Table of Contents

What Is Renko Charting

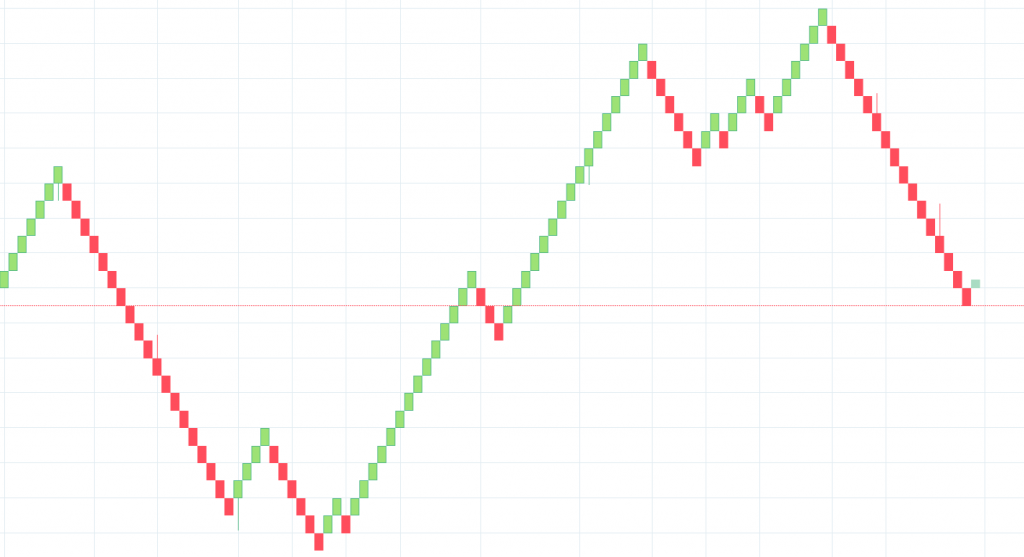

Renko trading is not as popular and not as well known as normal candlestick or bar chart. Renko chart, developed by the Japanese, is a graphical display that only involves the price movement, as the time and volume are not included. The construction of a Renko chart is simple: a brick (the “body” of a Renko bar) is formed in the next column once the price exceeds the top or bottom of the previous brick by a predefined amount.

The difference between common charts and Renko is noticeable. The conventional charts like candlestick charts or bar charts are plotting a new candlestick, bar based on time. The uniqueness of Renko charts is that this technique plots a brick only when the price moves a certain amount of pips /ticks in one direction or the other.

RENKO Chart Trading – Advantages Over Candlestick Charts And Bar Charts

• very effective for traders to identify key support/resistance levels

• offer a cleaner look of the market and indicate trends in a more clean way

• remove the “market noise” seen on typical candlestick charts or bar charts, including wicks, false breakouts and price volatility.

• more suitable for scalping and short-term trading

• allow traders to catch larger moves by filtering out minor price fluctuations

• better determination of stop losses and take profit targets

• minimize overtrading and increase patience

Renko Trading Strategy For Forex And Stock Market

1. How is a 100 Renko brick formed?

• a new green renko bar forms only after the current price exceeds the top of the previous Renko bar by 100 pips.

• the closing price of a green Renko bar is also the high for the green Renko bar.

• a new red Renko bar forms only after the current price surpasses the bottom of the previous Renko bar by 100 pips

• the closing price of a red Renko bar is also the low for the green Renko bar.

2. Indicators Needed For The Renko Trading System:

1. 100 Renko brick

2. 10 simple moving average – 10 SMA

Moving averages are used to calculate the average value of a security’s price over a determined period of time. Moving averages are extremely popular among trend following traders. The simple moving average (SMA) represents an average of the closing price of a security over a specified number of periods. The simple moving average is more stable and signals changes in price movements relatively slowly.

The On Balance Volume (OBV), developed by Joe Granville, is a momentum indicator that relates volume to price change. On Balance Volume indicator shows if market’s volume is flowing into or out of a security/stock. In other words, the OBV offers information regarding the strength of price movements.

– When the security/stock closes above the previous close, all of the day’s volume is considered up-volume.

– When the security/stock closes below than the previous close, all of the day’s volume is considered down-volume.

So, the OBV increases or decreases during each day in correlation on whether the price closes higher or lower compared to the close during the previous day.

The main assumption is that On Balance Volume movements precede price changes. As the volume is the main fuel behind the market, OBV is designed to anticipate when major moves in the markets would occur. It is believed that “smart money” can be seen accumulating into the security/stock by a rising OBV and when the public comes along into the security/stock, both the security and the OBV will increase. The numerical value of OBV is statistically irrelevant.

3. Renko Trading Strategy Rules:

• We use the 100 Renko brick to identify key support/resistance levels, to determine the market trends and to place our stop-loss and take-profit targets

• We use 10 simple moving average to determine the short-term trend

• On Balance Volume (OBV) to determine if market’s volume is flowing into or out of the traded instrument

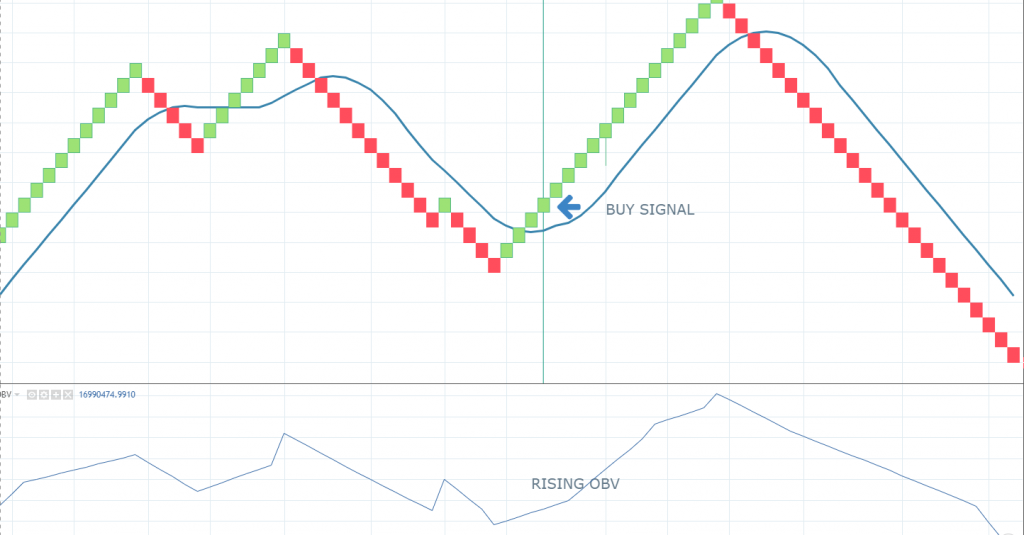

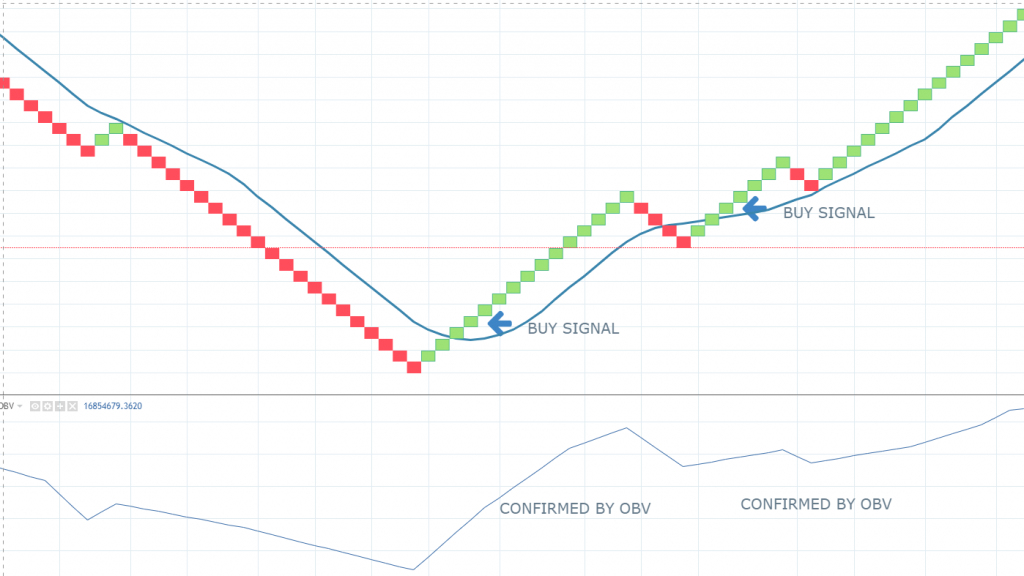

Setup for a Long (BUY) signal:

1. A new green renko bar forms above the SMA10

2. We only take trades in the direction of the SMA. When the Renko bars are traded above SMA10, we look for long entries

3. We filter the signal with the On Balance Volume. We look for a new high in the OBV, which indicates that buyers are stronger than sellers, and the price is likely to increase. When OBV increases in tandem with the price, the upward trend is confirmed.

4. Stop loss will be placed 2 Renko bars below the entry point.

5. We can exit the position manually if the price falls below the simple moving average.

6. Minimum take profit should be 4-5 Renko bars into the future, to cover the spread and commissions. When the price reach this target, we can move our stop loss to break even and let the trade ride, or we can use a trailing stop to capture a larger part of the move.

Chart no.1 – long signal

Chart no. 2 – long signal

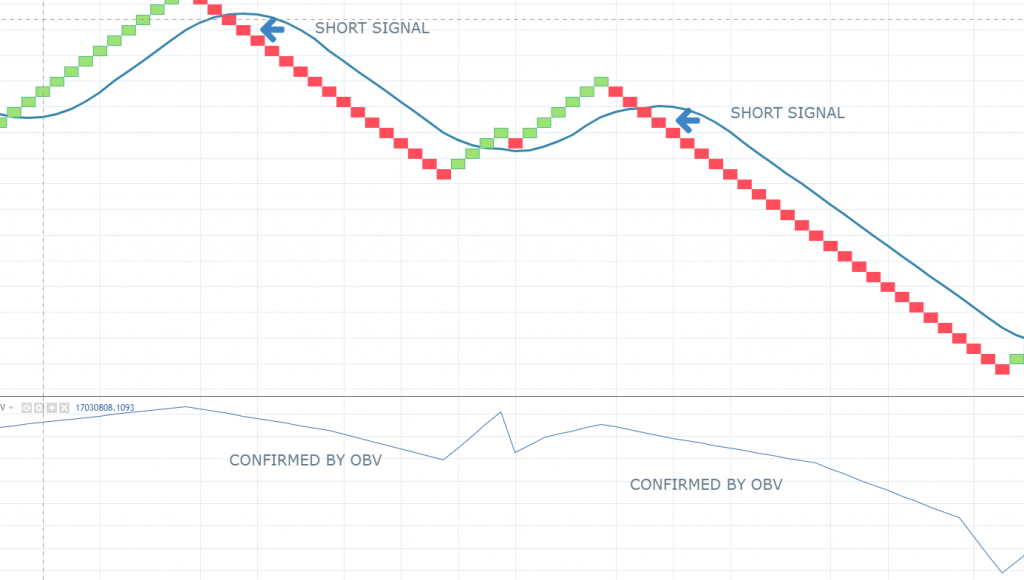

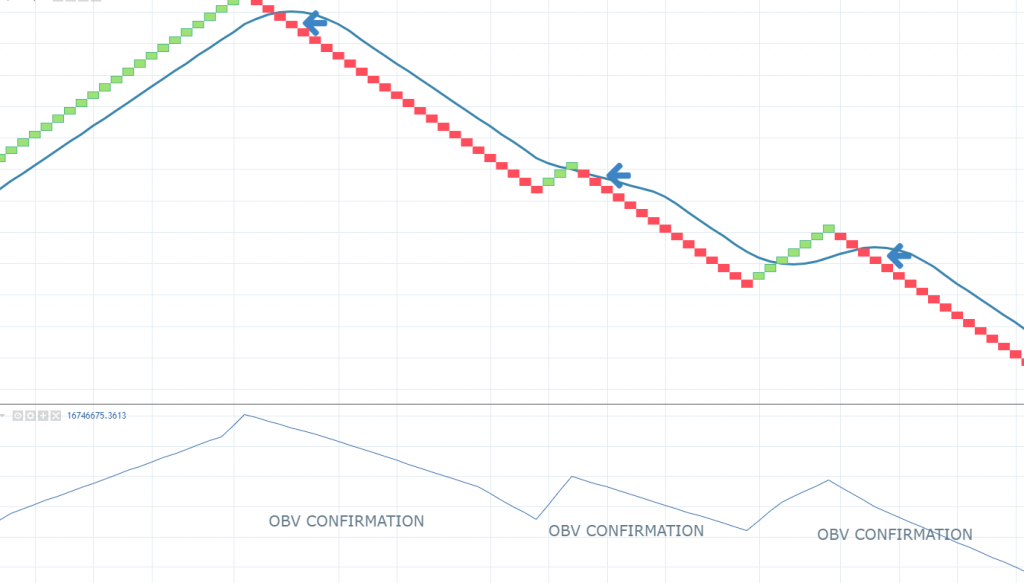

Setup for a SHORT (SELL) signal:

1. A new red Renko bar forms below the SMA10

2. We only take trades in the direction of the SMA. When the Renko bars are traded below SMA10, we look for short entries

3. We filter the signal with the On Balance Volume. We look for a new low in the OBV, which indicates that sellers are stronger than buyers, and the price is likely to decrease. When OBV decreases in tandem with the price, the downward trend is confirmed.

4. Stop loss will be placed 2 Renko bars above the entry point.

5. We can exit the position manually if the price increases above the simple moving average.

6. Minimum take profit should be 4-5 Renko bars into the future. When the price reach this target, we can move our stop loss to break even and let the trade ride, or we can use a trailing stop to capture a larger part of the move.

Chart no. 3 – short signal

Chart no. 4 – short signal

Renko charts are one of the most valuable instruments, which offer a great value to patient traders. This Renko trading strategy was designed for Forex and stock market, but you can also test it on Bitcoin cryptocurrency or other instruments. If you want to use it on other instruments, you must backtest the right brick size, study historical data and try different combinations.

10 thoughts on “Renko Trading Strategy: How To Trade Renko Charts”

In the Tradingview built-in indicator list there is no Renko chart available. In the public library there are 18 different offerings. Which of the public charts is the one to use?

Look under chart type… You see these option:

Line, Candle, Heikin-Ashi, RENKO, etc!!

Hi Installed Trading View charts I have found Ichimoku cloud indicators but unable to find Renko are they under something else

Are you using Renko in ATR or Traditional?

Hello,I have downloaded mt4 on the phone Android ,can’t see renko chart,but I can see ichimoku indicator,please redirect

Regards Jesse.

Renko is available for premium account & not free account, as for MT4 there no build-in renko charts .. u need to find Renko Indicator which is quite tricky for MT4. The best is to use renko is TradingView

Hi

In your chart no.1 buy signal, there is another green bar crossed above the 10SMA, is that a valid signal?

You filter the signal with the On Balance Volume. You look for a new high in the OBV.

The new high is from where to where?

hi sir

where to find renko chart indicator?

thanks a lot for clear explanation

learnt a lot with the explanation..Its working