Table of Contents

What Is A Carry Trade In Forex

Carry trade is an interesting long-term strategy that is based on the difference in interest rates around the world. It’s a strategy through which an investor sells a certain currency at a relatively low-interest rate and uses the funds to buy another currency that generates a higher interest rate. By executing a carry trade, the trader intends to generate profit from the difference in interest rates between two countries.

Let’s consider the next example – a trader borrows Japanese yen at a cost close to 0%, converts them into dollars and deposits them at a 2% interest rate. This generates a 2% profit each year, assuming the exchange rate remains unchanged. And what if you could do this with leverage? The return on your capital would be even greater!

It is worth mentioning the high degree of risk that accompanies this strategy. Using the example above, if the dollar falls significantly in relation to the yen, such a transaction may generate losses despite the positive difference in interest rates. That’s because you have to pay more for the yen before returning the money you have borrowed. Also, with leverage, a small movement can generate much greater losses.

On the other hand, it does not mean that such a strategy is meaningless. With an appropriate approach, you could benefit not only from the difference in interest rates but also from the change in the exchange rate.

Forex Carry Trade Strategy

The starting point for a carry trade strategy is the difference between the interest rates of two currencies. On the Forex market, this difference is hidden behind the term known as a swap.

The swap is an overnight interest, deriving from the fact that the interest rate of each currency is different:

- Since all currencies are traded in pairs, you always have to borrow a coin to buy another

- Also, you are going to pay interest on the loan, but you also get interest on the currency you own

- If the difference between what you pay and what you receive is positive, then you are eligible for a net positive swap

- If the difference is negative, which means you pay more than you get, then your account will be debited with that swap amount.

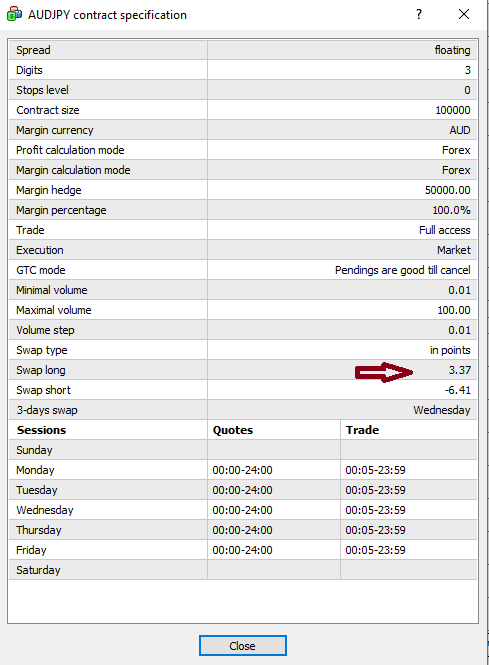

In AUD/JPY example above:

- a long position on AUDJPY will bring you about 3.37 points per day for each trading lot

- if you do not close the transaction for a year, you will get about 1200 points from the swap

- if the market moves against you, your profit or loss will be the difference between the swap gained and the loss generated by the Forex market movements

- on the other hand, if the pair’s quote increases, you will have an extra profit

That’s how carry trade works and that’s why it’s called a long-term strategy.

FX Carry Trade Strategy Rules

Here are some rules that are worth following in order to maximize potential profits:

- Choose the pair with the greatest difference between interest rates

- Find a pair that is in trend

- Evaluate the risk and decide the Stop Loss order

- Track the transaction and any potential interest rate changes

While rules 1 and 3 are obvious to an advanced trader, rules 2 and 4 require further explanations.

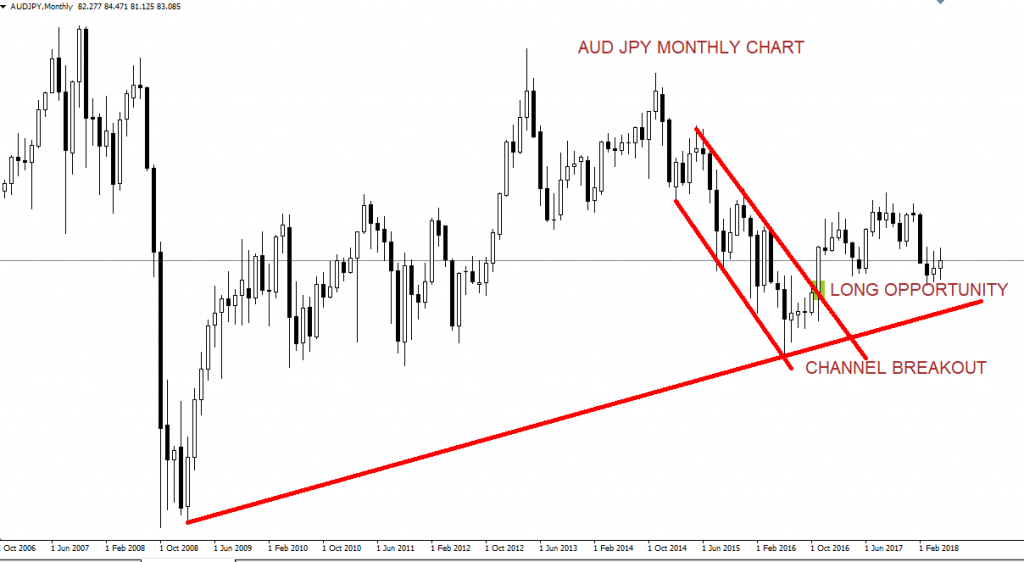

As mentioned above, the exchange rate is the biggest risk factor in a carry trade strategy. You cannot avoid the changes that occur in Forex rates, but you can potentially choose a currency pair that can move in the direction you want.

It is important to be a long-term move, so choosing a pair that is in a medium or long-term trend is the answer we are looking for.

In the AUD/JPY monthly chart above, we identified a channel breakout in the direction of the main trend. A long entry on the market would be a safe entry, considering the long term. The long position on the instrument is related to a positive swap, and thus the profit of such a transaction would be even greater. The market is trending up, the swap is positive – carry trade works perfectly.

Carry Trade Risk

By now, you understood how a carry trade works. But what are the risks of such a transaction? The exchange rate is the most important and holds the higher risk, but the changes in interest rates must also be taken into account.

- If the central banks maintain their old policies and don’t change the interest rate, such risks are diminished.

- If the policies change constantly then the difference in interest rates will also change

As a regular trader, you must always be aware of how central banks operate and what are their long-term policies. If you carry trade – this is even more important.