Table of Contents

What Is Awesome Oscillator

The Awesome Oscillator (AO), developed by Bill Williams is a momentum indicator, representing a 34-bar simple moving average that is subtracted from a 5-bar simple moving average. Basically, the Awesome Oscillator measures the immediate momentum of the last 5 bars and compares it to the momentum in the last 34 bars. The Awesome Oscillator indicates if bulls or bears are in control of the market.

AO is a leading indicator because it tracks the momentum of the market.

How To Read Awesome Oscillator

The Awesome Oscillator compares the recent momentum with a momentum over a wider frame of reference. The indicator is plotted as a histogram and is used to confirm the trends and determine possible cycle turn points.

The Awesome Oscillator values fluctuate above and below the zero line.

• A green bar indicates that the bar is higher than the previous one

• A red bar indicates that the bar is lower than the previous one

Traders interpret the AO as follows:

• the oscillator above the zero line forming a peak signals a bullish trend

• the oscillator below the zero line forming a peak signals a bearish trend

• the oscillator crossing the zero line from down to up indicates a bullish momentum

• the oscillator crossing the zero line from up to down indicates a bearish momentum

How To Use Awesome Oscillator – Signals and Trading Strategies

1. Awesome Oscillator Zero-Line Crossover Trading Strategy

The zero line crossover is one of the most common strategies used by traders when using the Awesome Oscillator. The rules are simple:

• when the AO crosses above the zero line, short-term momentum is rising faster than the long-term momentum, indicating a buying pressure

• when the AO crosses below the zero line, short-term momentum is decreasing faster than the long-term momentum, indicating a selling pressure

I prefer to filter the zero line cross signal with an exponential moving average, for a better confirmation of the main market trend. As we can observe in the Bitcoin chart below on the H1 timeframe, this setup offered 2 valid signals when the AO crossed below the zero line.

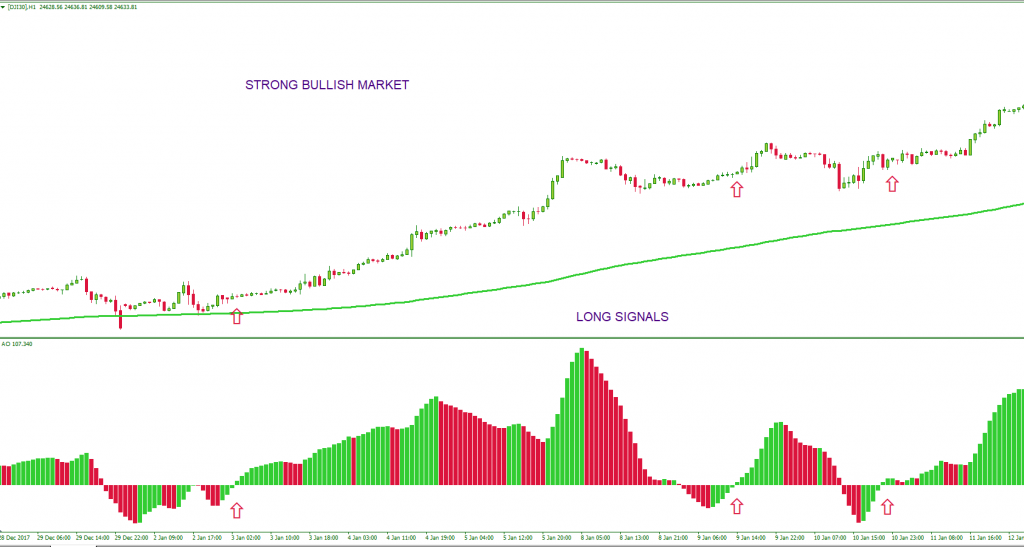

Let’s analyze another chart, this time the Dow Jones Index on 1-hour time frame.

As we can see, the Awesome Oscillator generated 3 solid buy signals. With a proper money management and a trailing stop, traders could capture some decent price movements by using this strategy. As most of the oscillators, the AO works even better when the market rallies.

The main selling point of this strategy is taking positions only in the direction of the trend. Being a swing trading strategy, this system involves two basic steps:

– Waiting for a pullback before entering the trade

– Entering the market when the traded instrument shows a sign that its price will continue in the direction of the prevailing trend.

2. Awesome Oscillator Twin Peaks Trading Strategy

For this setup to offer a valid signal, the market needs several conditions to be met:

• two consecutive peaks must be formed above the zero line for a sell entry, or below the zero line, for a buy entry

• the second peak must be lower than the first one and is followed by a red bar for a sell entry, or higher than the first peak and is followed by a green line, for a buy entry

• the body between the peaks stays above the zero line for a sell signal, and below the zero line for a buy signal

This setup resembles a lot with a divergence between the price and the Awesome Oscillator. In other words, when the price rallies to a new high but the Awesome Oscillator cannot increase to a new high, forming a lower peak then we have a divergence. We must keep in mind that, price/Awesome Oscillator divergence is not an exceptional signal. It occurs frequently, as it is inevitable and is useful only when used in conjunction with other indicators or price action techniques.

The setup is NOT suitable for trend following traders. This system tries to capture swings and is rather difficult to spot, as it can lead to many false signals. This strategy demands confirmation from other indicators.

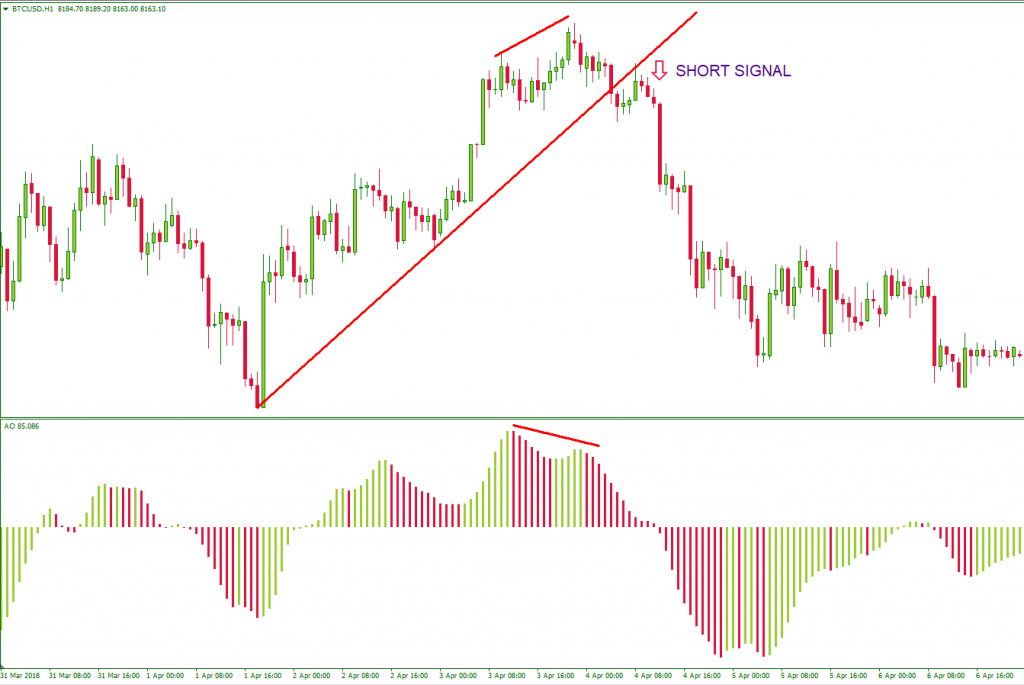

In the Bitcoin twin peaks chart above, all the conditions were met :

- The Awesome oscillator formed 2 peaks in a strong uptrend, with the second one being lower than the first one.

- The Awesome oscillator stayed above the zero line

- A red bar occurred on the AO, signaling a switch in momentum

A conservative entry was generated when the price breached the lower trend line of the uptrend and retested it. Thus the previous support became resistance and we were safe to enter the short side.

Let’s take another example.

On the Dow Jones Index H1 twin peaks chart, a valid configuration occurred during a strong downtrend. We filtered the signal with the same method used before: we waited for the price to close above the upper trend line of the downward channel. After the price retested the broken trend line, the former resistance became support and long positions were indicated after this confirmation.

You can see that by this time the Awesome Oscillator moved into positive territory, crossing the zero line, which is another confirmation that the market momentum switched to the upside.

3. Awesome Indicator Saucers Trading Strategy

This strategy tracks the short-term changes in the momentum and requires a pattern in three consecutive bars of the AO histogram:

• three bars must be on the positive side /negative side of the zero line

• a red bar, followed by a smaller red bar, followed by a green bar indicates a bullish saucer

• a green bar, followed by a smaller green bar, followed by a red bar indicates a bearish saucer

This strategy works well when we trade only in the direction of the main trend. Best way to do this is to add a 200-exponential moving average and take only buy signals if the price trades above the 200 EMA and only sell signals if the price trades below the 200 EMA.

Awesome Oscillator – Pros And Cons

• ↑ leading indicator because it tracks the momentum of the market.

• ↑ good at identifying divergences on the chart

• ↑ good during a trending market condition

• ↓ can produce numerous whipsaws if not used correctly

• ↓ does not contain all of the data necessary for proper analysis of price action, so it should be used in combination with other indicators