Table of Contents

A defensive stock is what investors should want in uncertain market conditions and should hold when market conditions are very tough.

All investors want to profit from the financial market as much as possible, but beginners seem to want even more than others. The so-called defensive stocks are the closest tools of these investors. That’s because defensive stocks are less influenced by the macroeconomic context and even by crises.

What is a Defensive Stock

Many investors are constantly seeking to diminish the impact the market volatility has on their portfolios. For this reason, they allocate a portion of their total portfolios for defensive stocks as part of a sound risk management strategy.

That’s because the defensive stocks are less affected by an economic slowdown.

Think of the defensive stock as insurance. They protect the investors from large losses when stock markets enter into correction territory.

The reason for this is simple. Defensive stocks are generally stocks of companies from sectors where demand for goods and services do not decrease as much as other sectors during economic slowdowns.

A few examples of defensive stocks include public utility companies like gas and electricity, food, tobacco, medicine, cosmetics etc.

Think about it. Let’s assume we are in recession:

- You will continue to use electricity and heat, take showers and wash dishes during a recession

- You will continue to make phone calls to your family, friends and work colleagues during bad economic times

- You will continue to buy food. Maybe not from the expensive restaurants, but from smaller groceries

- If you are a smoker, the chances are you are still going to buy cigarettes. Maybe not the expensive ones, but you will most likely buy a cheaper brand

- You won’t cut purchases of soap, toothpaste and creams used daily

- You will continue to take medications even during times of economic slowdown.

The reality is that you will choose to cut other expenses, but not the ones linked to either basic human needs or addictions.

That’s why defensive stocks are considered the most stable stocks on the market, offering a constant dividend and remaining somewhat unaffected by the volatility of the stock market. During adverse economic conditions, defensive stocks often outperform most other stocks in the market.

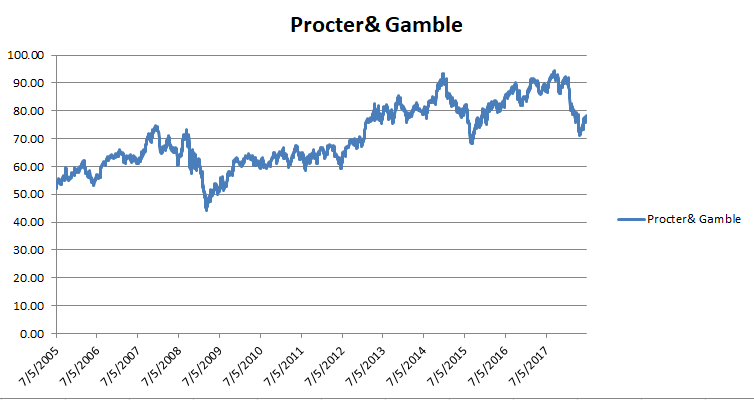

Let’s analyze the charts plotted above. The first chart is a defensive stock, Procter & Gamble, a multi-national consumer goods corporation. The chart was plotted for 2015 – 2018 period.

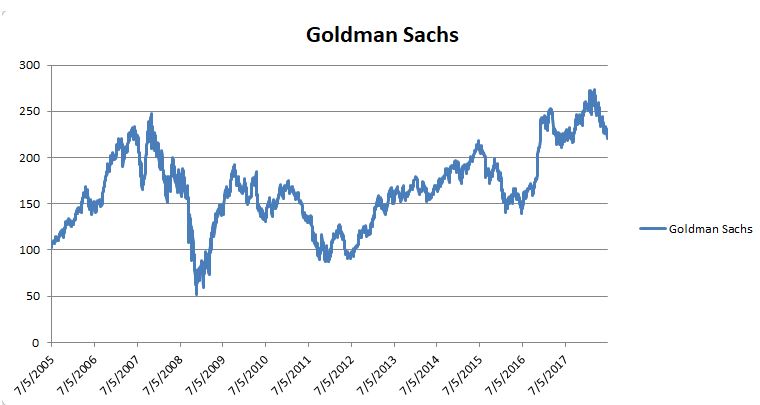

The second chart is Goldman Sachs, leading global investment banking, securities and investment management firm, during the same period.

If we look on the charts at the 2007–2008 period when the financial crisis was dominating the financial markets, we immediately see the power of defensive stocks during adverse conditions.

During the worst financial crisis since the Great Depression of the 1930s, Procter & Gamble stock halved in value from around 75$ to 35$. The defensive side of the stock wasn’t able to cope with the magnitude of the crisis.

But look at the Goldman Sachs evolution during that period. The stock fell from 250 $ to a minimum of 50$. That’s quite a correction.

If we look at the following next 2 -3 years after the crisis, we see the price of Procter & Gamble stock recovering and stabilizing. The Goldman Sachs evolution during that period was extremely volatile, with huge upward and downward swings.

The main advantage of defensive stocks is that, over time, they have generally performed as expected. In the past 50 years, utilities, healthcare and food stocks have outperformed the broad market during bear markets. These stocks have also outperformed during recessions, but not by a significant margin as you can see in the example above.

How to Identify Defensive Stocks

Identifying a defensive stock might seem easy at first sight. However, this task is more complex than we might think. An inexperienced investor would pick some stocks from utilities, telecoms, pharmaceuticals or food retail sectors and consider the job done.

That’s not the smartest way to include defensive stocks in your portfolio. Just because a stock belongs to a defensive sector, this doesn’t mean that you are protected from losses.

There are several ways in which an investor can identify the optimal defensive stocks, with the lowest risks.

Beta Coefficient

The most used tool by analysts is the BETA coefficient, which shows the correlation between the evolution of a stock and the overall market evolution.

The BETA coefficient of a stock is a measure of its volatility against a benchmark, representative for the overall stock market evolution. The indicator shows how much a stock will correlate with the general market trend and what risks this company implies.

The lower the degree of correlation, the more useful the stock is when the market decreases. However, the calculation of the BETA indicator for all companies on the stock exchange implies a rather large effort from an investor.

So, when are talking about BETA, we talk about risk and we refer to the volatility of a stock. In other words, it measures the likelihood that the value of the shares will change dramatically in a short period of time.

Specifically, the beta indicator reflects the investors’ reaction to the evolution of the company in which it invests.

For example, the BETA value of 1 indicates that the stock price moves in line with the global market. If the market rises 20%, the stock price will rise 20%, if it drops 10%, so does the price of the stock. This is not calculated daily but over a few months.

Low-value BETA and high-value BETA

First of all, we need to know that the BETA coefficient has two main values depending on which investors are targeting the strategy they are interested in:

- Stocks that have a high BETA coefficient are more volatile than the market. The higher the beta, the more volatile they are. If the market rises by 10%, the stock will increase by a higher margin, of 15%, for example. During adverse conditions when the market will record correction, these stocks will decrease even more.

- On the other hand, low beta stocks are less volatile than the market. If the market decreases by 10%, the stock will decrease by a lower margin, of 5%, for example. However, the defensive stocks are not expected to experience significant increases during times of economic advance.

It is extremely useful to take into account the BETA value of an industry when comparing companies in that industry. By using the BETA coefficient, we choose the industry and buy the right stocks for our investment plans.

We know, for example, that tech stocks have a high beta and the technology industry has a high volatility.

Let’s consider a scenario where we know that the BETA coefficient for telecom stocks is 1.2 and we find a company with a beta coefficient of 0.8. This gives us the following information: the company is less volatile than the market and highly stable within the industry it belongs to.

Average True Range

Defensive stocks can be easily identified by analyzing the price range they have evolved over a given period. The lower the difference between the maximum period and the minimum of the period, the more stable the stock can be. This translates into the fact that a defensive stock has a lower risk of recording large corrections in the short term.

The average true range reveals information about how volatile a defensive stock actually is:

- High ranges reveal high volatility

- Small ranges suggest low volatility.

It’s a useful indicator for giving an idea about how much the price of a defensive stock may move in a defined time frame.

Difference between the Current Price and the Minimum Price

Another criterion through which an investor can identify defensive stocks is the difference between the current market price and its minimum price. The closer the stock is to its minimum value, the lower the correction rate.

This is somewhat logical considering the fact that as long as the stock did not increase, the selling pressure is also lower.

Instead, stocks that are trading near their maximum levels are riskier because, in times of instability on the stock exchange, they may suffer more extensive corrections.

Advantages of Defensive Stocks

Higher dividend yields

A big advantage of defensive stocks is that they are non-cyclical. These stocks produce solid earnings regardless of the performance of the larger economy. They also offer higher than average dividend yields because the companies pay out most of their earnings to shareholders.

Protect your capital

The most important advantage of defensive stocks is that they have the potential to protect investors’ capital during a slowdown. If you invest in defensive stocks you are less likely to be affected by what happens in the country’s economy.

Of course, defensive stocks will decrease during a recession, but the impact will be much lower compared to the rest of the market.

Lower Volatility

The most important role of the market volatility is to estimate the value of market risk. In other words, the volatility measures the market risk that an investor is willing to take when investing in a certain stock.

Defensive stocks are generally considered non-volatile and stable. They register moderate price fluctuations. When you invest in a defensive stock you know that the chances for the stock to record major fluctuations in short periods of time are slim.

Safe-Haven during Turmoil

Defensive stocks are considered safe-haven assets. A safe-haven asset protects investors during crises.

You must not confuse the term “safe-haven” with “hedging”. Hedging protects investors during normal times, but not necessarily during the recession. A safe-haven asset is expected to retain its value in times of market turbulence when most asset prices decline.

Defensive stocks are not completely recession-proof. Let’s refer to them as recession-resistant. Defensive stocks are more resistant to bad economic conditions due to their link to basic human needs or addictions, but they are by no means invincible.

Disadvantages of Defensive Stocks

Lower Returns during Economic Boom

During an economic slowdown, defensive stocks often outperform most other stocks in the market. However, during times of economic boom, the defensive stocks don’t usually record significant increases compared to other stocks.

Look at the evolution of the Procter & Gamble defensive stock since 2013, during a period of optimism and a healthy economy. Not much happened during this period.

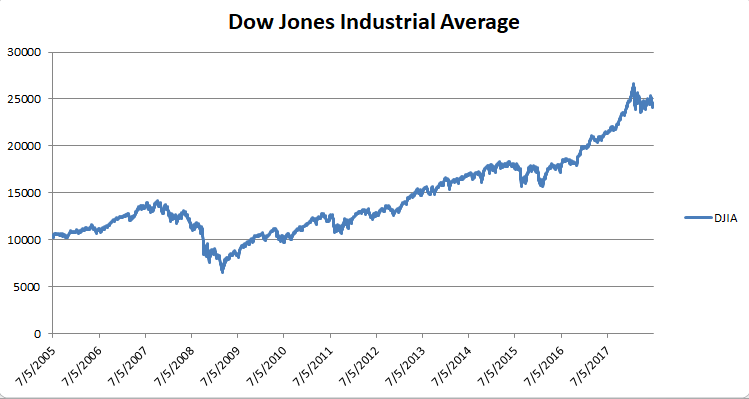

Compared to the evolution of the Dow Jones Industrial Average, we immediately see the difference. When the optimism is high and the markets are recording important increases, less volatile companies like defensive stocks are left behind by investors, who prefer to invest their money in riskier investments.

Low Volatility

For an investor with a high-risk aversion, a non-volatile defensive stock isn’t considered an attractive opportunity. Sure, it might offer him some insurance during bad times, but the defensive stocks won’t bring explosive profits in a short time.

For this reason, defensive stocks are considered boring by aggressive investors.

Final Thoughts

If you prefer to invest in the long term and you have a low tolerance for large capital losses, defensive stocks will suit you.

By adding some defensive stocks in your portfolio you will reduce the overall risk of your portfolio while remaining fully invested. At the same time, you will mitigate large losses of capital during periods of turbulent financial times.

However, you should not expect to record higher total returns than traditional benchmarks during strong bull markets. If you invest in defensive stocks you should expect long-term returns similar to traditional benchmarks but at a significant reduction in portfolio volatility.

Many beginners consider that investing in a portfolio of defensive stocks is a smart move that will offer them high returns. However, the key to any investment portfolio is diversification. If you’re planning to invest in defensive stocks you must diversify your portfolio across many different sectors.