trending market condition, giving a lot of false signals

↓ does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other tools

↓ the range of the oscillations are not proportionate to the price action

↓ lagging indicator and can produce numerous whipsaws if not used correctly