Table of Contents

What Is CCI

The Commodity Channel Index (CCI), developed by Donald Lambert, is an oscillator used in technical analysis in order to measure the variation of a security’s price from its statistical mean.

- High values indicate that prices are unusually high compared to average prices.

- Low values of CCI indicate that prices are unusually low.

The CCI technical indicator must be used in combination with other oscillators in order to offer traders reasonable signals to estimate changes in the direction of price movement of the security/stock.

How To Read Commodity Channel Index CCI

There are two main methods used by traders to interpret the Commodity Channel Index: looking for divergences and as an overbought/oversold indicator. A divergence occurs when the trading instrument’s price is making new highs while the CCI is failing to reach its previous highs.

The Commodity Channel Index typically oscillates between – 100 and + 100. When used as an overbought/oversold indicator:

- values above +100 imply an overbought condition.

- values below -100 imply an oversold condition

As in the case of the Relative Strength Index, the Commodity Channel Index is quite volatile, and frequently reaches highs and lows, while generating contradicting signals. Used in a wrong way, CCI is useless for many traders. Although CCI is indeed useful for gaining an overview of the overbought/oversold conditions of the market, the oscillator should not be used as a trading signal without a confirmation.

Commodity Channel Index CCI Best Settings And Values

Since the CCI is one of the most popular indicators, traders always tweak their CCI settings, depending on their favorite time frame or trading style. Most of them use the standard settings, CCI set on a 21 period. CCI of 14-period and 50-period are also popular among traders.

- A shorter CCI period – below 14 – with be very volatile and will generate a lot of false signals

- A longer CCI period – above 50 – smooths out the plotted line and will generate fewer, but more accurate signals.

In what concerns the overbought and oversold levels, most traders use the standard levels 100/-100 lines. Some traders prefer to use the 200/-200 lines to determine when the market is overbought and oversold, in order to filter market noise.

How To Trade CCI Indicator – Signals and Trading Strategies

Commodity Channel Index CCI Overbought/Oversold Divergence Trading Strategy

The general belief is that if a market reaches overbought levels (too many buyers on the market), then prices should go lower. Also, if a market reaches oversold levels (too many sellers on the market), prices should increase.

It is important to remember that simply because a market reaches overbought or oversold levels, does not mean that market prices will immediately reverse in the opposite direction. During periods of strong upward trends of downward trends, markets can remain in the overbought or oversold areas for days, weeks or even months.

That’s why Commodity Channel Index is used by many traders in a wrong way. When the CCI technical indicator hits or exceeds values above -100 or 100, many traders interpret this as a signal to enter counter trend positions, in response to overbought and oversold conditions on the market.

Sometimes the prices can stay a long time in the overbought or oversold areas and during that time they can continue to go higher or lower. Just look at the EUR/USD chart below. Despite the fact that the CCI index was clearly oversold, reaching even -200 level, the price continued to plunge. CCI is not a reliable indicator for taking overbought/oversold signals by itself.

Other traders search for CCI divergences on the charts and automatically interpret this as a valid signal to enter the market. Just because a CCI divergence occurs on the charts, that doesn’t mean that you should automatically enter a reverse position. Let’s take a look at the following chart to understand this concept better.

As you can see, during a strong bullish movement, the CCI index offered many divergences, and all of them FAILED.

A better strategy is to filter the market noise and invalid signals, by merging these 2 approaches to trade the Commodity Channel Index and combine them into one signal. I prefer to further filter the signal with other simple technique, for a conservative entry: a trend line breakout.

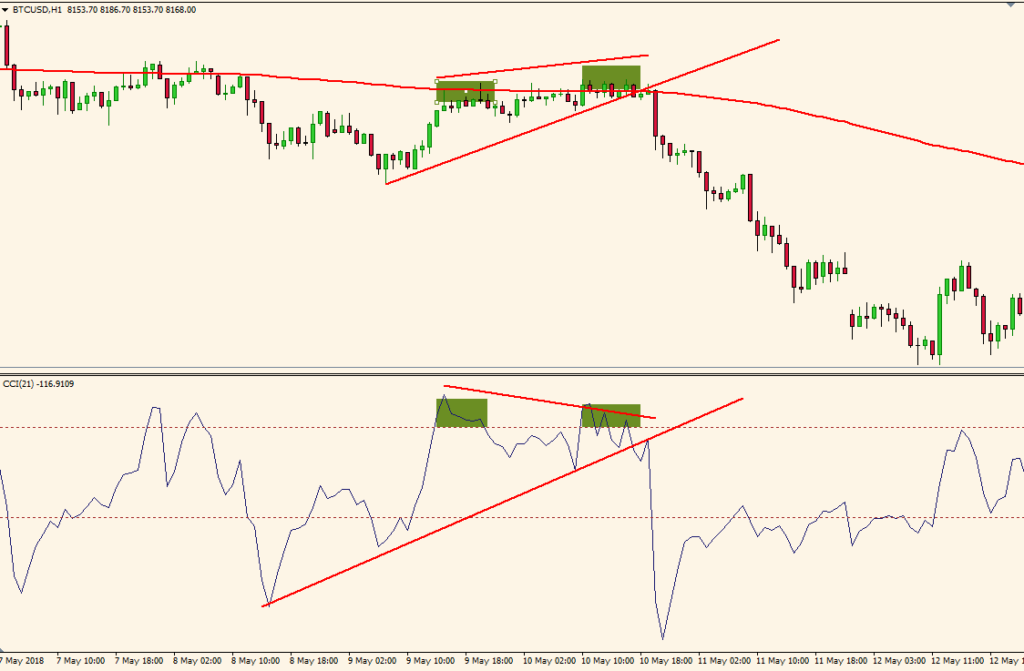

Let’s analyze the Bitcoin CCI chart above.

- The CCI reads that Bitcoin is clearly overbought (step 1).

- The price made a higher high but was not confirmed by the CCI, which made a lower high, indicating a divergence (step 2).

- In addition, the price is trading below EMA 200 (another great trend indicator).

- We enter a short position only after the price closes below the trend line.

- The trendline break is a smart way to filter false signals, as it will bring more downward momentum once breached.

If you adopt a conservative trading style, a smarter method would be to wait for a confirmation from the price. Despite the fact that we spotted a divergence on the chart and the CCI was clearly overbought, we filtered these signals with a trend line breakout. The price closing below the lower trend line of the channel confirmed the valid signal and the downward momentum.

Let’s look at another Bitcon chart. We observe that the price is trading around the EMA 200, and the CCI indicates oversold signals. A bullish CCI divergence is also on the table, with the price making lower lows, while the CCI indicating higher lows. We enter a long position only after price closes above the trend line.

This strategy will filter a lot of market noise. In combination with a basic analysis of support and resistance, CCI is reliable not only in trending markets but also during ranges.

CCI Indicator – Moving Average Crossover Trading Strategy

Another common strategy used by traders is to take signals on CCI technical indicator around the 0-level. This leads some people to think when the CCI crosses the 0-level to the upside that the trend up, and when the CCI drops below the 0 level, the trend is down. This is an incorrect way to interpret the CCI. The CCI around the 0-level just evidences the indecision in the market. This will often correspond with many whipsaws and price action in a trading range.

I prefer to ignore the 0 level and add a long-term moving average on the chart, in order to filter the bad signals. As in the previous strategy, I will confirm the signal with a break of a trend line.

For this setup, I plotted the CCI on the chart, but not with the default settings of 21. I used a 50-period CCI for a smoother line on the chart. I also applied a 200 simple moving average, not on the price, but on the commodity channel index. I chose the 200 period for the simple moving average because I’m interested in determining the medium term direction.

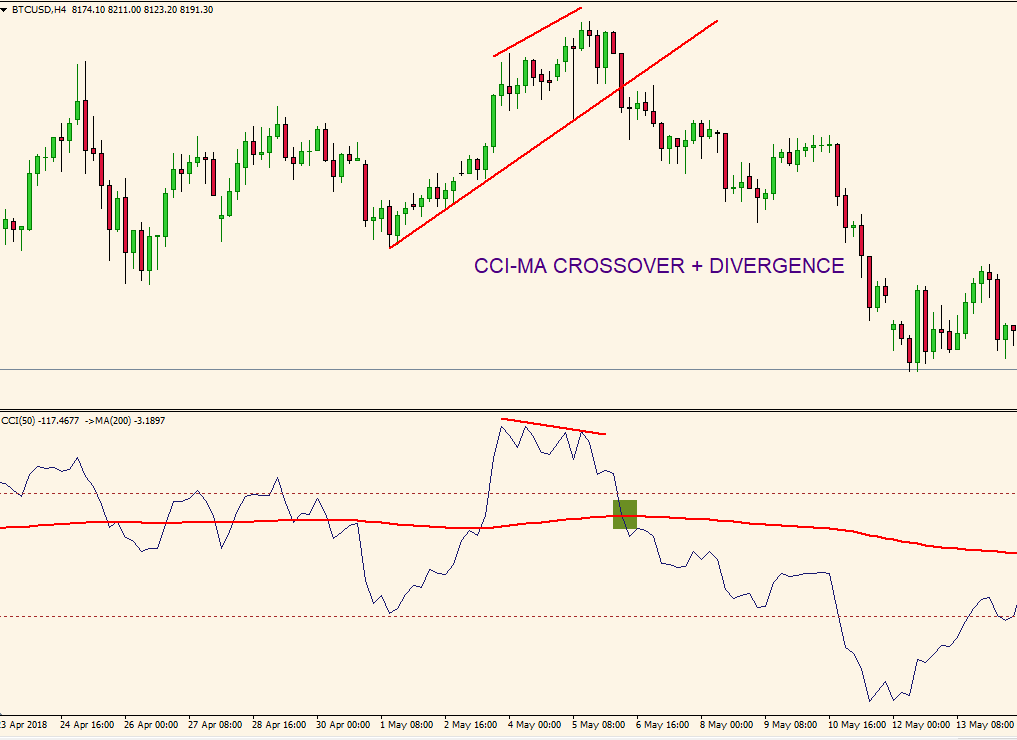

Let’s analyze another Bitcoin chart. We spot a CCI-MA crossover and also a bullish divergence on the CCI. We wait for the price to close above the upper trendline of the channel, and we’re safe to enter on the long side. Once the trendline is broken to the upside, the momentum will shift, as more bulls will enter the market.

Here’s another great example, on the H4 chart of Bitcoin. We have all the clues that the market will plunge, CCI divergence +overbought CCI + crossover of CCI with the MA. The trendline break is the confirmation we need, and we’re safe to ride the downward momentum.

It’s important to check all 3 signals before entering a trade :

- a divergence between CCI and the price

- MA-CCI crossover

- trend line breakout

By trading this way, you’ll have market momentum on your side and you’ll avoid getting whipsawed by the market.

CCI Trading Strategy: How to Use Commodity Channel Index for Scalping

Scalping is one of the most used trading methods. This trading technique is used by both experienced traders and market beginners. The main aim of scalping is to obtain small incremental gains that add up to a large profit, rather than big gains from a small number of trades.

Scalping involves holding positions for just a few seconds or minutes, at the most.

The Commodity Channel Index (CCI) is a helpful indicator for taking small portions of profit from the market.

I prefer to use the CCI index in combination with pivot points and look for breakouts in the direction of the main trend.

How do I determine the market breakouts? By drawing trend lines on the Commodity Channel Index.

The technique of drawing trend lines is subjective, is not a precise science.

This method is simple: you draw straight lines on the CCI indicator connecting support points for an uptrend or resistance points for a downtrend.

A valid trend line should connect two or more support CCI points that define the trend.

You also need to determine the main trend. I prefer to add pivot points on the chart. Pivot Points represent levels that are used by floor traders to determine directional movement and potential support/resistance levels.

Pivots Points are an accurate indicator, as the most market participants are watching and trading these key levels. Part of what makes the Pivots Points so reliable is the fact that they are based purely on price.

Let’s see the main rules of this setup:

- Being a scalping system, we will only follow the 1-min chart

- We will trade only low spread instruments ( EUR/USD, Dow Jones Index or DAX30 Index for example)

- Plot the Commodity Channel Index calculated for the last 100 periods – we want to eliminate market noise as much as possible

- Plot the daily pivots points and pay attention to the central pivot point and the S1 and R1 levels

- Determine the main direction of the day by comparing the central pivot point with the value of the previous day

- If the current pivot point is higher than the previous one, only consider taking long entries

- If the current pivot point is lower than the previous one, consider taking only short entries

- After you establish the direction, start looking for CCI trend line breakouts, in the direction of the main trend

- Trade breakouts around the central pivot point and S1/R1 levels. Signals occurring around S2/R2 or S3/R3 are ignored

- Stop-loss orders are placed above or below the pivot point the most recent pivot point.

- Aim for at least 1:1 risk/reward ratio. When the market moves in your favor, move your stop loss to break-even and let the trade run.

Enough with the theory and let’s see some charts. Above we have the Dow Jones Index on the 1-min chart.

We plotted the pivot points and the 100-period CCI.

We determined that the daily outlook was on the downside, as the current pivot point is lower than the previous day.

We started looking for breakouts on the CCI. This setup generated 2 valid signals. Ideally, we also want the CCI to close below the 0 level, for a safer entry point.

Here’s another chart, this time the EUR/USD 1-min chart. This time we have a long bias for the day, as the current pivot is higher than the previous one.

The setup generated 4 signals during the day. 3 of the trades were successful.

The first trade that we lost took place during Tokyo session. Although it was a valid signal, the market volatility was pretty low during that session. Maybe you should take signals occurring only during London and New York trading sessions.

The key is to enter near the pivot point. If the signal occurs in the middle area of the central pivot point and S1 or R1, I would avoid taking that trade.

Also, remember that this is a scalping system and you should always be prepared to exit the market quickly.

Trading Strategy: How to Use CCI Indicator for Day Trading

If you don’t enjoy scalping, then the Commodity Channel Index is also useful for day trading.

The main advantage of this day trading strategy is that we take positions only in the direction of the main trend. The strategy involves two basic steps:

- Determining the main trend before entering the trade

- Entering the market when the traded instrument shows a sign that its price will continue in the direction of the prevailing trend.

For determining the main trend we will use the Keltner Channel indicator. Keltner Channel is a combination of an exponential moving average and the Average True Range indicator.

Identification of the market trend is one of the most important roles of the Keltner Channel. The indicator is used by most traders who want to trade in the direction of the prevailing trend on the market.

In order to smooth the signals offered by the Commodity Channel Index indicator, I prefer to add a moving average to the indicator.

By adding a moving average on the Commodity Channel Index chart window, I seek to take quality crossover signals.

Here are the main guidelines that you should follow:

- We will use this setup on the 15-min or 30-min charts

- Plot the Keltner Channel with a 200-period exponential moving average and an ATR multiple of 1 – we use a longer period in order to filter market noise.

- Add the Commodity Channel Index indicator calculated for the last 100 periods – again, this higher value is to protect ourselves from getting false signals

- Add a 200-period exponential moving average to the CCI – a longer-term moving average added on CCI will work better than a short-term moving average. The 200 EMA will produce fewer whipsaws.

- We search for CCI to cross above the 200 EMA when the price is trading above the Keltner Channel for a long entry

- We search for CCI to cross below the 200 EMA when the price is trading below the Keltner Channel for a short entry

- Stop loss placement is above or below the Keltner Channel. We exit when an opposite crossover occurs

Let’s look at some charts to see this setup in action.

Above we have a SP500 index CCI chart. The Keltner Channel’s slope is pointing downwards, so we are looking to short the market.

We start looking at the CCI chart, to spot a crossover with the 200 EMA. The first signal occurred rapidly and it was a successful trade.

Now, regarding the profit taking levels and stop loss orders, there aren’t clear rules. These levels depend on the risk aversion on the trader. I prefer to add a trailing stop once the price moves in my favor.

Sure, I get stopped a lot at breakeven and it could be frustrating. But in the long term, this technique benefits me.

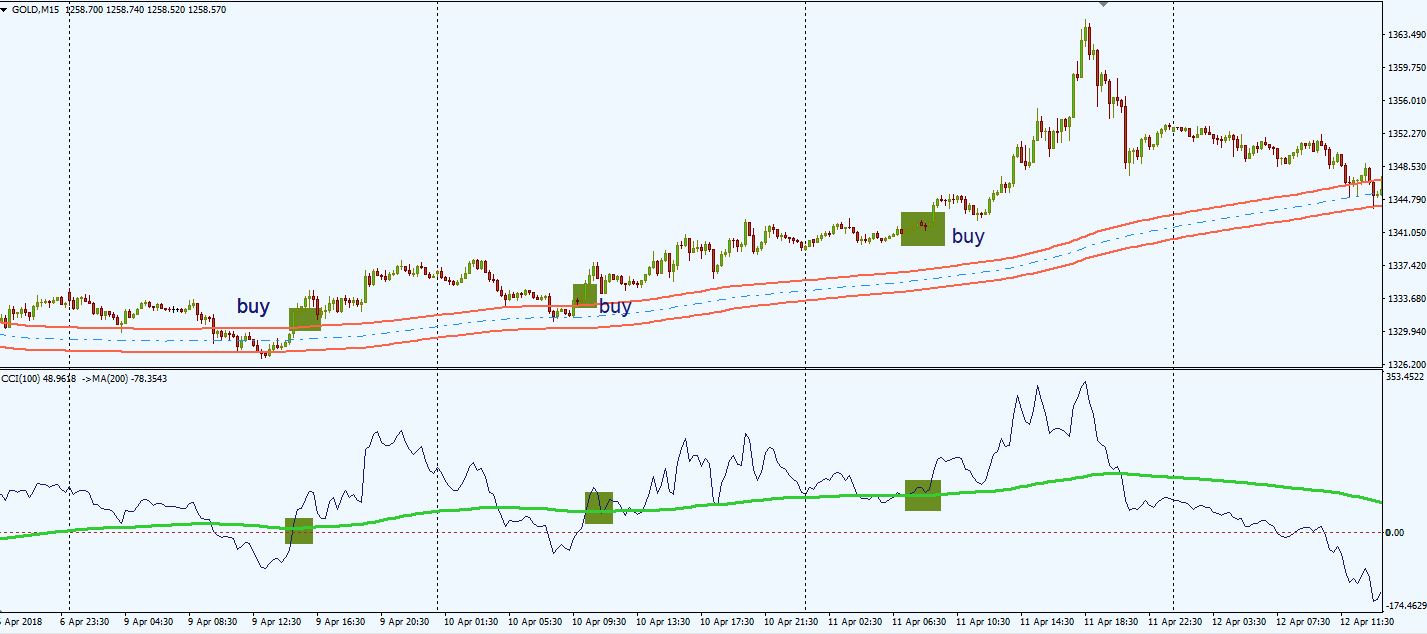

Here’s another example. This time we have the Gold chart, on the M15 timeframe.

We are in a long trend, determined by the upward slope of the Keltner Channel.

This setup generated 3 decent signals when the CCI 100 crossed the 200 EMA.

During trending conditions, this system will keep on the right side of the market.

You should note take trades if the crossover between the CCI 100 and 200 EMA occurs when the price is inside the Keltner Channel.

CCI Index Trading Strategy for Swing Trading/Position Trading

The Commodity Channel Index works excellent in swing trading and position trading strategies. If you are are not interested in analyzing lower time frames, then CCI formula can help you to see the bigger picture of the market.

The main goal is to profit from swings in price movement over the course of several days or weeks.

For this setup, we will use the CCI in combination with Chaikin Money Flow indicator.

Chaikin Money Flow is a technical indicator which determines if an instrument is under accumulation or distribution. This indicator measures buying and selling pressure over a set period of time.

We’ll use the Chaikin Money Flow in order to confirm the market trend, and also to see if the trend is strong or not.

In order to smooth the signals offered by the Chaikin Money Flow indicator, I will add an exponential moving average on the oscillator. By adding a moving average on the Chaikin Money Flow’s chart window, I plan to take crossover signals.

Now, if we want to trade a crossover between the Chaikin Money Flow oscillator and a moving average, we should be aware of an important thing. A crossover will catch good movements when markets are trending.

When markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades.

That’s when the CCI stock indicator intervenes. The CCI formula will confirm if we are trending or not.

Here are the main rules of this setup:

- We will use higher timeframes, H4 charts or Daily charts

- Add the Chaikin Money Flow indicator with a 50-period input. We want to smooth the indicator, so we used a higher input number

- Plot a 200-period exponential moving average on the Chaikin Money Flow. A longer-term moving average added on Chaikin Money Flow will work better than short-term moving average. A longer-term moving average will produce fewer whipsaws.

- Add the 50-period Commodity Channel Index (CCI 50), with the 0-level plotted

- Buy signals when the Chaikin Money Flow crosses above the 200-period exponential moving average, and the CCI is above its zero level

- Sell signals when the Chaikin Money Flow crosses below the 200-period exponential moving average, and the CCI is below its zero level

- Stop-loss orders are set below or above a relevant recent market swing

- Ideally, we want to ride the trend as much as possible, so we should use a trailing stop

Let’s analyze some charts.

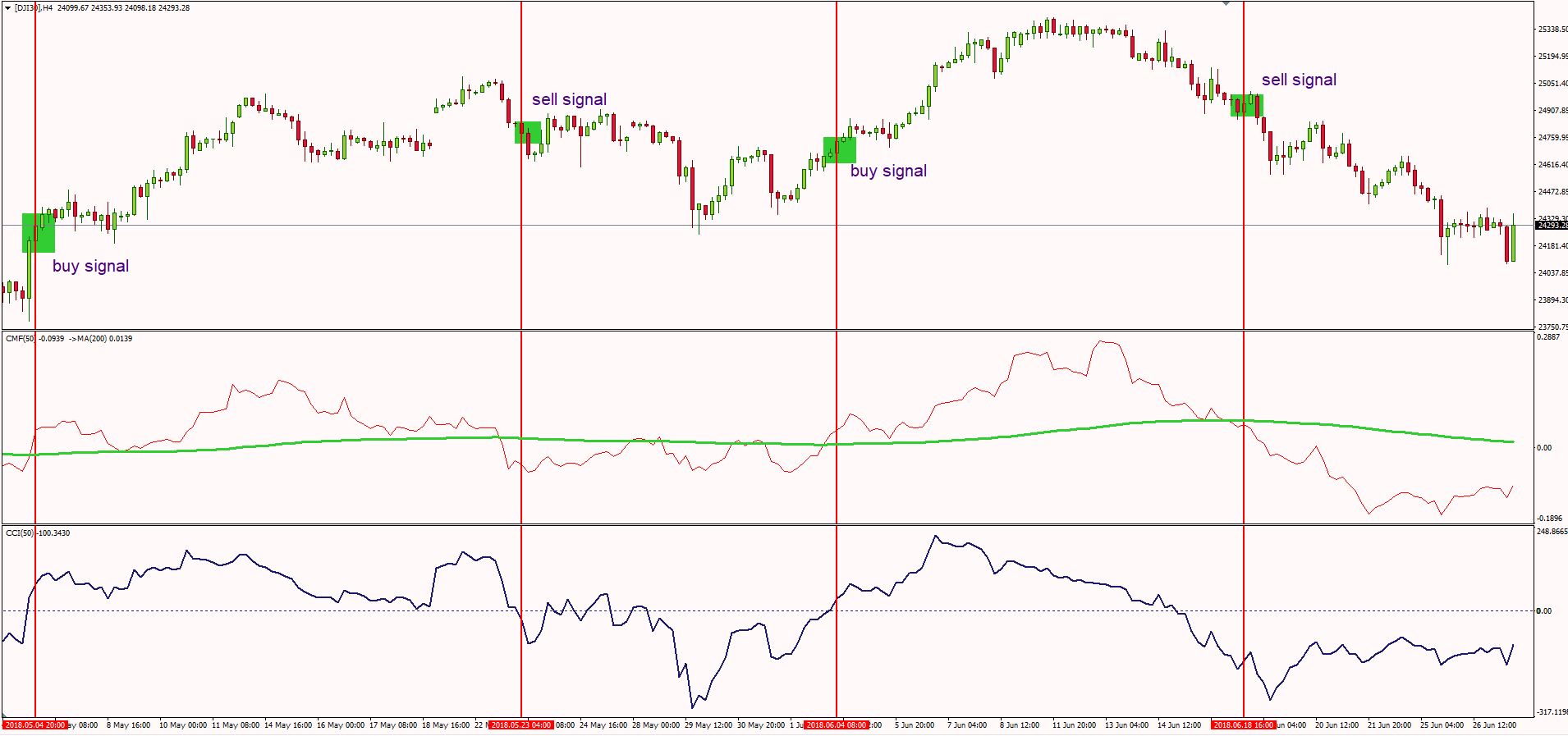

Above we have a Dow Jones Index H4 CCI chart. When we start looking for a trade, we first analyze the Commodity Channel Index. Below 0, we look for short positions. Above 0 we look to buy the market.

Once we determined the trend, we search for a crossover between the Chaikin Money Flow and 200 EMA, in order to confirm the trend.

If we analyze this example, this setup generated 4 valid setups. As you can see, all of them were successful, except for the second signal which was a break-even trade.

When you see the CCI stock indicator stagnating around the 0 level, it’s better to close the trade manually.

Let’s also analyze the Ethereum cryptocurrency daily chart.

During the last half of year, this setup generated 6 signals. 5 of the trades were successful.

As you can see, during this period, the market recorded an uptrend, a downtrend and also traded sideways. However, if we took all the signals, we would have profited from these movements.

The key ingredient of this setup is the patience. You have to wait for the setup to develop and you have to be disciplined to stay in the trade.

CCI Index – Pros And Cons

- ↑ good at identifying divergences on the chart

- ↑ excellent during a trending market condition, combined with moving averages

- ↑ useful at identifying overbought and oversold areas on the chart

- ↑ lagging indicator and can produce numerous whipsaws if used on lower timeframes

- ↑ does not contain all of the data necessary for a proper analysis of price action

- ↑ it should be used in combination with other tools

1 thought on “CCI Trading Strategy: Day Trading With Commodity Channel Index”

What pivot point indicator you use in the cci+pivot point strategy?

Can i have it, please?