Table of Contents

What Is Relative Strength Index RSI

The Relative Strength Index (RSI), developed by Welles Wilder in 1978, is one of the most popular overbought/oversold (OB/OS) indicators. The Relative Strength Index is an internal strength index which is adjusted on a daily basis by the amount by which the market increased or fell.

- The RSI values range from 0 to 100.

- A high RSI occurs when the market has been increasing rapidly.

- A low RSI occurs when the market has been selling off sharply.

The Relative Strength Index is a powerful indicator and one of the most reliable oscillators when used correctly.

Relative Strength Index Best Settings

Since the RSI is one of the most popular indicators, traders always tweak their RSI settings, depending on their favorite timeframe or trading style. RSI indicator is excellent at generating buy and sell signals.

Most of them use the standard settings, RSI set on a 14 period. RSI of 5, 7 and 50 period are also popular among traders.

- A shorter RSI period – below 10- with be very volatile and will generate a lot of false signals

- A longer RSI period – above 20- smooths out the plotted line and will generate fewer, but more accurate signals.

In what concerns the overbought and oversold levels, most traders use the standard levels, 70/30 lines. Some traders prefer to use the 80/20 lines to determine when the market is overbought and oversold, in order to filter market noise.

How To Read The RSI Indicator

In short time frames, the Relative Strength Index is very volatile, frequently reaching extreme highs and lows, and generating contradicting signals. In flat markets, the Relative Strength Index will generate signals while prices trade in a range, with no clear direction. Used in a wrong way, RSI is useless for many traders.

Don’t let the 70/30 RSI levels fool you into entering countertrend positions. The RSI is indeed useful for gaining an overview of the overbought/oversold conditions of the market but it should not be used as a trading signal without a confirmation.

Another great use of the Relative Strength Index is to watch for divergences between the RSI and the price of the security/stock. For example, when prices rallied to a new high but the RSI cannot increase to a new high, then we have a divergence. However, Price/RSI divergence is not an exceptional signal. It occurs frequently, as it is inevitable and is useful only when used in conjunction with other indicators.

How To Trade With RSI | Signals and Trading Strategies

RSI FX Overbought/Oversold Divergence Trading Strategy

The general belief is that if a market reaches overbought levels (too many buyers on the market), then prices should go lower. Also, if a market reaches oversold levels (too many sellers on the market), prices should increase.

It is important to remember that simply because a market reaches overbought or oversold levels, does not mean that market prices will immediately reverse in the opposite direction. During periods of strong upward trends of downward trends, markets can remain in the overbought or oversold areas for days, weeks or even months.

A lot of traders use RSI the classic way aka the wrong way. When the RSI hits or exceeds values of 70 or 30, signaling overbought and oversold, they enter counter trend positions. That’s a wrong approach to what concerns the RSI. Sometimes the prices can stay a long time in the overbought or oversold areas and during that time they can continue to go higher or lower.

The divergences between the price and the RSI are also traded in a wrong way by many traders. Just because an RSI divergence appears on the charts, that doesn’t mean that you should automatically enter a reverse position.

I prefer to filter a lot of market noise and invalid signals, by combining these 2 approaches to trade the Relative Strength Index, and merge them into one signal. I also prefer to further filter the signal with another technique, a trend line breakout, for a conservative entry.

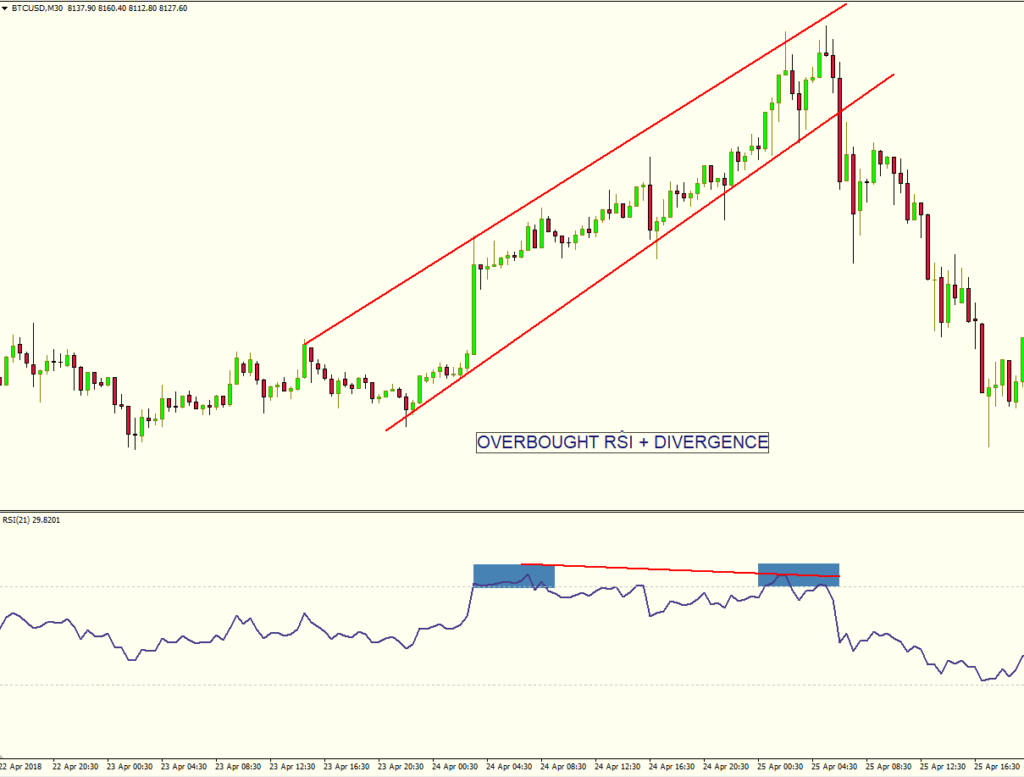

We can observe on the Bitcoin chart above a valid entry in a short position. The Bitcoin was clearly overbought, with the RSI reaching the 70 level two times during the upward movement. The price on the chart made a higher high but was not confirmed by the RSI, which made a lower high, indicating a divergence.

If you adopt a conservative trading style, a smarter approach would be to wait for a confirmation from the price. Despite the fact that I spotted a divergence on the chart and the RSI was clearly overbought, I filtered these signals with a trend line breakout. The price closing below the lower trend line of the channel confirmed the valid signal and the downward momentum.

Short positions were safe only after the price closed below the trend line – previous support became resistance.

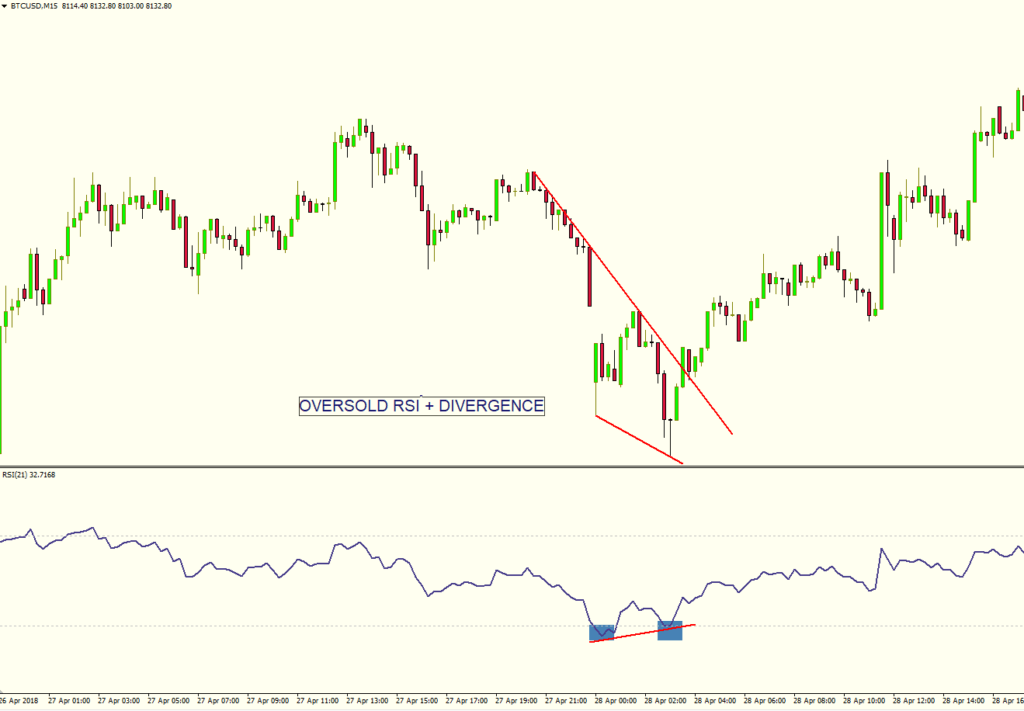

The same scenario took place on the second Bitcoin chart. This time we have an RSI trade divergence and an oversold area. Combined with the break to the upside of the trendline, we have a valid entry to the upside.

RSI – Moving Average Crossover Trading System

Another preferred strategy used by traders is to take signals on RSI around the 50 level. This leads some people to think when the RSI crossovers the 50 level to the upside that the trend up, and when the RSI drops below the 50 level, the trend is down. This is a wrong way to interpret the RSI. The RSI around the 50-level just evidences the indecision in the market. This will often correspond with price action in a trading range.

I prefer to ignore the 50 level and add a long-term moving average on the RSI, in order to filter the bad signals. I will also confirm the signal with the same technique used in the previous strategy, a trend line breakout.

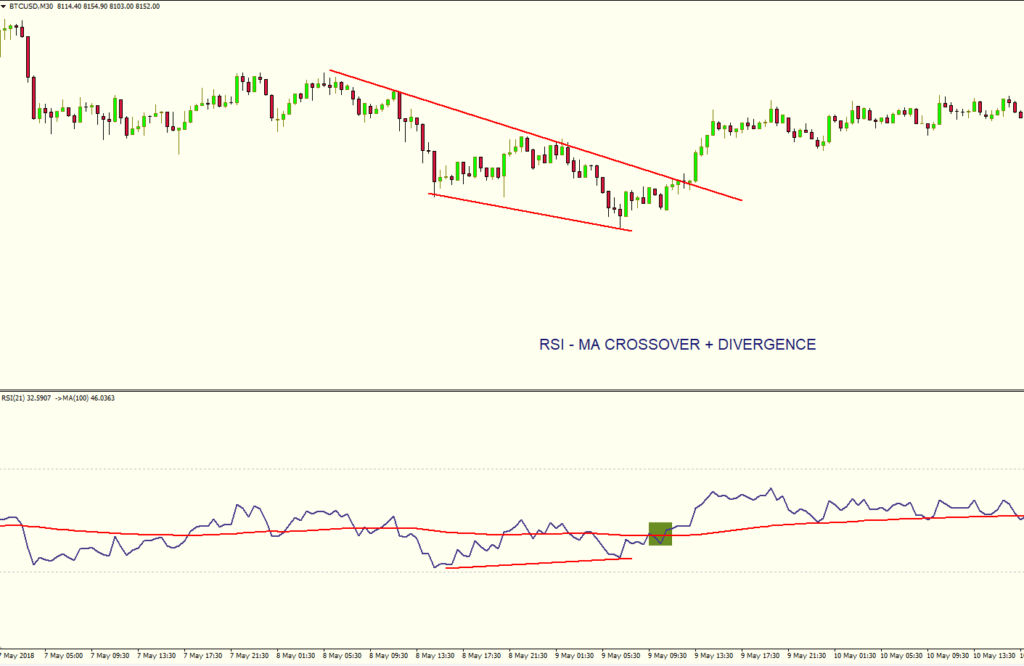

Again on the Bitcoin chart, we spot an RSI-MA crossover, confirmed by the break of the trend line to the upside, plus an RSI divergence. This is one of the strongest indications that the market momentum will move to the upside.

It’s important to check all 3 signals before entering a trade :

- a divergence between RSI and price

- MA-RSI crossover

- trend line breakout

By trading this way, you’ll have market momentum on your side and you’ll avoid getting whipsawed by the market.

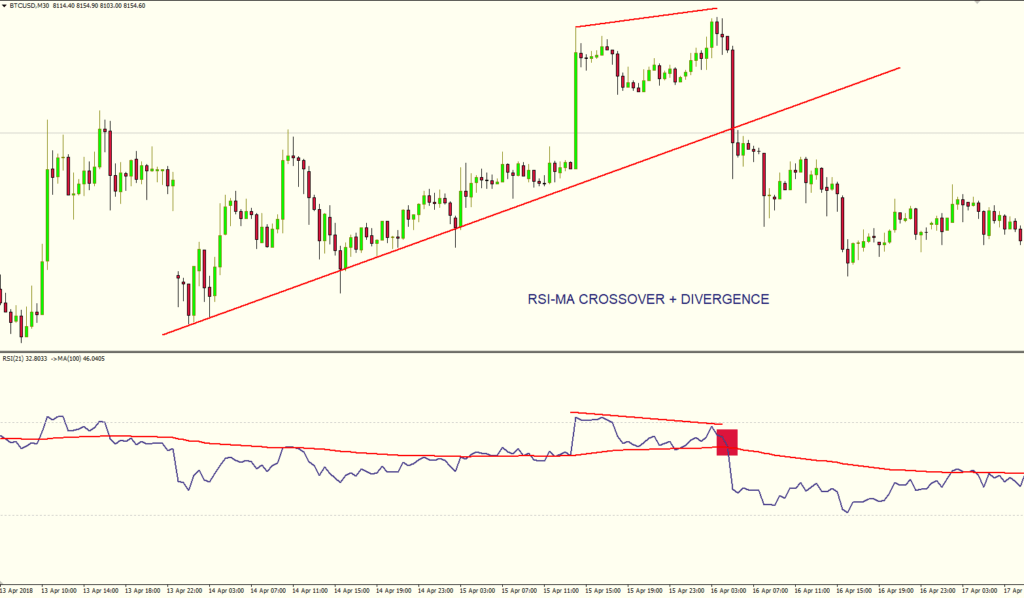

As we can observe in the previous Bitcoin chart, we have another great signal, RSI-MA crossover in conjunction with an RSI trade divergence. We confirmed the signal when the price closed below the trendline.

Best Relative Strength Index Trading Strategy: How to Use RSI for Scalping

Scalping is one of the most used trading methods. This trading technique is used by both experienced traders and market beginners. The main aim of scalping is to obtain small incremental gains that add up to a large profit, rather than big gains from a small number of trades.

Scalping involves holding positions for just a few seconds or minutes, at the most.

The Relative Strength Index (RSI) is a helpful indicator for taking small portions of profit from the market.

However, a good scalping trading technique which includes the Relative Strength Index (RSI) must use other indicators to determine the main trend.

For this setup, I use the Ichimoku indicator. We will only need the Kumo cloud, so we’ll plot only this indicator.

Ichimoku is one of the technical indicators that predict price movement and not only measures it. The advantage of the indicator is the fact that offers a unique perspective of support and resistance, representing these levels based on price action.

In order to smooth the signals offered by the Relative Strength Index indicator, I prefer to add a moving average to the indicator.

By adding a moving average on the Relative Strength Index chart window, I seek to take quality crossover signals.

Here are the main guidelines of this Relative Strength Index trading strategy that you should follow:

- Being a scalping system, we will only follow the 1-min chart

- We will trade only low spread instruments ( EUR/USD, Dow Jones Index or DAX30 Index for example)

- Plot the RSI calculated for the last 100 periods – we want to eliminate market noise as much as possible

- Add a 200-period exponential moving average to the RSI – a longer-term moving average added on RSI will work better than a short-term moving average. The 200 EMA will produce fewer whipsaws.

- We search for RSI to cross above the 200 EMA, when the price is trading above the Kumo cloud for a long entry

- We search for RSI to cross below the 200 EMA, when the price is trading below the Kumo cloud for a short entry

- Ideally, we want a buy crossover above the RSI 50 level and a sell crossover below the RSI 50 level.

- Stop loss placement is above or below the Kumo cloud. We exit when an opposite crossover occurs.

Now let’s analyze some charts.

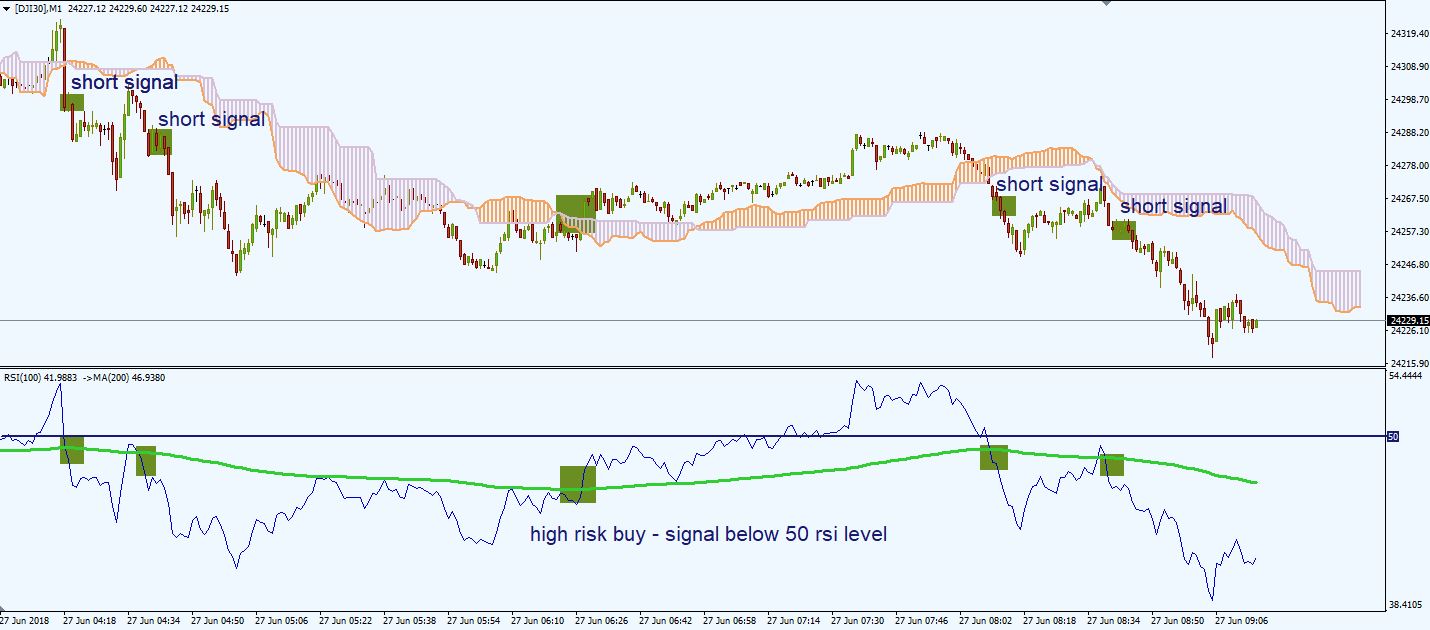

Above we have a Dow Jones Index 1-min chart. We added all the indicators we started looking for signals, in the direction of the Kumo cloud.

The first 2 signals were 2 short entries. As you can see the crossover between the RSI and the 200 EMA occurred below the 50 level. Those are the signals we are looking for.

The third signal was a buy signal. However, despite the fact the price closed above the Kumo cloud, the RSI – 200 EMA crossover happened below 50 level. I never take this kind of trades.

The last 2 signals were 2 valid short entries. The RSI – 200 EMA crossover occurred below the 50 level, the price was traded below the Kumo cloud, so we were good to go.

Remember that this is a scalping system, so you have to get in and get out of the market quickly.

After the market goes in my favor, I always move my stop loss to break even. You will be stopped out at breakeven often. It will be frustrating, I know, but you will protect your capital.

Here is when you should avoid trading this setup.

When you see the Kumo cloud changing its color often in a short period of time, this means that the market is undecided. So you should avoid taking signals.

Also, when you see the RSI trading above and below the 50 level, crossing it many times, this also translates into a market range.

We want the RSI to be above or below the 50 level, without breaching it. We also want the price to be stabilized below or above the Kumo cloud.

When these 2 conditions are not met, you should not take signals.

RSI Forex Trading Strategy: How to Use RSI for Day Trading

Scalping may seem easy, but the reality is that it’s an advanced trading style. If you prefer day trading, the Relative Strength Index can also help you take better trades.

When I trade with RSI I mainly look at divergences. Divergences are leading patterns and are high probability setups when traded correctly.

That’s why, when day trading, you should search for divergences as it can improve your trading style.

Here is how I use the RSI for day trading. For this setup, I added the Bollinger Bands with a 50-period moving average and standard deviation of 3. Almost 99% of the price action is contained within the standard deviation of 3 of the Bollinger Bands.

Now, I don’t know about you, but I prefer to trade with the odds in my favor. So, if a standard deviation of 3.0 will offer me around 99% certainty that the price won’t exit the Bollinger Bands, then I will be interested to trade only with these settings.

Here are the main guidelines of this setup:

- We will use this setup on the 15-min or 30-min charts

- Plot the Bollinger bands with a 50-period moving average and a standard deviation of 3

- Search for periods when the price is trading near the upper or lower Bollinger Band

- Plot the RSI indicator and start looking for divergences on FX Market.

- We are not interested in taking signals when the RSI is overbought or oversold. We time our entries based on divergences. If there are no divergences, we don’t trade.

- We enter the market once a divergence occurs near the upper or lower Bollinger Band

- The stop-loss order is placed outside the Bollinger bands

- The first take profit target will be the middle Bollinger Band. At this time, we move our stop loss to break even and let the trade go to its full potential.

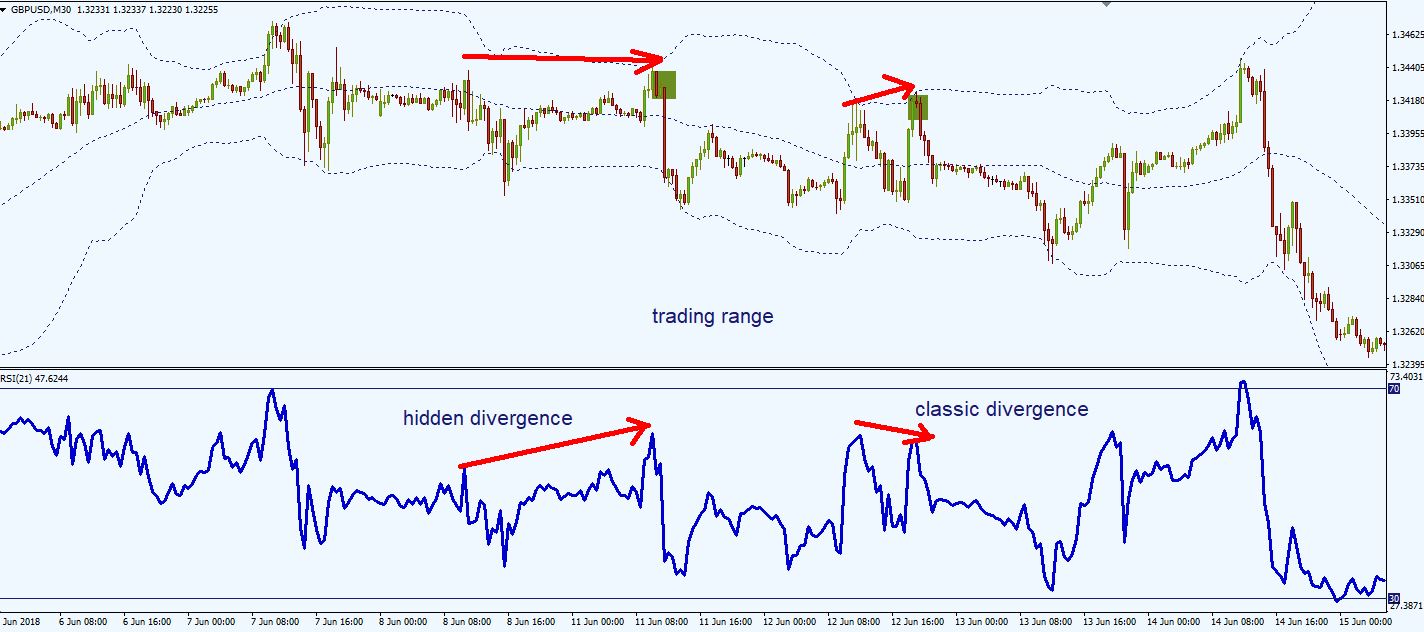

Let’s see this system in action. We have the GBP/USD 30-min chart, with the indicators plotted on it.

As you can see, this setup generated a high probability trade once the price touched the lower Bollinger Band. The RSI divergence was the catalyst for the price to change its direction. This was a stress-free trade, as the price reached our first target (the middle band) quickly.

Let’s look at another setup. This time, let’s see how this setup works during a trading range.

As you can see, the price is trading sideways, with no clear direction.

However, despite that, this setup offered 2 high probability trades. The first signal was a hidden divergence near the upper Bollinger Band. When the Bollinger Bands are narrow as in this example, you should aim for the lower Bollinger Band, and not the middle one.

The second entry was a classic divergence, also around the upper Bollinger Band.

The main advantage of this setup is that we don’t chase the trades. We don’t aim for the RSI to be oversold or overbought. From start, we eliminate a lot of false signals.

Trading Strategy: How to Use RSI for Swing Trading/Position Trading

If you prefer to focus on the bigger picture of the market then the RSI is also useful for swing trading and position trading.

The main advantage of the following strategy is that we take positions only in the direction of the main trend. The strategy involves two basic steps:

- Determining the main trend before entering the trade

- Entering the market when the traded instrument shows a sign that its price will continue in the direction of the prevailing trend.

The main goal is to profit from swings in price movement over the course of several days or weeks.

For determining the main trend we will use the Keltner Channel indicator. Keltner Channel is a combination of an exponential moving average and the Average True Range indicator.

Identification of the market trend is one of the most important roles of the Keltner Channel. The indicator is used by most traders who want to trade in the direction of the prevailing trend on the market.

Here are the main guidelines that you should follow:

- We will use higher timeframes, H4 charts or Daily charts

- Plot the Keltner Channel with a 200-period exponential moving average and an ATR multiple of 1 – we use a longer period in order to filter market noise.

- Add the RSI indicator calculated for the last 50 periods – again, this higher value is to protect ourselves from getting false signals

- We analyze the slope of the Keltner Channel: upward slope for possible long entries and downward slope for possible short positions

- We search for buy entries once the RSI closes above the 50-level and the Keltner Channel’s slope is upward

- We search for short entries once the RSI closes below the 50-level and the Keltner Channel’s slope is downward

- We place our stop-loss order below the Keltner Channel when we enter long, and above the Keltner Channel when we short the market

- Ideally, we want to ride the trend as much as possible, so we should use a trailing stop

Let see some charts.

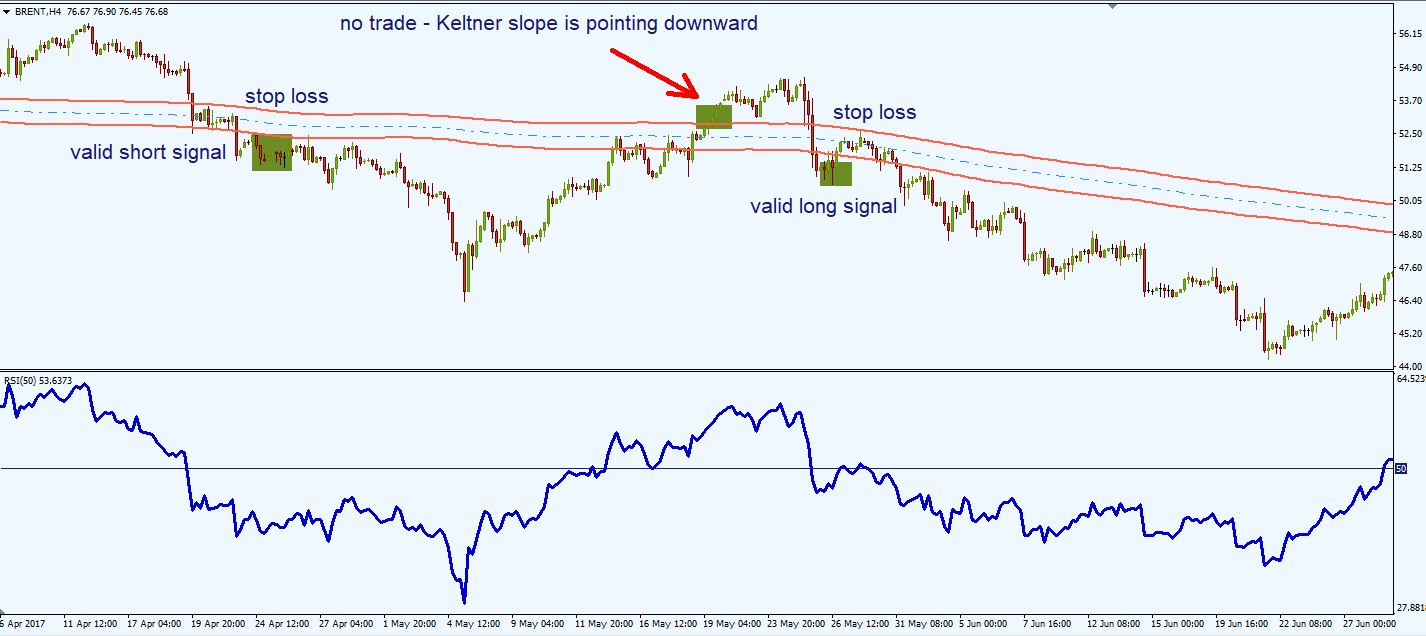

Let’s look at Brent Crude Oil H4-chart. We added the RSI and the Keltner Channel and we start looking for some signals.

The first signal was a buy entry, once the price closed above the Keltner Channel and the RSI was over 50. Despite the fact the market moved in our favor, we ignored the first signal because the slope of the channel wasn’t upward.

This rule is very important, as you will receive many false signals. In the long term, it’s better to follow the slope of the Keltner Channel.

We entered a long position, once the slope of the Keltner Channel turned positive and the RSI crossed back above 50 level.

The stop-loss was placed below the Keltner Channel.

Here’s another chart. In this example, the system generated 3 signals. The first one was a valid short position, as the RSI was well below the 50 level and the price was traded below the Keltner Channel.

The second one was a buy signal, which we ignored, as the slope of the Keltner Channel was negative.

The third signal was a sell entry. This signal gave us some hard times, as the price retraced inside the channel. But, we had our stop-loss order placed on the other side of the Keltner Channel and we got lucky as the price eventually moved in our favor.

Note: even if the price would have hit our stop loss level, we still had the chance to re-enter the market once the RSI fell below 50 level.

This system is suited for trading stocks. If you are a position trader and have the discipline and patience to ride a trend, you might catch something like this:

Just look at the Amazon stock on the daily chart. Once the price closed above the Keltner Channel and the RSI was over 50 level, a megatrend started developing.

With an adequate trailing stop and armed with discipline and patience, you can hit a “home-run” with this setup.

Relative Strength Index Pros And Cons

- ↑ good during a trending market condition, combined with moving averages

- ↑ excellent at identifying divergences on the chart

- ↑ useful at identifying overbought and oversold areas on the chart

- ↓ lagging indicator and can produce numerous whipsaws if not used correctly

- ↓ does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other tools